- FINTAK Weekly Newsletter

- Posts

- The Power of Social Media

The Power of Social Media

A weekly digest of news, opinions and all things financial technology

The withdrawal of Kenya's 2024 Finance Bill by President William Ruto marks a critical moment in the country's recent history.

This also highlights the powerful role social media played in mobilizing and coordinating civic action against the controversial legislation. Even after amendments and concessions, the overwhelming opposition to the bill, amplified through various social media platforms with the #RejectFinanceBill2024 hashtag, ultimately led to its withdrawal.

This case study demonstrates the galvanizing power of social media in modern civic engagement and political activism.

Kenya Clears the June 2024 Eurobond

Kenya has cleared the remaining $556.97 million of its $2 billion Eurobond, due by June 24, 2024. This settlement, completed on June 21, three days before the maturity date, marks a significant fiscal achievement for the country. Earlier in February, the government had partially settled the bond through a $1.44 billion buyback, covering about 72.3% of the principal amount.

The country's foreign exchange reserves saw a notable increase last week, reaching $8,321 million, meeting the Central Bank of Kenya's (CBK) statutory requirement of four months' reserves. This rise was attributed to a $1.2 billion Development Policy Operations (DPO) loan from the World Bank, designated for the Eurobond settlement.

Breega Launches $75 Million Fund for African Startups

Paris-based venture capital firm Breega is launching a $75 million fund to invest in early-stage startups in Africa, focusing on sectors such as fintech, healthtech, proptech, logistics, and edtech. The firm has already secured commitments for around 70% of the capital in the first close.

Breega is expanding its presence in Africa by opening new offices in Lagos and Cape Town, complementing its existing locations in Paris, London, and Barcelona.

The Africa-focused fund, named "Africa Seed I," will be led by Melvyn Lubega and Tosin Faniro-Dada, both of whom bring significant entrepreneurial and operational experience.

The fund aims to invest between $100,000 and $2 million in startups across major African markets, including Nigeria, Egypt, South Africa, and Kenya, as well as Francophone countries like Morocco, Senegal, Ivory Coast, Cameroon, and the DRC.

Breega has already backed nine startups in Africa and plans to make at least 40 investments from this fund. The firm's strategy involves leveraging local partners who understand market dynamics and focusing on solutions tailored to meet local needs, rather than replicating U.S. or European models.

A One-Stop Shop for Foreign Investors

Kenya Investment Authority acting Managing Director Florence Benta Were

Great news for businesses looking to invest in Kenya! The country is launching a brand new online portal to simplify the process. This "Kenya Investment Single Window" will be a one-stop platform for foreign investors to apply for and register all necessary business permits.

The portal aims to streamline the business environment and reduce costs. It was developed by the United Nations Conference on Trade and Development for the Kenya Investment Authority. Currently, obtaining permits can be a complex process involving multiple agencies and levels of government.

The new system will connect databases like eCitizen, KRA(KENYA REVENUE AUTHORITY)'s iTax, and county government portals, eliminating the need for separate applications and visits to various offices. This will save investors valuable time and resources.

Previously, businesses faced challenges due to overlapping regulations and permits across different agencies. The Single Window aims to address this by providing a clear and centralized platform. This will make it easier for investors to navigate the system and reduce unnecessary hurdles that can discourage investment.

The Kenya Investment Single Window is expected to boost investor confidence, promote successful ventures, and contribute to Kenya's economic development.

15 Vodacom SA Workers Arrested, 630 Dismissed Over Fraud and Irregularities

Vodacom , South Africa's largest mobile phone operator, dismissed over 630 staff members and contractors and saw 15 individuals arrested for alleged fraud and other irregularities during the past financial year, from April 2023 to March 2024. According to Vodacom's annual report, its corporate security divisions investigated 8,652 cases, with 6,872 being external and 1,780 internal. These investigations, which led to the arrests and dismissals, were initiated through various channels, including direct reports from customers, service providers, online reports, business referrals, the company's fraud management system, and external whistleblowing.

Vodacom's audit, risk, and compliance committee conducted several in-depth sessions on compliance-related matters during this period. These sessions emphasized the "Doing What’s Right" online ethics program for employees, contractors, and suppliers, as well as the "Speak Up" initiative, which allows individuals to raise concerns about potential irregularities in financial reporting or other issues.

The ₦200 Billion USSD Debt Ringing Up Trouble in Nigeria

Nigerian banks owe telecom companies ₦200 billion (about $132 million) for Unstructured Supplementary Services Data (USSD) banking. According to TechCabal, this has been going for six years. Despite recent interventions by regulators and a payment plan established in late 2023, repayment has been slow.

Gbenga Adebayo, president of the Association of Licenced Telecommunication Operators of Nigeria (ALTON), warns that the debt, which includes principal and interest, may increase if payments continue to drag. Bank executives, however, question the transparency of the billing process and how telcos arrived at the debt figure.

Innovations at Flutterwave Boost Its Global Footprint and Valuation

Flutterwave founder and CEO, Olugbenga Agboola

Nigeria attracted the largest share of startup funding in Africa, securing $1.37 billion out of the continent's total of $4 billion. The country, along with South Africa, Egypt, and Kenya, accounted for 80% of the total funding raised in Africa, with Nigeria alone raising 35% of the capital.

Flutterwave recently raised $250 million in a Series D funding round, increasing its valuation to over $3 billion. The company has processed over 200 million transactions worth more than $16 billion across 34 countries in Africa and serves over 900,000 businesses worldwide.

Flutterwave has introduced new products and improvements under its Flutterwave 3.0 rebrand. These include Flutterwave Capital, a Buy Now Pay Later service; Grow, a B2B service for global business incorporation; Fintech as a Service (FaaS), a solution for startups to become fintech companies using Flutterwave's pre-built API; and Cards, a platform for businesses to issue virtual and physical debit cards to their customers.

The company's founder and CEO, Olugbenga Agboola, also attributes Flutterwave's growth to the support from customers, partners, banks, regulators, and the public. He also acknowledges the crucial role played by the Central Bank of Nigeria in providing a framework for innovation and growth in the payment system

UAE's Growing Influence in African Economics

In 2022, the UAE emerged as the leading source of capital inflows into Africa, totaling $50 billion, nearly double that of France, Europe's largest contributor.

The UAE is focusing on strategic sectors in Africa, including infrastructure, energy, transport, logistics, technology, and mining. Emirati companies, particularly DP World and Abu Dhabi Ports, have expanded their presence in African ports and logistics, operating in 13 African ports across the continent.

The UAE is investing heavily in both fossil fuels and renewable energy projects across Africa, positioning itself as a key player in the continent's energy transition. Abu Dhabi has adopted a more centralized and geostrategic approach to Africa, appointing its first minister of state for African affairs in 2021.

The UAE has signed Comprehensive Economic Partnership Agreements with several African countries and is working to position itself as a trade hub between Africa, Asia, and Europe. Emirati engagement in Africa also includes military and security cooperation, with defense agreements and training programs established with several African nations.

Congolese Delivery Startup Noki Noki Secures $3 Million in Seed Funding

Noki Noki Services, a logistics startup from the Democratic Republic of Congo, has secured $3 million in seed funding to expand its operations. The funding round was led by Uma Ventures and will help the startup scale its services across its existing six markets and strengthen its presence in new markets, including the DRC.

This investment is part of a broader trend of increasing venture capital in Congolese startups, which raised $62 million in 2023, making the DRC the largest contributor to startup funding growth in Central Africa.

Founded in 2021 by Jonathan Yanghat, Noki Noki offers various logistic solutions such as Noki Food for meal delivery, Noki Drive for supermarket shopping, and Noki Pay, an integrated payment interface. The company serves over 10,000 users and recorded transactions worth over 1 billion CFA francs ($167 million) in 2023.

Yanghat expressed that the funding will help the company achieve its goal of becoming a leading last-mile delivery service in Africa.

South African Biotech Firm Immobazyme Secures $1.3M to Accelerate Biotech Operations

South African biotechnology company Immobazyme secured $1.3 million in a recent funding round led by the University Technology Fund (UTF) and University of Stellenbosch Enterprises. Founded in 2019 as a spin-off from Stellenbosch University, Immobazyme specializes in precision fermentation technology to develop high-value protein ingredients. The company's product range includes growth factors for the cell-cultured meat industry, enzymes like dextranase for the sugar industry, and food ingredients for the food and beverage sector.

With this new funding, Immobazyme plans to double the size of its production facility and expand its capacity. This investment underscores the growing interest in alternative protein sources and the potential of precision fermentation technology. The company's expansion plans position it to play a significant role in these developing markets, particularly in the areas of cell-cultured meat and biotechnology-derived ingredients.

Two Rivers International Finance & Innovation Centre (TRIFIC) SEZ Secures $47.5M Funding

Two Rivers International Finance & Innovation Centre SEZ, (TRIFIC) Kenya's only services-focused Special Economic Zone-SEZ, has secured an investment of Ksh 6 billion ( about $47.5 million) from Vantage Capital Fund Managers (Pty) Ltd, an African mezzanine finance investor. This investment will be used to acquire and fit out TRIFIC's first office tower, the TRIFIC North Tower, and develop a new 76,800 square metre office tower to accommodate additional SEZ enterprises.

TRIFIC SEZ aims to create an integrated business environment with world-class infrastructure, advanced technology, and a robust regulatory framework. The SEZ has already secured bookings from fourteen different enterprises for the TRIFIC North Tower and has a pipeline of additional businesses interested in joining the zone. These enterprises are expected to create 10,000 jobs, attract US$65 million in foreign direct investment, and facilitate the export of services worth US$390 million annually.

Euronet Partners with Fintech Galaxy to Enhance Open Banking Payments in MEA

Euronet , a global financial technology and payments provider, has partnered with Fintech Galaxy, an open banking and financial innovation company, to enhance open banking-based payment processes in the Middle East and Africa. This collaboration introduces a new Banking as a Service (BaaS) offering for banks, fintechs, and merchants in the region, providing faster, more secure, and cost-effective account-based transactions.

The partnership aims to revolutionize payments through features such as card as a service, real-time payment processing, and advanced fraud detection. By integrating directly with consumers' bank accounts, the solution lowers transaction costs and improves user convenience, potentially increasing digital transaction adoption rates, which are currently growing at over 20% annually in the region.

The fraud detection system employs a dual-layer approach, with a rules-based module for mid-size markets and a strategic component for high-volume transactions. This sophisticated model leverages rich transactional data from open banking to enable real-time analysis and early detection of potential fraud.

UN Agency: Foreign Investment in Africa Drops; Energy Sector Receives Biggest Deals

According to the World Investment Report released by the U.N. Trade and Development, Africa experienced a significant decline in foreign investment last year, with finance deals dropping by 50 percent to $64 billion. This decrease is attributed to the global economic slowdown, rising geopolitical tensions, and high interest rates in Western economies, which made investments in emerging markets less attractive. Central African countries were the most affected, recording a 17 percent drop in foreign investment, while West Africa saw the smallest decline at 1 percent.

The reduction in foreign investments is also linked to protectionist policies implemented by some African governments, as well as regional realignments that have disrupted global trade networks and supply chains. Experts point to issues such as corruption, bureaucracy, political uncertainty, and unfavorable business environments as factors deterring investors. However, Africa has still managed to attract investments in some large-scale projects, particularly in renewable energy and electric vehicle manufacturing.

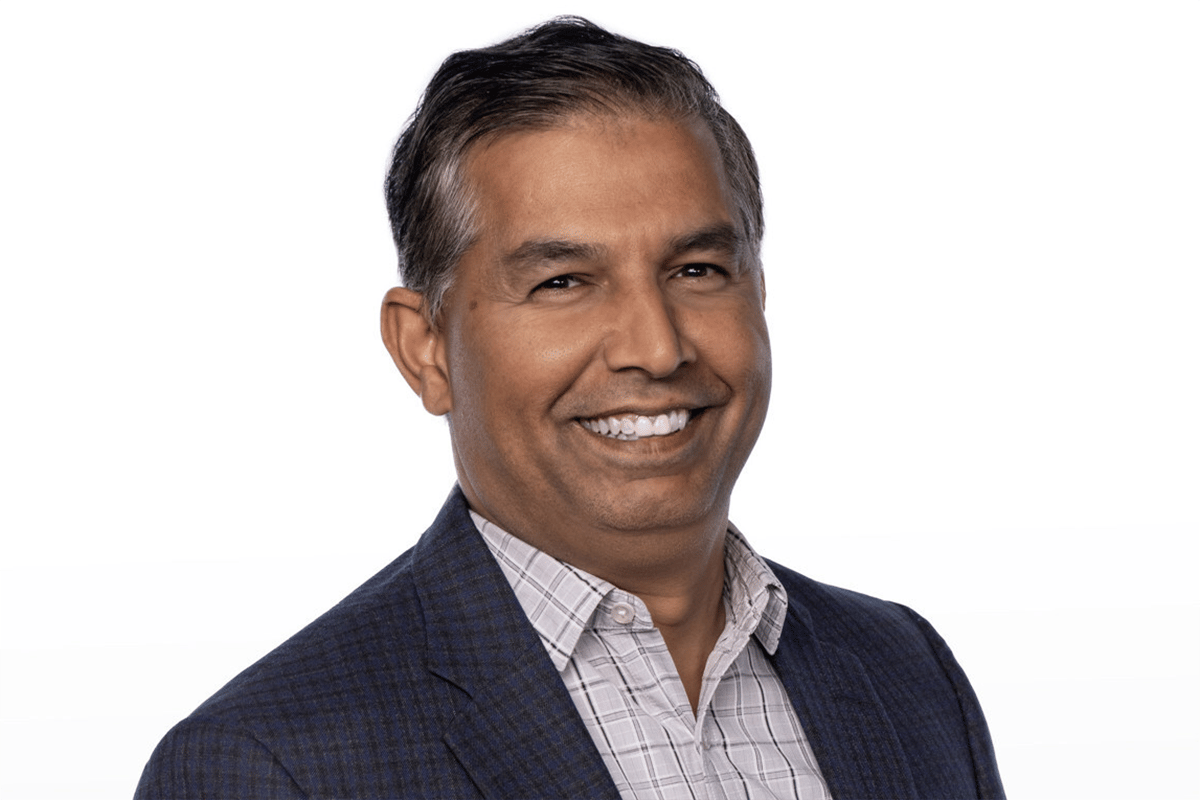

PayPal Appoints Industry Veteran Srini Venkatesan as New Chief Technology Officer

PayPal has announced the appointment of Srini Venkatesan as its new Chief Technology Officer, effective June 24, 2024. In this pivotal role, Venkatesan will lead the development and deployment of technology across PayPal's entire ecosystem.

Venkatesan's extensive experience in technology, digital transformation, and AI personalization, gained from his work with some of PayPal's largest customers and partners, is expected to be invaluable in his new position. Prior to joining PayPal, Venkatesan held leadership roles at Walmart Global Tech India, Yahoo , StubHub, and eBay, further bolstering his credentials in the fintech industry.

PayPal's President and CEO, Alex Chriss, expressed confidence in Venkatesan's ability to drive innovation and enhance the customer experience, stating that his expertise will be crucial in shaping the company's technology-driven initiatives.

Venkatesan succeeds Archie Deskus, who decided to leave PayPal after a two-year tenure. In his new role, Venkatesan plans to leverage his experience in creating innovative customer experiences to personalize PayPal users' shopping journeys.

Ethiopia Tops East African FDI Charts

Ethiopia has emerged as a leading destination for foreign direct investment (FDI) in East Africa, according to the latest World Investment Report by UN Trade and Development (UNCTAD). In 2023, Ethiopia attracted $3.3 billion in FDI, outpacing regional competitors Kenya ($1.5 billion) and Uganda ($2.9 billion).

The Ethiopian Investment Commission (EIC) reports that the country has already drawn $3 billion in FDI in the first ten months of the 2023/2024 fiscal year, to reach $3.5 billion by year-end. China remains Ethiopia's largest FDI source, accounting for nearly half of all inbound projects.

According to the report, key factors driving Ethiopia's FDI growth include:

Public-private partnerships (PPP): The country has boosted investment through PPP initiatives and direct negotiations with foreign companies.

Renewable energy projects: AMEA Power, a UAE-based company, has committed $600 million to develop a 300 MW wind energy project in the Somali Regional State.

Financial sector liberalization: Ethiopia has opened its doors to foreign investment in digital payment systems. Safaricom Ethiopia, for instance, received a license to offer mobile financial services, with its M-Pesa user base growing rapidly.

While Ethiopia leads in East Africa, Egypt remains the top FDI recipient in Africa overall, attracting $9.8 billion in 2023, followed by South Africa with $5.2 billion.

Globally, FDI flows to developing economies decreased by 7% to $867 billion in 2023, representing 65% of global flows. The United States maintained its position as the largest FDI recipient worldwide, accounting for nearly a quarter of the global total, while China and Hong Kong together accounted for 21%.

EU Highlights Funding Options for Tanzanian Businesses, Provides €4 Million for Small Enterprises

The European Union is boosting private sector growth in Tanzania through its 'Global Gateway' strategy. At a recent "Grow with European Union Finance" session, the EU presented financial opportunities and signed a €4 million grant for micro-enterprises. The event provided guidance on financing tools for Tanzanian SMEs and built on previous discussions about improving access to finance.

The grant was signed with the Financial Sector Deepening Trust to support SMEs led by women and youth. Over 100 representatives from various sectors attended, showing high demand for EU-facilitated financing.

EU officials emphasized their comprehensive support for Tanzania's business environment. Edward Claessen from the European Investment Bank noted that Tanzania received the largest EIB support in sub-Saharan Africa last year, benefiting thousands of enterprises.

New AfDB and ASF Partnership to Improve Knowledge-Sharing and Technical Assistance

Aida Ngom, AfDB Director of the Private Sector Development Department and by the Managing Director of the African Solidarity Fund, Abdourahmane Diallo

The African Development Bank (AfDB) and the African Solidarity Fund (ASF) have signed a letter of intent to enhance their collaboration to improve knowledge-sharing and technical assistance between the two institutions, particularly in risk management and organizational structures.

Aida Ngom, Director of the Private Sector Development Department at AfDB, and Abdourahmane Diallo, Managing Director of ASF, formalized the agreement during the third Ordinary Session of the ASF Board of Governors.

Diallo emphasized the ambitious nature of this partnership and the commitment to ongoing projects that support young people, women, and other target groups in Africa. "This approach reflects the African Solidarity Fund's commitment to promoting inclusive and sustainable development on the continent," he said.

"As far as the African Development Bank is concerned, the African Solidarity Fund is a strategic and important institution. We look forward to our two institutions working more closely via this strategic partnership," said Ngom.

The partnership is a step towards promoting inclusive and sustainable development across the continent, reflecting both institutions' shared goals to drive economic and social progress through strategic cooperation.

Nairobi Sets the Scene for AI Ethics Discussions with Eastern Africa and UNESCO

Kenya and UNESCO are co-hosting the Eastern Africa sub-Regional Forum on Artificial Intelligence in Nairobi. The event will bring together 15 nations to discuss AI's potential and ethical implications in the region. The forum will focus on implementing UNESCO's recommendation on AI ethics, which was adopted by 193 countries in 2021.

Readiness Assessment Methodology (RAM) reports from the region will be presented, and the event will feature participation from private sector representatives and women experts in AI. EARFAI builds on previous UNESCO AI forums in Africa and contributes to the organization's global AI agenda. It also supports the development of the African Union Continental Strategy on AI. The forum aims to advance good AI governance and explore AI's role in addressing regional challenges, particularly in education.

Canadian Overseas Packaging Industries Limited Moves to Full Ownership of East African Packaging Industries

East African Packaging Industries Limited

Canadian Overseas Packaging Industries Limited-Copil has announced securing a 91.99% shareholder acceptance to take over full ownership of East African Packaging Industries Limited. The firm has initiated steps to acquire the remaining 8.01% stake compulsorily. Copil, which previously held a 92.1% stake in EAPI, first renewed its bid to acquire minority shares in April, following an initial interest made public in 2003.

Company Secretary David Eramian stated that private notices had been issued to non-assenting shareholders regarding the compulsory acquisition plans. The recent bid saw Copil receive 91.99% acceptances, bringing it closer to full ownership. A letter of offer was sent to all EAPI shareholders, except 29 whose addresses could not be traced.

EAPI, delisted from the Nairobi Securities Exchange PLC over two decades ago, manufactures packaging materials for various industries, including cement and horticulture. Copil also owns Caribbean Packaging Industries in Trinidad and Tobago, Jamaica Packaging Industries, and Paper Processors Limited in Jamaica, with a distribution operation in Barbados called Barbados Packaging Industries.

According to EAPI's last annual report for June 2002, the company had 7,680,000 ordinary shares in issue, Sh954 million in assets, and 310 employees.

GreyDots AI launches Generative AI to rival Other LLMs

On Friday, June 14th, GreyDots AI launched Nigeria’s first generative AI chatbot named Nigeria Info Generative Pre-trained Transformer (NiGPT). NiGPT is designed to provide Nigerian-centric answers, positioning itself as a competitor to other large language models like Google’s Gemini and OpenAI’s ChatGPT.

GreyDots AI, founded by Arnold Agure-Dam and Julius Olaolu Oyekanmi, aims to enhance various sectors of Nigeria’s socio-economic landscape through this innovation.

The launch event, held at Eko Hotels and Suites in Lagos, was attended by notable figures including Ayodele Olawande, the minister of state for youth development; Tubosun Alake, the Lagos state commissioner for innovation, science and technology; and other dignitaries and industry leaders. Uche Nnaji, the minister of innovation, science and technology, represented by Martins Emeje, expressed the ministry’s support for technological advancements in Nigeria.

E-payment, Collection Services in Egypt Rise to $51.8 Billion in 1st 11 months of FY23/24

During the period from July 2023 to May 2024, Egypt saw significant growth in various electronic payment and collection services. The value of e-payment services for government employees' payrolls increased by 24%, reaching EGP 299.4 billion, up from EGP 242.2 billion in the same period of the previous fiscal year. Similarly, e-payment services for suppliers grew by 14%, amounting to EGP 1.1 trillion, compared to EGP 989.8 billion previously. Electronic customs collections experienced a notable rise of 38%, reaching EGP 284.3 billion, up from EGP 205.8 billion.

The electronic tax collection transactions also saw a growth of 16%, totaling EGP 613.1 billion. There was a 38% increase in citizens' interest in paying government dues electronically, with the value of collections through the "Citizens' Payment" service reaching EGP 61.4 billion, compared to EGP 44.4 billion. Collections through government electronic collection machines (GPOS) increased by 31%, reaching EGP 60.8 billion, up from EGP 46.3 billion.

The government's online payment gateway witnessed a substantial growth of 78%, with collections exceeding EGP 1 billion, compared to EGP 600 million in the previous fiscal year. Additionally, collections through integrated collection companies connected to the government's Electronic Payment and Collection Centre grew by 55%, reaching around EGP 1.9 billion, up from EGP 1.2 billion.

Gocardless Partners With Federation Of Small Businesses To Tackle Late Payments

GoCardless has partnered with the Federation of Small Businesses (FSB) to help its members address the issue of late payments. This collaboration includes the launch of the FSB GoCardless Late Payments Hub, which provides practical tips and advice on managing payments more effectively.

The hub aims to help small business owners take control over when and how they get paid, thereby reducing the administrative burden and improving cash flow. FSB members will also benefit from cost savings and support when signing up for GoCardless services, subject to eligibility criteria.

Nicola Hamilton , VP of Marketing, Brand & Communications at GoCardless, emphasized that small business owners often face significant delays in receiving payments, which can be costly and time-consuming.

She noted that many small business owners avoid confronting customers about late payments, which needs to change.

Caroline Lavelle , Chief Commercial Officer at FSB, highlighted that late payments not only strain finances but also affect the mental well-being of small business owners. She expressed hope that the new online hub would be a valuable resource for FSB members.

Tech Innovation Drives Success for Kenyan E-Recruitment and Real Estate Platforms

BrighterMonday Kenya has been recognized as the Best E-Recruitment Platform at the Kenya E-Commerce Awards 2024. According to the company, The company's success is attributed to its advanced tech-enabled Applicant Tracking System and relevance matching algorithms.

BrighterMonday plans to further enhance user experience through automated CV services and AI-powered job recommendations.

"This year, we shall continue optimizing technology to respond to the needs of our users, especially when it comes to automated CV services and job recommendations for our seekers on one hand and AI-powered candidate matching solutions for employers on the other.” said Dennis Githinji, BrighterMonday's Head of Operations and Customer Experience

Similarly, BuyRentKenya was award as the Best Real Estate Marketplace. This is an online real estate platform in Kenya that connects property seekers with verified real estate agents, private sellers, and landlords across the country. As a marketplace for buying, selling, and renting properties, it offers a comprehensive database of over 7,500 listings, covering various regions including Nairobi and Mombasa. The sister company, PigiaMe, also emerged victorious by winning the Gold award in the Best Classifieds Website Category

“This win at the E-commerce Awards is a significant milestone that reflects the company’s dedication to innovation, customer satisfaction, and industry leadership.” said BuyRentKenya CEO Elizabeth Costabir.

These are some of the innovations that bring to light how digital innovation is driving progress across various industries in Kenya, and ultimately contributing to the country's Vision 2030 pillar of world class infrastructure facilities & services.

US Govt To Support Kenya’s Clean Energy Transition

The United States Department of Energy, through Deputy Secretary David Turk, has expressed interest in investing in Kenya's green energy sector, particularly in e-mobility and clean power generation. Turk highlighted Kenya's impressive achievement of generating 93% of its electricity from renewable sources, surpassing the United States in this regard. He emphasized the U.S. government's commitment to working closely with Kenya to create a conducive environment for the green energy sector, focusing on policy infrastructure and capacity building to leverage financial flows.

In May 2024, Kenya launched the Green Resilient Electricity System Programme in partnership with the European Union. This initiative aims to support Kenya's ambitious goal of achieving 100% clean power generation by 2030. The programme will provide critical investments to expand green electricity production and improve grid stability and efficiency.

Currently, Kenya sources up to 91% of its energy from renewable sources, with geothermal energy contributing 47%, hydropower 30%, wind 12%, and solar 2%. The Kenya Electricity Generating Company estimates that the country has the potential to increase its geothermal energy capacity to 10,000 MW, which would exceed the current peak demand of about 2,000

Mobile Money Subscriptions Rebound After Scrapping Of Airtel Transfer Code

According to the Business Daily, mobile money subscriptions in Kenya have rebounded after a period of decline. The latest data from the Communications Authority of Kenya shows that mobile money subscriptions increased to 38.4 million in the quarter ending March 2024, up from 38 million in the previous quarter.

This growth can be attributed to Airtel Kenya 's introduction of a new USSD code for money transfers, which has made it easier for customers to use their service. The move has helped Airtel Money gain market share, rising to 3.4% from 3.1% in the previous quarter.

Despite this growth, Safaricom PLC 's M-PESA Africa continues to dominate the market with a 96.5% share of mobile money subscriptions. Telkom's T-Kash remains a minor player with a 0.1% market share.

The report also highlights that the total value of mobile money transactions increased by 5.4% to Sh2.4 trillion during the quarter. This growth in both subscriptions and transaction values indicates a recovery in the mobile money sector after a period of stagnation.

Fidelity Insurance and M-TIBA Launch Tech-Driven Health Cover

Fidelity Insurance has partnered with the health insurance technology platform M-TIBA to launch "My Afya Shield," a health coverage product that emphasizes health and wellness through technology. This collaboration marks a significant shift in health insurance by prioritizing preventive healthcare over curative treatments. My Afya Shield offers comprehensive benefits, including treatments, access to vaccines, counseling services, mental wellness support, rehabilitation services, and personalized wellness programs. Notably, it includes coverage for alcohol and drug abuse rehabilitation as a standard feature, along with regular health check-ups.

The product is underwritten by Fidelity Insurance and accessed via M-TIBA’s digital health insurance platform, which connects members to a wide network of healthcare providers. Members can initiate treatments through the M-TIBA App and USSD, monitor benefits and limits in real-time, review claims, and easily locate and access care at healthcare providers. Additionally, members can add family members as dependents and manage their healthcare needs independently with 24/7 support.

Cadana Secures $7.1M Seed Funding To Expand Payroll and Remittance Offerings In Emerging African Markets

Cadana, a fintech startup founded in 2021 by Albert Owusu-Asare and Ameer Shujjah, raised $7.1 million in seed funding to enhance payroll services and remittance for African workers. The global freelancer market, worth $1.3 trillion, has highlighted the need for efficient payroll and tax solutions, especially in emerging markets where legal complexities are often overlooked. Cadana addresses these challenges with its APIs and white-label products, enabling global workforce platforms to integrate seamless payment and payroll management systems.

Operating in over 32 emerging markets, including Ghana and Nigeria, Cadana focuses on reducing wage payment delays and lowering remittance fees, which are critical for workers supporting multiple family members. The startup has processed over $150 million in transactions and saved workers more than $2.5 million in fees.

Revolut Seeks at Least $40 Billion Valuation

British fintech company Revolut is seeking a valuation exceeding $40 billion through a planned $500 million sale of its existing shares, according to reports from Financial Times and Reuters. This new valuation would represent a more than 20% increase from its previous $33 billion valuation in 2021. If confirmed, this valuation would make Revolut the most valuable fintech startup, surpassing other notable fintech companies such as Wise, which has a market capitalization of $8.9 billion, and challenger banks Monzo and Starling, valued at $4.6 billion and $3.2 billion, respectively.

Revolut, founded in 2015, operates as a payment institution in the UK and is currently seeking a UK banking license, a process that has been ongoing since 2021. The company generates revenue from payments, subscriptions, and customers trading stocks and cryptocurrencies.

Recently, Revolut has expanded its offerings to include a range of trading instruments such as contracts for differences and bonds through third-party integrations.

Technology's Role in Improving Service Delivery and Boosting Revenue in Kenyan Counties

The inaugural OSR Growth Conference at the Kenya School of Monetary Studies highlighted technology as a crucial tool for Kenyan counties to enhance service delivery and boost their Own Source Revenue. County leaders, revenue experts, and tech companies gathered to discuss innovative strategies for improving OSR collection, addressing the limitations of relying on national allocations. Despite counties collecting a record Ksh 20 billion in the first half of the fiscal year, this falls short of the 30% target, emphasizing the need for more sustainable approaches.

Success stories from Homa Bay and Vihiga counties demonstrated how technology adoption, such as revenue collection apps and data-driven healthcare initiatives, can drive service quality and revenue generation. With proper optimization, counties could generate an estimated KSh 260.6 billion from various revenue streams.

Women in AI: Anika Collier Navaroli Zeal to Balance Power in AI

Anika Collier Navaroli

Through her research and advocacy, Anika Collier Navaroli is making strides in addressing power imbalances in the tech industry. As a senior fellow at Columbia University's Tow Center for Digital Journalism and a Technology Public Fellow with the MacArthur Foundation, Navaroli has a rich background in media law and policy. Her career includes roles at Stanford, Twitch, and Twitter, where she worked on initiatives to verify historically excluded individuals and amplify diverse voices.

Navaroli's journey into AI began during her undergraduate years in a newsroom when she transitioned to digital formats, sparking her interest in the intersection of technology and society. Her notable work includes the "Black in Moderation" project at Stanford, which highlights the experiences of marginalized individuals in tech and raises awareness about diversity and inclusion.

Navigating the male-dominated tech sector as a woman in AI, Navaroli emphasizes the concept of 'compelled identity labor,' where marginalized employees often represent entire communities. She advocates for setting boundaries and selective engagement to manage this burden.

Looking ahead, Navaroli sees the importance of journalism education in fostering critical thinking and ethical decision-making in AI development. By nurturing a new generation of tech accountability professionals, she aims to pave the way for responsible AI innovation and regulation, bridging the gap between industry insiders and regulators for a more ethical technological future.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya. If you're interested, please don't hesitate to get in touch. Please email us at 𝐩𝐫@𝐟𝐢𝐧𝐭𝐞𝐜𝐡𝐚𝐬𝐬𝐨𝐜𝐢𝐚𝐭𝐢𝐨𝐧.𝐚𝐟𝐫𝐢𝐜𝐚 with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 - 31,780+💙S𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply