- FINTAK Weekly Newsletter

- Posts

- Safaricom's Space Oddity: When the Big Fish Gets Starlink-ed

Safaricom's Space Oddity: When the Big Fish Gets Starlink-ed

A weekly digest of news, opinions and all things financial technology

Safaricom's Space Oddity: When the Big Fish Gets Starlink-ed

Safaricom PLC , long the dominant force in Kenya's telecommunications sector, is now facing challenges with the entry of Starlink into the market. Traditionally accused of monopolistic practices by competitors like Airtel and Telkom, Safaricom finds itself in a role reversal, urging the Communications Authority of Kenya to impose restrictions on satellite internet providers such as Starlink. Safaricom's main concern is that these providers should operate as infrastructure providers, ensuring they invest in the country and adhere to local regulations.

Starlink's arrival marks a shift in the internet landscape by offering direct-to-consumer satellite internet, which circumvents traditional infrastructure. This move could democratize internet access in Kenya, challenging Safaricom's market hold. Safaricom's reliance on its financial technology services, especially M-Pesa, has been crucial to its success. However, as fintech continues to evolve, new competitors are emerging, pushing Safaricom to innovate beyond its existing offerings.

The entry of Starlink serves as a wake-up call for Safaricom. To remain relevant and competitive, to embrace change, foster innovation, and focus on delivering value to its customers.

The digital landscape is rapidly evolving, and adapting to these changes is crucial for Safaricom's future success in Kenya's telecommunications industry.

⚠️Uganda Targets 59 Rogue Loan Apps

💰 Workpay Lands $5 Million to Fuel African Expansion

📉 Kenya’s Credit Rating Takes Another Hit

🚗 Bolt Teams Up with HAKKI AFRICA to Drive Vehicle Ownership

🔋 Solarise Africa Secures R160 Million for Green Energy Growth

👨⚖️ Meta Admits to Government Pressure Over Content Moderation

🌍 Africa Isn’t Alone in Navigating Regulatory Maze...

And Much More...

Karibu Connect Brings Starlink Internet to Kenya

Karibu Connect is the company introducing Elon Musk's Starlink Internet service to Kenya, an authorized reseller aiming to revolutionize internet access across the country. Starlink, known for its advanced satellite technology, promises to deliver high-speed internet connectivity to even the most remote areas, addressing long-standing connectivity challenges in Kenya.

The arrival of Starlink through Karibu Connect is expected to enhance internet services by providing reliable and fast connectivity, which is crucial for various sectors, including education, healthcare, and business. This development is particularly significant for rural and underserved regions, where traditional internet infrastructure has been lacking.

Starlink's entry into the Kenyan market is poised to challenge existing internet service providers by offering competitive pricing and superior service quality. This competition could lead to improved internet services and lower costs for consumers.

As Karibu Connect facilitates this technological advancement, it marks a pivotal moment in Kenya's digital landscape, potentially transforming how Kenyans access and utilize the internet.

Flutterwave Partners with American Express to Elevate E-Commerce in Africa

Flutterwave announced that its online merchants in Nigeria can now accept American Express payments. This development allows American Express Card Members, whether they hold consumer, business, or corporate cards, to make direct payments to e-commerce businesses using Flutterwave in Nigeria. The service is set to expand to other countries, including Tanzania, Rwanda, Ghana, and Uganda, in the near future.

This collaboration offers advantages for both merchants and consumers. Flutterwave merchants can now tap into a new customer base of American Express Card Members, enhancing their business opportunities across Africa and globally.

For consumers, the partnership provides greater flexibility and choice in payment methods, reinforcing the American Express global network and expanding the locations in Africa where American Express Cards can be used.

Olugbenga Agboola, Founder and CEO of Flutterwave, emphasized the company's mission to connect the world to Africa through innovative payment solutions.

"This is one of our initiatives to ensure that more people across the world can pay using Flutterwave in Africa. We understand the value of providing shoppers with payment methods that work for them, as well as helping businesses to expand their customer bases, " he added.

Uganda Identifies 59 Illegal Online Loan Apps

The Ugandan government has released a list of 59 online loan applications operating illegally within the country. These apps have been criticized for their predatory practices, including charging exorbitant interest rates ranging from 28% to 37% and employing unethical methods such as harassment and blackmail to recover debts.

The Uganda Microfinance Regulatory Authority (UMRA) has highlighted that these apps violate the Tier 4 Microfinance Institutions and Money Lenders Act, 2016, and the newly established digital lending guidelines for 2024.

They are known for bypassing consumer protection laws, abusing data privacy, and using aggressive recovery tactics that extend to borrowers' contacts without consent. This has led to severe consequences for borrowers, including public shaming and threats.

UMRA has urged the public to avoid transacting with these unauthorized lenders and has emphasized the importance of adhering to legal and regulated financial services. The government is working to implement stricter regulations to safeguard consumers and restore trust in the digital lending sector.

Kenyan Startup Workpay Secures $5 Million to Expand Across Africa

Kenyan HR and payroll startup Workpay has successfully raised $5 million in a Series A funding round, led by Norrsken22 and joined by notable investors including Visa , Y Combinator, and several others.

This funding aims to support Workpay's expansion across Africa and enhance its financial services offerings. The company, which provides a comprehensive cloud-based HR and payroll platform, is poised to address the challenges faced by small and medium-sized businesses in Africa, many of which still rely on manual payroll processes.

Workpay's platform simplifies payroll management by offering tools for time tracking, leave management, and expense tracking, among others. It also ensures compliance with local regulations across different countries.

With this new investment, Workpay plans to broaden its financial services, integrate AI into its performance management tools, and continue its growth trajectory. The company serves over 1,000 businesses across 20 African countries, and its revenue has seen significant growth in 2024.

iColo Enhances Data Centers with Solar Power in Nairobi and Mombasa

iColo has bolstered its commitment to sustainability by adding over 650 kilowatts of solar power to its campuses in Nairobi and Mombasa. This move aligns with iColo's broader strategy to support renewable energy targets and contribute to a sustainable future.

The Nairobi campus, a major hub for national and global networks, now benefits from over 450 kW of this new solar capacity, supporting its ongoing expansion. Meanwhile, the Miritini campus in Mombasa has incorporated nearly 200 kW, enhancing its role as a key interconnection hub with more than 85 network providers.

iColo's solar investments are part of its long-term plan to meet increasing power demands sustainably. The company aims to have 25% of its facilities' power needs met through solar installations. This initiative is a testament to iColo's leadership in harnessing Kenya's renewable energy resources, with the country's power grid already comprising 82% renewable sources.

In line with Digital Realty's global sustainability goals, iColo is actively exploring additional solar installation opportunities and remains committed to reducing emissions significantly by 2030.

Kenya's Credit Rating Downgraded Further

S&P Global Ratings has downgraded Kenya's long-term foreign currency sovereign credit rating from 'B' to 'B-', marking the third such downgrade since June following similar actions by Fitch Ratings and Moody's Ratings'. The decision reflects growing concerns about Kenya's fiscal and debt trajectory, with S&P citing the country's high government debt burden and large fiscal deficits as key contributing factors.

The downgrade comes in the wake of President William Ruto's decision to abandon the Finance Bill, which aimed to generate Ksh 346 billion through new taxes.

Despite maintaining a stable outlook, S&P's action shows increased skepticism about Kenya's fiscal management and debt sustainability. The downgrade is likely to impact Kenya's borrowing costs and complicate its efforts to finance its budget deficit.

Kenya's economic challenges are further compounded by its reliance on external financing, particularly from institutions like the IMF and World Bank.

Africa's Path to Industrial Growth

The evolving landscape of manufacturing and industrialization in Africa presents both opportunities and challenges. With abundant natural resources, a youthful population, and expanding markets, Africa holds significant potential to become a key player in global manufacturing. However, the continent faces hurdles such as inadequate infrastructure, political instability, and limited access to technology.

To achieve successful industrialization, it is crucial for African countries to focus on developing infrastructure, enhancing education and skills training, and fostering innovation. Creating favorable business environments to attract foreign investment is also essential. By addressing these areas, Africa can harness its potential and drive economic growth through manufacturing and industrialization.

Africa's Cybersecurity Challenges Impact Economies

Africa is grappling with significant cybersecurity challenges that are affecting its economic growth. The continent's rapid digital transformation has outpaced the development of effective cybersecurity measures, leaving many countries vulnerable to cyber threats. This lack of preparedness is costing African economies dearly, with an estimated loss of around 10% of GDP due to cybercrime.

The increasing reliance on digital technologies has exposed critical infrastructure to cyberattacks, which can lead to severe disruptions in economic activities. Financial institutions are particularly targeted, with nearly 18% of successful cyberattacks aimed at this sector. Additionally, the telecommunications industry, with its expanding customer base, is also a prime target for cybercriminals seeking data theft and extortion opportunities.

Despite these challenges, only a minority of African countries have implemented comprehensive cybersecurity legislation. As of 2021, only 29 African nations had introduced such laws, highlighting a significant gap in regulatory frameworks. This lack of regulation and awareness exacerbates the continent's vulnerability to cyber threats, making it an attractive target for international cybercriminals.

Efforts are being made to address these issues, with some countries taking steps to enhance their cybersecurity infrastructure and legislative measures.

However, the pace of these developments is slow, and there is a pressing need for a more robust and coordinated approach to cybersecurity across the continent. Strengthening cybersecurity is crucial not only for protecting economic interests but also for ensuring the safe and secure digital transformation of Africa.

Fido Secures $10 Million Series B Investment for Expansion

Fido, a fintech platform operating in Ghana and Uganda, has secured $10 million in Series B funding to enhance its digital credit services across Africa. This investment, led by MASSIF, a financial inclusion fund managed by the Dutch entrepreneurial development bank FMO, will enable Fido to expand its operations and address the financing needs of small and medium-sized enterprises on the continent.

Since its inception in 2015, Fido has been a pioneer in providing accessible credit solutions to individuals and businesses lacking traditional financial histories.

By leveraging technology and alternative data, Fido has extended credit to over 650,000 customers. The new funding will allow Fido to increase its lending capacity in its existing markets and explore opportunities in new African countries, focusing on communities typically underserved by mainstream financial institutions.

MASSIF's investment underscores its commitment to fostering financial inclusion and supporting the growth of micro, small, and medium-sized enterprises. This collaboration aims to bridge the $331 billion finance gap faced by SMEs in Africa, offering innovative digital lending solutions to underserved populations.

Bolt and HAKKI AFRICA LIMITED Partner to Boost Vehicle Ownership for Kenyan Drivers

This collaboration aims to facilitate the deployment of 1,500 vehicles over the next 18 months. The initiative is designed to make vehicle ownership more accessible for drivers by offering reduced loan down payments and performance-based incentives.

Hakki Africa's credit scoring system is a key component of this partnership, helping drivers who traditionally face challenges in accessing financial services.

This system enables drivers to secure loans more easily, thus promoting financial inclusion within the ride-hailing industry. The partnership provides an opportunity for drivers to own vehicles after a repayment period of approximately three and a half years, potentially increasing their net income and opening up new business opportunities once the loan is paid off.

Meta Addresses Content Moderation and Government Pressure

Meta has responded to the U.S. House Committee on the Judiciary regarding content moderation on its platforms. In a letter to Chairman Jim Jordan, Meta acknowledged the pressure it faced from the U.S. government, particularly during the Biden Administration, to censor COVID-19 content. Meta admitted that while it made its own decisions, the pressure was unwelcome, and it regrets not being more vocal against it.

The letter also addressed an incident involving the FBI, where Meta was warned about potential Russian disinformation related to the 2020 election. This led to the temporary demotion of a New York Post story about Joe Biden's family.

Meta has since revised its policies to prevent similar actions without thorough fact-checking.

Meta emphasized its commitment to maintaining content standards without government influence and is prepared to resist such pressures in the future.

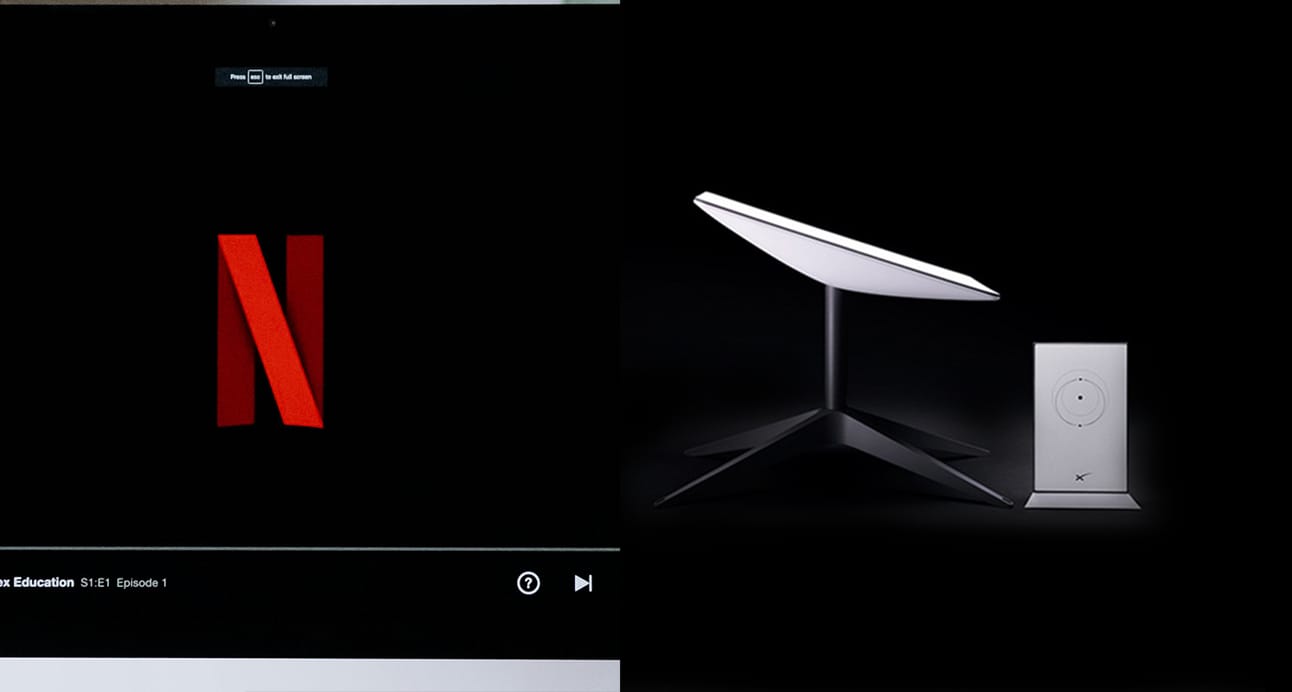

Netflix Faces Challenges in Kenya Compared to Starlink's Success

Netflix's struggle to capture the Kenyan market is becoming increasingly apparent, especially when compared to the rapid success of Starlink. A major factor contributing to Netflix's challenges is its reluctance to integrate M-Pesa, Kenya's dominant mobile payment platform, as a direct payment option.

Despite offering competitive pricing and a free plan tailored for the Kenyan market, Netflix's complicated payment process remains a significant barrier for potential subscribers. Current workarounds, such as linking PayPal to M-Pesa or using the Global Pay Visa Card, involve extra steps that many consumers find cumbersome.

In contrast, Starlink has quickly adapted to local consumer preferences by integrating M-Pesa into its payment system, making it easier for customers to subscribe. Additionally, Starlink has made its internet kits widely available and introduced flexible payment plans, including a rental option, which has resonated well with Kenyan consumers.

South African Rand Softens Amid Economic Data Anticipation

The South African rand has recently experienced a dip, trading at 17.73 against the US dollar, marking a 0.2% decline from its previous close. This weakening comes as investors await the release of South Africa's key economic indicators, which include metrics such as vehicle sales and business confidence. These indicators are crucial as they will provide insights into the country's economic health and influence the South African Reserve Bank's (SARB) monetary policy decisions.

The rand had shown strength due to a weaker dollar and positive risk sentiment but has now softened, aligning with trends seen in other emerging market currencies. Economists are predicting that the SARB might cut interest rates next month for the first time in over two years, adding another layer of complexity to the currency's outlook.

Furthermore, global attention is focused on the US Federal Reserve's upcoming actions and Chair Jerome Powell's speech at the Jackson Hole symposium, as these could have significant implications for the rand. The interplay between local economic data and global economic cues highlights the rand's sensitivity to broader economic forces. As South Africa navigates these challenges, the outcomes of these economic indicators and global developments will be pivotal in shaping the country's financial landscape.

Adbud Unveils AI-Driven Pedestrian and Car Tracking System

Adbud Tech Limited launched an innovative system that uses Artificial Intelligence and Computer Vision to track and measure pedestrian and vehicular movements in real-time. This new system is designed to meet the growing demand for detailed traffic and engagement data from various sectors, including government and retail.

The system offers the ability to adjust content dynamically based on real-time audience data, such as changing messages displayed on digital billboards to suit different times of the day or specific demographics. This approach not only enhances engagement but also allows for immediate feedback on content performance, enabling quick adjustments to maximize impact.

Adbud's CEO, Stanley Mwangi, highlighted the importance of hyper-personalized data in today's information-rich environment. The system's AI-driven capabilities allow for precise audience targeting, offering a more effective way to segment and engage with different groups. This development aligns with global trends in digital screen content, which is expected to grow significantly in the coming years.

Fragmented Regulatory Landscape: It's Not Only in Africa

The European Union is facing challenges with its AI regulatory framework, echoing issues seen in other regions like Africa. Meta CEO Mark Zuckerberg and Spotify CEO Daniel Ek have expressed concerns that the EU's inconsistent regulations are hindering innovation. They argue that the fragmented regulatory structure creates confusion and uncertainty, preventing companies from fully leveraging AI technologies.

This situation is not unique to Europe. In Africa, similar regulatory hurdles exist, with countries working to develop cohesive AI policies amidst diverse legal and digital landscapes. Both regions are grappling with the need to balance innovation with regulation, striving to create environments that support technological advancement while ensuring compliance and protection.

The EU's experience highlights the broader global challenge of regulating AI. Inconsistent application of laws, such as the General Data Protection Regulation (GDPR), has led to delays and complications, similar to the regulatory bottlenecks faced in Africa. These issues underscore the necessity for streamlined and clear regulatory frameworks that can foster innovation without stifling progress.

As both Europe and Africa navigate these complexities, there is a growing recognition of the need for thoughtful regulation that supports open-source AI development.

Prospects for Tech VC Funding in Africa Amid Interest Rate Cuts

The landscape of venture capital funding for tech startups in Africa is poised for potential change following recent interest rate cuts. The Central Bank of Kenya, for instance, lowered its benchmark interest rate to 12.75% in August 2024, marking a shift from the previously high rates maintained since 2012. This move could signal a more favorable environment for venture capital investments, as lower interest rates generally reduce borrowing costs and encourage investment activities.

However, the rebound in tech VC funding is not solely dependent on interest rates. The first quarter of 2024 saw a significant drop in funding for African startups, with a decline of over 50% compared to the previous year. This downturn reflects broader challenges in the global macroeconomic environment, including high interest rates and currency devaluation, which have put pressure on investment flows into the continent.

Despite these challenges, there is optimism that strategic interest rate cuts could stimulate investment by making capital more accessible and attractive. The tech sector, particularly fintech, remains a key focus for investors, addressing critical issues across the continent and drawing significant interest. Additionally, efforts to diversify investment beyond the major hubs in Africa could further enhance the attractiveness of the region for tech investors.

Uchaguzi Recognized as Finalist in World Justice Challenge 2024

Uchaguzi, a project developed by Ushahidi, was named a finalist in the World Justice Challenge 2024, organized by the World Justice Project. This prestigious competition recognizes innovative initiatives that strengthen the rule of law and democracy. Uchaguzi was selected from a pool of 424 submissions from 109 countries, highlighting its impactful contributions to electoral integrity and citizen empowerment in Kenya.

The World Justice Challenge 2024 focused on the theme "The Rule of Law: Foundation of Democracy," featuring 30 finalists from 23 countries. These projects were evaluated based on their effectiveness in areas such as electoral processes, justice institutions, free media and trustworthy information, and youth engagement. Finalists had the opportunity to present their work at the American Bar Association Annual Meeting in Chicago, where winners were announced.

Ushahidi, founded in 2008 in Kenya, is a global non-profit technology company known for its crowdsourcing platform that enables users to report and map data via mobile phones or the internet. The organization was co-founded by Erik Hersman, Ory Okolloh, Juliana Rotich, and David Kobia, and has played a significant role in crisis response, human rights reporting, and election monitoring worldwide.

Rwanda's Interest in Joining the Kenya-EU Economic Partnership

Rwanda has shown interest in joining the Economic Partnership Agreement between Kenya and the European Union. This move could open new avenues for Rwanda in terms of trade and economic collaboration with the EU. The EPA, which Kenya has negotiated, allows for duty-free access of over 80% of its goods to the EU market and is set to ease duties on EU goods starting from 2031.

The interest from Rwanda highlights the potential for increased regional cooperation within the East African Community regarding trade agreements with the EU. However, there are concerns among some EAC members about the implications of Kenya's deal with the EU, particularly regarding the rules of origin and the impact on the region's agricultural sector.

Despite these concerns, the Kenyan Trade Ministry has defended the agreement, emphasizing that it adheres to EAC rules and should not harm regional interests. Rwanda's potential inclusion in the EPA could strengthen its economic ties with the EU and provide a platform for further integration within the EAC.

South African Telecoms Seek Contributions from OTT Platforms

South Africa's telecommunications industry is calling for over-the-top (OTT) platforms to contribute to the costs associated with network expansion. The Association of Comms and Technology has emphasized that OTT platforms, which significantly increase internet traffic, rely heavily on robust network infrastructure to succeed. As major telecom operators such as Vodacom and MTN invest approximately 41 billion rand ($2 billion) annually in expanding their networks, the ACT suggests that OTT providers should share these financial burdens through mutually agreed usage charges.

The ACT argues that any cost-sharing agreement must be legally sound, commercially fair, and considerate of industry dynamics. This initiative is part of a broader trend where traditional telecom companies and digital platforms are increasingly intersecting. The proposal aims to ensure that both sectors contribute equitably to infrastructure costs, potentially setting a global precedent for similar arrangements.

MTN's CEO, Ralph Mupita, has highlighted the necessity of a balanced approach to avoid damaging the broader ecosystem. This development could impact profit margins and operating costs for both digital content providers and telecom operators, potentially leading to fluctuations in stock prices as companies adapt to new regulatory frameworks and cost-sharing models.

New Approaches to Sustainability in Shipping: Decarbonization Strategies

The shipping industry is increasingly focusing on sustainability and decarbonization as it seeks to reduce its environmental impact. New strategies are being developed to address the carbon emissions associated with maritime transport, which is a significant contributor to global greenhouse gas emissions. These strategies include the adoption of alternative fuels, such as liquefied natural gas and biofuels, which offer cleaner alternatives to traditional marine fuels.

Innovations in ship design and technology are also playing a crucial role in reducing emissions. Enhanced hull designs, energy-efficient engines, and the integration of renewable energy sources, such as wind and solar power, are being explored to improve fuel efficiency and lower carbon footprints. Additionally, digitalization and data analytics are being utilized to optimize shipping routes and operations, further contributing to emission reductions.

Collaboration across the industry is essential for the successful implementation of these sustainability initiatives. Stakeholders, including shipping companies, governments, and international organizations, are working together to establish regulations and standards that promote environmental responsibility. By embracing these new approaches, the shipping industry aims to meet global climate targets and ensure a sustainable future for maritime transport.

Africa and the Third World in the global Tech-driven Economy

The role of Africa and the Third World in the global economic framework is a subject of ongoing discussion and analysis. Historically, these regions have been marginalized in the global economy, often seen as peripheral players compared to more developed nations. However, there is a growing recognition of their potential and the strategic importance they hold in the current global economic order.

Africa, in particular, is experiencing dynamic changes with its wealth of natural resources, youthful population, and increasing digital transformation. These factors present significant opportunities for economic growth and development. The continent's integration into the global economy is being facilitated by initiatives such as the African Continental Free Trade Area (AfCFTA) Secretariat's initiatives, which aims to boost intra-African trade and strengthen economic ties with the rest of the world.

Despite these opportunities, Africa and the Third World face numerous challenges, including political instability, inadequate infrastructure, and limited access to capital. These issues hinder their ability to fully participate in and benefit from the global economy. Addressing these challenges requires concerted efforts from both domestic and international stakeholders to create an enabling environment for sustainable development.

Ghana's PayBox Unveils Buddy Financial Services App

Ghanaian fintech startup PayBox has launched a new financial services app called Buddy, aimed at empowering young Africans with greater financial freedom. This integrated platform leverages blockchain and artificial intelligence to offer innovative solutions for financial management. Buddy is designed to challenge inflation, reduce transaction fees, simplify cross-border payments, and enhance investment returns.

The app functions as both a mobile and decentralized application, providing a user-friendly interface that allows users to manage both personal and business finances. It is likened to popular financial services such as PayPal or Monzo but tailored specifically for the African market. Buddy AI, currently in its beta phase, enables users to engage in insightful conversations about their finances, offering guidance and valuable insights.

PayBox is already making strides in cross-border payments and fund transfers across more than 23 African countries, specifically targeting small and medium-sized enterprises. With the launch of Buddy, PayBox aims to further drive innovation and inclusivity in the financial sector across the continent.

Cheersway E-Commerce Plans Pan-African Expansion

Cheersway E-Commerce Ltd. has unveiled ambitious plans to expand its operations across Africa, aiming to establish a significant presence in every corner of the continent. The company intends to gradually set up modern e-commerce hubs throughout Nigeria and extend its reach to neighboring African countries. This strategic move is part of Cheersway's vision to enhance its market footprint and cater to the growing demand for online shopping in Africa.

The expansion plan involves creating a robust infrastructure that supports seamless e-commerce transactions, thereby improving accessibility and convenience for consumers. By establishing these hubs, Cheersway aims to provide efficient delivery services and a wide range of products to a diverse customer base. The company is committed to leveraging technology and innovation to drive its growth and meet the evolving needs of African consumers.

Cheersway's expansion reflects the broader trend of increasing e-commerce activity on the continent, driven by rising internet penetration and a burgeoning middle class. As the company embarks on this journey, it seeks to contribute to the digital economy and support the economic development of the regions it enters.

Treepz Achieves Milestone with First Cross-Border Rental Trip

Nigerian mobility startup Treepz has successfully completed its first cross-border rental trip, marking a significant milestone in its expansion strategy. This achievement underscores Treepz's commitment to enhancing mobility solutions across Africa, facilitating seamless travel experiences for its users. The cross-border trip involved a journey from Nigeria to Ghana, demonstrating the company's capability to operate efficiently in multiple countries and manage the logistical challenges associated with cross-border transportation.

Treepz's innovative approach combines technology with traditional transport services, providing users with reliable and affordable travel options. The successful completion of this trip not only highlights the startup's operational capabilities but also sets the stage for further expansion into other African markets.

South Africa's Leadership in AI and ChatGPT Adoption

South Africa is emerging as a global leader in the adoption of ChatGPT and artificial intelligence technologies. This development highlights the country's proactive approach to integrating AI into various sectors, positioning itself at the forefront of technological innovation. The widespread adoption of AI in South Africa is driven by the need to enhance productivity, streamline operations, and foster innovation across industries.

Businesses in South Africa are recognizing the transformative potential of AI, utilizing it to automate processes and improve efficiency. The country's commitment to embracing AI is evident in its strategic initiatives aimed at fostering an environment conducive to technological advancements. This includes investments in AI research and development, as well as the creation of policies that support the growth and integration of AI technologies.

South Africa's leadership in AI adoption is not only transforming its economic landscape but also setting a benchmark for other nations to follow.

As AI continues to evolve, South Africa's proactive stance and strategic investments are likely to yield significant benefits, contributing to its economic growth and global competitiveness.

Google Cloud and Prudential to Enhance Insurance with AI

Google Cloud partnered with Prudential plc to integrate artificial intelligence (AI) into the insurance sector, focusing on enhancing experiences for customers, agents, and employees. This collaboration will support the establishment of Prudential's new AI Lab, which aims to address business and customer challenges in the insurance industry across Asia and Africa.

Prudential, which operates in 24 markets within these regions, is committed to using technological innovation to add value for stakeholders. The AI Lab will accelerate the adoption of machine learning and generative AI, helping to improve customer experiences, drive technology-powered distribution, and increase access to affordable healthcare.

This initiative will provide Prudential's workforce with tools to develop scalable AI products, supported by Google Cloud's advanced AI and data analytics solutions.

AfDB and AU Launch Initiative to Eradicate Hunger in Africa

The African Development Bank (AfDB) and the African Union (AU) have launched a significant initiative aimed at eradicating hunger across the continent by 2030.

This ambitious program seeks to address food insecurity and promote sustainable agricultural practices to ensure that all Africans have access to sufficient and nutritious food. The initiative focuses on increasing agricultural productivity, enhancing food systems, and improving resilience to climate change.

It aims to mobilize resources and foster partnerships among governments, private sector players, and international organizations to drive innovation and investment in agriculture. By leveraging technology and best practices, the program intends to transform Africa's agricultural landscape and contribute to the continent's economic growth and development.

NIBSS Joins Africa's First Regulated Blockchain for Payments

The Nigeria Inter-Bank Settlement System has partnered with Zone to join Africa's first regulated blockchain network for payments. This collaboration represents a significant development in the integration of blockchain technology within the financial sector, marking one of the first instances of regulatory involvement in a private blockchain consortium.

NIBSS aims to enhance its Payment Terminal Service Aggregation operations, ensuring improved oversight and compliance with the Central Bank of Nigeria's payment standards.

This partnership leverages blockchain's capabilities to provide decentralized routing and real-time settlement, allowing for direct exchanges of financial messages between banks without intermediaries. The move is expected to improve operational efficiency, reduce costs, and enhance financial inclusion in Nigeria.

Liquid Telecom's Expansion in Africa with U.S. Support

Liquid Intelligent Technologies is seeking to raise $225 million in equity by the end of the year, with significant investment from the U.S. International Development Finance Corporation. The DFC is set to be a major participant in a $90 million tranche, highlighting the U.S.'s strategic interest in African infrastructure amid increasing geopolitical competition with China. This investment will help Liquid manage upcoming loan and bond repayments, including a $156 million term loan and $620 million in bonds due in 2026.

Liquid is collaborating with tech giants Microsoft and Google on broadband projects across East Africa. The partnership with Microsoft aims to provide affordable broadband to 20 million people in Kenya and Zambia. Meanwhile, the collaboration with Google focuses on building terrestrial fiber networks across several African countries, offering connectivity to data centers and an alternative to subsea cable routes.

Liquid has already laid over 110,000 kilometers of fiber across Africa, addressing the continent's demand for high-speed internet and data storage. This expansion is crucial as Africa remains the least connected region globally, despite its growing population and potential for digital transformation.

Ericsson's Ambitious Expansion in Mobile Financial Services

Ericsson is making significant strides in the mobile financial servicessector, aiming to expand its influence and capture a larger market share. Currently, the Ericsson Wallet Platform supports 457 million registered mobile wallets, with around 114 million active users across 24 countries, predominantly in Africa. This platform processes an impressive 36 billion transactions annually, amounting to a total transaction value of $501 billion.

Despite holding about 10% of the MFS market, Ericsson aspires to increase this share to 50%. The company aims to position itself as a comprehensive financial services platform, extending beyond mobile money to offer a wide range of financial solutions. To achieve this, Ericsson has integrated 3,000 third-party partners into its application programming interface (API), fostering an open developer environment that encourages innovation and collaboration with banks, enterprises, and the broader fintech ecosystem.

Ericsson's expansion plans also involve addressing regulatory challenges across African markets, emphasizing the need for cohesive regulatory frameworks to support cross-border commerce and economic growth. By creating a stable and secure environment, Ericsson aims to facilitate the growth of both large corporations and small businesses in Africa's dynamic economy.

Cyber Outages Highlight Need for Multilayered Defense in Digital Economy

Recent cyber outages, including a potential cyberattack on the Port of Seattle, emphasize the vulnerabilities within the digital economy's infrastructure. These incidents, alongside the July Microsoft outage, illustrate the fragility of core internet structures and the growing threat of cyberattacks aimed at disrupting operations, stealing data, or demanding ransoms. As digital reliance increases, so does the risk of such attacks.

To combat these threats, the FBI has advocated for a dual-pronged cybersecurity approach that combines traditional security best practices with emerging solutions. This recommendation follows an audit revealing weaknesses in the FBI's own data management, highlighting the complex challenges organizations face in securing their digital perimeters.

A multilayered security strategy, or "defense in depth," is crucial for mitigating risks. This involves implementing various defensive measures such as firewalls, intrusion detection systems, and network segmentation to protect critical assets.

Continuous monitoring and a well-developed incident response plan are essential for real-time threat detection and response. As the cyberthreat landscape evolves, integrating advanced technologies like AI and machine learning can enhance threat detection by analyzing user behavior and identifying anomalies.

Somalia's Push for Digitalisation and Financial Inclusion

Somalia's Registration Authority has partnered with local banks to advance digitalisation and financial inclusion across the country. This collaboration aims to modernize Somalia's financial sector by integrating digital solutions that enhance accessibility and efficiency.

The initiative is part of a broader effort to transform Somalia's financial landscape, aligning with the Federal Government's reform agenda and the ongoing digital transformation in the region.

The partnership focuses on leveraging technology to improve financial services and increase access for underserved populations.

By adopting digital platforms, the initiative seeks to streamline financial transactions, reduce costs, and promote economic participation among Somali citizens. This move is expected to facilitate greater financial inclusion, enabling more people to access banking services and participate in the formal economy.

Solarise Africa Secures R160 Million Investment for Renewable Energy Expansion

Solarise Africa secured a R160 million (about $9 million) investment from Mergence Investment Managers to expand its renewable energy solutions across South Africa. This strategic funding partnership will enable Solarise Africa to accelerate the deployment of Commercial and Industrial (C&I) scale solar energy systems, addressing the growing demand for reliable and sustainable energy solutions in the region.

The investment marks a significant milestone for Solarise Africa, reinforcing its mission to promote sustainable energy development. The funds will primarily be used to finance the installation and expansion of solar energy systems for commercial and industrial clients, helping them reduce energy costs and carbon footprints. This initiative comes at a time when businesses are increasingly investing in renewable energy to mitigate against an unreliable grid and demonstrate a commitment to sustainability.

The deal was facilitated by PSG Capital , with additional support from Viruni Capital Partners, highlighting the confidence in Solarise Africa's role in advancing renewable energy adoption in South Africa.

NSSF's Haba Haba Secures Future for Kenyans Abroad

The National Social Security Fund (NSSF Kenya) extended its Haba Haba savings plan to Kenyans living in the diaspora, offering them a secure and efficient way to save for their future. This initiative is part of NSSF's broader strategy to expand social security coverage and provide financial security to all Kenyans, regardless of their location.

Haba Haba, initially launched in 2019, is a flexible savings plan designed for members of the informal sector. It allows participants to save a minimum of Ksh. 25 per day, with the option to withdraw 50% of their contributions after five years of consistent saving.

The plan is accessible through mobile phones, making it convenient for users to manage their savings and access various financial services, including pension, medical cover, and loans.

Kenya and China Enhance Cooperation in Renewable Energy

Kenya and China have signed a significant agreement to boost cooperation in renewable energy. This partnership is expected to unlock financing for green energy projects in Kenya, with China providing expertise and technology to enhance local capabilities in solar and other renewable technologies.

The collaboration aims to expand Kenya's electricity generation capacity from renewable sources and includes joint assessments to better understand the needs of Kenya's renewable energy market.

Kenya's installed electricity capacity stands at 3,112 megawatts, with solar contributing 210 megawatts. The new agreement will support the country's goal of increasing its reliance on renewable energy, which already constitutes a significant portion of its energy mix.

The partnership was announced during the 2024 China-Africa Digital Financial Inclusion Summit, attended by over 100 participants from China and Africa, focusing on strategies to improve access to financial services and energy solutions.

Coupa adds 100+ AI Tools to Spend Management Platform

Coupa has significantly bolstered its platform by integrating more than 100 AI-powered innovations. This strategic enhancement aims to serve businesses of all sizes by focusing on co-innovation with customers to drive profitable and sustainable growth.

As businesses navigate shifting market dynamics and tighter capital constraints, Coupa's AI-driven solutions offer a pathway to improved efficiency and effectiveness.

Among the newly introduced tools is Coupa Navi, designed to enhance productivity by streamlining customer interactions. It provides faster access to document statuses and approvals and serves as an always-available knowledge base for instant query responses.

Another notable addition is Contract Intelligence, which offers risk-informed clause recommendations and generative AI-generated legal summaries, helping customers mitigate potential issues.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have a fintech story or innovation to share?

Reach out to us at [email protected] and get featured in our vibrant community.

We cannot wait to hear from you!

Reply