- FINTAK Weekly Newsletter

- Posts

- Esther Kimani Awarded Tenth Africa Prize for Her AI Innovation

Esther Kimani Awarded Tenth Africa Prize for Her AI Innovation

A weekly digest of news, opinions and all things financial technology

Esther Kimani won the prestigious 2024 Africa Prize for Engineering Innovation awarded by the Royal Academy of Engineering. Her winning innovation is an early crop pest and disease detection device that uses AI and machine learning to rapidly identify agricultural pests and diseases afflicting crops.

Kimani was awarded £50,000 (Ksh 8.1 million) - the largest prize amount in the competition's 10-year history) to further develop her innovation.

The solar-powered tool uses AI-enabled cameras to detect and identify agricultural pests and diseases within five seconds, providing swift intervention recommendations via SMS.

Current diagnostic methods can take up to three weeks, leading to crop losses. Kimani's device, featuring a high-sensitivity camera and an extensive pest database, captures images within a 600-meter range and uses advanced machine learning for analysis.

It offers a cost-effective alternative to traditional methods, with a leasing fee of $3 per month. The device also alerts government officers about pest presence, provides weather predictions, and suggests suitable seeds and crops.

Data from the devices is used for monitoring and policymaking. This innovation can increase crop yields by 40% and reduce losses by 30%.

My parents would lose up to 40% of their crops each farming season, which affected our standard of living. We are empowering smallholder farmers, many of whom are women, to increase their income. We aim to scale to one million farmers in the next five years.

Three other finalists from Kenya, Cote d'Ivoire, and Uganda received £15,000 (Ksh 2.4 million) each, from their innovations:

Kevin Maina's Eco Tiles (Kenya) are eco-friendly roofing materials made from recycled plastic, stronger and lighter than conventional tiles, reducing carbon emissions through a unique manufacturing process.

Rory Assandey's La Ruche Health (Côte d'Ivoire) uses "Kiko," an AI chatbot on WhatsApp, to provide health information and services, streamlining healthcare processes and facilitating over 150,000 interactions by May 2024.

Martin Tumusiime's Yo-Waste (Uganda) is a mobile app connecting users to waste collection agents, optimizing routes with GPS, serving 1,500 customers and aiming for 20,000 by 2026.

Dr. Abubakari Zarouk Imoro received the 'One to Watch' award for significant community impact.

The annual Africa Prize, founded in 2014, supports African innovators developing sustainable engineering solutions to local challenges. This year's event in Nairobi marked the 10th anniversary, with the alumni community now comprising nearly 150 entrepreneurs from 23 countries who have created over 28,000 jobs and benefited over 10 million people.

Airtel Expands 5G Network to 39 Counties in Kenya

Airtel Kenya has expanded its 5G network to cover 39 counties and 285 wards, with over 690 operational sites, and plans to add 1000 more by the end of the year, bringing the total to 1690 sites. The number of 5G users in Kenya grew by 13.3% to 509,737 from June to September 2023.

Airtel's Managing Director, Ashish Malhotra, highlighted the company's commitment to digital inclusion, driven by positive market response. Airtel initially launched its 5G service in July 2023, and in August, it announced a $150 million investment to expand its network.

As of early 2024, Kenya had 22.71 million Internet users, with a penetration rate of 40.8%, and the telecom market is expected to continue growing due to a rising population, better communication services, and increased smartphone adoption.

Safaricom Ethiopia Launches Services In Tigray Region

Safaricom Telecommunications Ethiopia PLC has officially launched commercial operations in the Tigray region, marking a step in the company's expansion within Ethiopia. The rollout is being executed in two phases, with the first phase already completed, involving the construction of 125 towers. The second phase will add another 166 towers to extend coverage to cities in Northern and Western Tigray.

This phased approach aims to build an independent, state-of-the-art 4G network that is 5G-ready. Safaricom has also established a regional office in Tigray, creating direct employment opportunities and planning further recruitment. Additionally, the company is generating thousands of indirect jobs through partnerships with local businesses for distributing airtime, SIM cards, devices, and producing branding materials.

This move follows Safaricom's broader expansion in Ethiopia, which began with the rollout of its network in Dire Dawa in August 2022 and the official launch of its national network in Addis Ababa and ten other cities in October 2022.

Copia Global Seeking Fresh Funding?

Copia Outlet Shop

Copia Global, the Kenyan B2C e-commerce startup that entered administration on May 24, remains operational despite laying off 1,060 employees. The administrators, Makenzi Muthusi and Julius Ngonga of KPMG, informed employees in termination letters that the business aims to continue while cutting operational costs and seeking new capital.

Makenzi Muthusi, in a termination letter, emphasized the need to right size and right shape the business to meet new digital opportunities and position it for profitable growth. He stated that the layoffs were necessary to maximize Copias long-term potential and were not a reflection of the employees performance.The company assured employees that they would be informed about potential employment opportunities, indicating the administrators commitment to turning around the struggling e-commerce giant.

However, it remains uncertain how the new management will attract new investors after previous efforts to save the company failed in early May.

The layoffs followed Copia's decision on June 4 to stop taking orders from Central and Eastern Kenya, suggesting that the administrators are scaling back operations to address cash flow issues.

Afreximbank Secures $100M Trade Finance Deal With DRC's Rawbank

African Export-Import Bank (Afreximbank) has signed an agreement to provide a US$100-million trade finance facility to Rawbank , the largest such facility ever extended by Afreximbank to a commercial bank in the Democratic Republic of Congo (DRC). This facility aims to enhance trade flows into and out of the DRC, thereby reducing pressure on the country's balance of payments. The agreement, part of the Afreximbank Trade Finance Facility programme, was signed during the Afreximbank Annual Meetings.

Haytham ElMaayergi , Executive Vice President of Global Trade Bank at Afreximbank, emphasized that the facility would support economic development in the DRC by leveraging intra-African and global trade opportunities.

Didier TILMAN, Vice-President of Business Development at Rawbank, highlighted the importance of this agreement, noting that it represents a substantial capital injection into Rawbank's trade finance capabilities and underscores the confidence in Rawbank's role in driving economic growth and facilitating trade in the region.

The AFTRAF programme is designed to provide trade confirmation services, guarantees and irrevocable reimbursement undertakings, countering the trend of international banks reducing or withdrawing trade lines to African banks. This strategic partnership is expected to create business opportunities for Rawbank and its clients, further supporting the economic development of the DRC.

Africa Data Centres Secures $108.9 Million in Funding to Expand Data Center Capacity in South Africa

In an effort to meet the increasing demand for cloud computing services in South Africa, Africa Data Centres has secured around $108.9 million in funding. This funding was arranged by RMB - Rand Merchant Bank (RMB) through a tailored financing solution.

Hardy Pemhiwa, President & Group CEO of Cassava Technologies, the parent company of Africa Data Centres, hailed this as a "significant milestone in the growth" of the company and emphasized their commitment to growth and their confidence in the future of the South African data centre market.

The additional funding will allow Africa Data Centres to support its customers' digital transformation efforts and further consolidate its position as a key player in the African data centre industry. The financing will enable the company to accelerate the expansion of its hyperscale data centre capacity by an additional 20MW.

Nana Phiri , the head of the corporate client group at RMB, highlighted the significant digital infrastructure opportunity in the data centre space, noting the large deficit of supply versus demand. "With the exponential growth in demand for data centre capacity in Africa, we are proud to partner with Africa Data Centres as they facilitate digital transformation across the continent," Phiri said.

AllianceDFA Announces Grantees for 2024 Small Grant Fund

The Alliance of Digital Finance and Fintech Associations has revealed the recipients of its 2024 Small Grant Fund, aimed at supporting Digital Finance and Fintech Associations (DFAs) in delivering local projects and initiatives to deepen their impact and scale.

After a competitive selection process, the following four DFAs have been chosen as grantees:

To explore their projects, please follow this link.

The Small Grant Fund provides financial assistance to DFA members, enabling them to contribute to market facilitation and support the growth of the digital finance ecosystem in their respective countries.

The selected grantees will now have the opportunity to implement their proposed projects, which are expected to have a significant impact on the digital finance landscape.

Further details about the grantees' projects and their progress will be shared on the AllianceDFA website.

The Small Grant Fund initiative aligns with AllianceDFA's mission to enhance the capacity of DFAs, lead the digital finance and fintech profession, and catalyze innovation and inclusion within the industry.

Roscas Leverages Technology to Enhance Financial Inclusion in Mozambique

Roscas Team

roscas, a fintech company in Mozambique, aims to go beyond just deploying capital and lending by facilitating inter-group lending and enabling groups to access credit from external institutions using their digital saving records. They are also exploring partnerships with investment banks to offer low-risk investment options for savings groups.

Despite a competitive fintech landscape, Roscas focuses on collaboration over competition and is currently scaling its platform locally before expanding into Sub-Saharan Africa. They have secured pre-seed funding from Renew Capital and restarted user acquisition after obtaining a provisional license from the Central Bank.

Roscas is building a new platform iteration, adapting to regulatory challenges, and leveraging technology to bridge the financial inclusion gap in Mozambique’s informal economy.

Zimbabwe Confronts Escalating Debt, Seeks Global Assistance

Zimbabwe's Finance Minister, Mthuli Ncube, has confirmed that the country's debt arrears have reached a staggering peak of US$6.7 billion. This huge debt burden is a major obstacle to Zimbabwe's development and restricts its access to global finance.

In an effort to address this crisis, the government is working with global finance bodies and creditors to create a sustainable payment plan. The goal is to not only clear the arrears but also to promote economic growth and improve the living conditions of Zimbabwean citizens.

According to reports, the government is asking its lenders for debt relief and the waiving of additional penalties. This approach is expected to offer Zimbabwe an opportunity to improve its financial situation and redirect crucial funds towards essential infrastructure and community development.

According to Zimbabwe's national debt register, almost 76% of its external bilateral debt of around US$6.2 billion is in arrears. The Paris Club members, primarily Western countries, are owed US$4.1 billion, with 98% of it in default due to an economic crisis that began in Zimbabwe two decades ago.

MENA Is Becoming an Instant Payment Paradise

The MENA region is rapidly emerging as a global leader in instant payments, driven by technological adoption, strategic government initiatives, and a significant increase in digital payment transactions. According to ACI Worldwide, the region is the fastest-growing real-time payments market globally, with transactions expected to surge from $675 million in 2022 to $2.6 billion by 2027, representing a compound annual growth rate (CAGR) of 30.6%.

Key countries like Saudi Arabia, the UAE, and Egypt are at the forefront of this transformation. Saudi Arabia's implementation of the Sarie system aligns with its Vision 2030, aiming to modernize payment infrastructure and reduce cash dependence. The UAE launched its instant payment platform, Aani, in 2023, further solidifying its position as a fintech hub. Egypt's Central Bank has rolled out the Instant Payment Network to reduce cash reliance and integrate more people into the formal economy.

The future outlook for instant payments in the MENA region is positive, with ongoing technological advancements and strong government support. The adoption of ISO 20022 enhances data quality and global compatibility, positioning MENA as a leader in financial technology innovation and setting new global standards for digital transactions.

inDrive.Freight Expansion in South Africa to Tackle Youth Unemployment

inDrive 's inDrive.Freight is expanding its operations to additional cities across South Africa.

inDrive.Freight is a freight delivery service offered by inDrive, a global mobility and urban services platform. The service allows users to transport heavy and bulky items, with a unique feature that lets customers set their own price for transportation. Here are the key aspects of inDrive.Freight:

This move aims to provide new employment opportunities, particularly for the youth, amidst ongoing job shortage protests. Since its launch, the platform has seen notable engagement, with over 40% of its drivers aged between 18 and 35 years old. Nearly 60% of the deals facilitated through the platform have been executed by young drivers, highlighting their adaptability to technological solutions.

Vincent Lilane, Business Development Representative in Southern Africa, emphasized the company's mission to empower young drivers with the necessary tools and technology to succeed in the freight industry. This initiative aims to foster economic development and create a more inclusive and resilient economy by leveraging the talent and adaptability of South Africa's youth.

AfDB Unveils Plan to Check Africa’s Debt Challenges

The African Development Bank Group Institute has introduced a new initiative that aims to offer tailored solutions to Africa's increasing debt issues. The launch took place in Addis Ababa, Ethiopia, under the theme "Developing and Deepening Domestic Debt Markets in Africa."

The goal of this initiative, as stated by AfDB's Director Abdoulaye Coulibaly , is to enhance the debt management capabilities of African countries' officials and institutions. This will help these nations tackle their debt challenges, restore macroeconomic stability, and promote inclusive growth. Additionally, the network will facilitate the sharing of experiences among debt managers in regional member countries.

The launch event brought together debt managers, heads of debt management offices, capital market operators, commercial bankers, as well as regulators including securities and exchange commissions and central banks. Participants discussed effective debt management frameworks, networking, and peer learning to support the development and deepening of domestic debt markets in Africa, aiming to ultimately promote debt sustainability.

AfDB's Institute Director, Eric Ogunleye, emphasized the growing need for financing in areas such as infrastructure development, poverty reduction, climate change mitigation, and addressing insecurity. These needs have led African countries to increase their borrowing, resulting in heightened debt vulnerability. As of April 2024, 13 out of 38 African countries with debt sustainability assessment data available are at high risk of debt distress, and 6 are already in debt distress.

Starlink Officially Enters Sierra Leone

Starlink, is now available in Sierra Leone, marking its 100th global market and reportedly the 10th African country to have official Starlink connectivity. This launch comes a year after Sierra Leone granted Starlink an operational license in June 2023. At that time, David Moinina Sengeh, the minister of basic and senior secondary education and chief innovation officer of Sierra Leone, announced that Sierra Leone had become the fifth African country to issue a license to Starlink.

In May 2024, Sengeh, along with other officials, met with senior staff of Starlink and SpaceX in Texas. A month later, the Internet service went live in Sierra Leone. Sengeh expressed his satisfaction, noting that the engagement with Starlink had begun a year prior and had now come to fruition.Starlink's entry into Sierra Leone is expected to significantly boost Internet connectivity in the country, where Internet penetration was 18% in 2020, rose to 21% at the start of 2023, and is projected to reach 40.41% in 2024. The service aims to provide high-speed Internet, particularly benefiting remote and underserved areas.

The launch in Sierra Leone follows the reversal of bans in several African countries. In April 2024, Ghana's National Communications Authority approved Starlink's operation, four months after initially declaring it illegal. Similarly, in May 2024, Zimbabwe and Botswana granted operational licenses to Starlink, with Botswana reversing an earlier rejection due to incomplete application information.

Airtel Activates 2Africa Cable From South Africa to Kenya

Airtel Africa has activated the initial phase of the 2Africa submarine cable, connecting Kenya, Tanzania, and South Africa. This 45,000 km subsea cable, the world's largest, aims to enhance internet connectivity across 33 countries with 46 landing points in Europe, Africa, and Asia. The cable is expected to have a capacity of up to 180Tbps.

The project, a collaboration between Airtel Africa and Alcatel Submarine Networks, underscores a commitment to bridging the digital divide in Africa. The 2Africa consortium includes partners like China Mobile International, Meta, Orange, Telecom Egypt, Vodafone Group, and WIOCC. The cable will further expand to other regions later this year.

Microsoft Isn't Leaving Nigeria

Microsoft has confirmed the closure of its Africa Development Center in Lagos, Nigeria, which primarily focused on engineering and innovation. Despite this, Microsoft Nigeria, which handles sales, marketing, and support, remains fully operational. The closure affects around 200 employees, who will receive salary payments until June 2024 and continue to be covered by health insurance.

The decision to shut down the ADC is part of Microsoft's broader organizational and workforce adjustments, which have been ongoing since 2023 to align with global market conditions and strategic growth areas. This move follows earlier layoffs, including a significant reduction of 10,000 jobs announced in January 2023.Microsoft established the ADC in Lagos and Nairobi in 2019 to expand its engineering talent pool and invest in local tech ecosystems.

Despite the closure, Microsoft emphasizes its continued commitment to Nigeria's transformation objectives and strategic investments in the region. The closure reflects broader economic challenges, including foreign exchange concerns and unfavorable economic conditions, which have led to the exit of several international businesses from Nigeria.

Tackling AI's Language Barrier in Africa

The global AI landscape, dominated by tools like OpenAI's ChatGPT and Meta's Llama 2, often fails to accommodate African languages, leading to potential digital exclusion. The Nigerian government's project intends to address this gap by training an LLM on five low-resource languages—Yoruba, Hausa, Igbo, Ibibio, and Pidgin—along with accented English. This effort will involve partnerships with local AI startups and contributions from Nigeria's tech talent program.

Silas Adekunle, co-founder of Awarri _, highlights the challenges of creating an AI tool that comprehends Nigeria's diverse linguistic and cultural landscape. Despite these challenges, the project aims to empower developers to build AI products tailored to the Nigerian market.

Africa, home to over 2,000 languages, sees most of its languages underrepresented online, with English dominating the digital space. However, African startups are rising to the challenge.

In Kenya, Jacaranda Health has developed UlizaLlama, a Swahili-based LLM for improving maternal healthcare. South Africa's Masakhane initiative and Lelapa AI's VulaVula are also working on translating and processing African languages.

AI experts warn that building LLMs for African languages poses significant challenges, including data scarcity and ethical concerns. Michael Michie of Everse Technology Africa emphasizes the need for regulations addressing consent, privacy, and compensation for data collection.

Vukosi Marivate of Lelapa AI points out the difficulties of ensuring proper reimbursement and recognition for contributors in open-source projects.

Users will be able to access the feature through the 'Manage storage' menu once it's launched in future updates.

Ghana's NAPRM-GC Partners with AfCFTA Office to Empower Local Businesses

The NATIONAL AFRICAN PEER REVIEW MECHANISM GOVORNING COUNCIL (NAPRM-GC) in Ghana has announced its collaboration with the AfCFTA National Coordinating Office to empower local businesses to take advantage of the opportunities provided by the African Continental Free Trade Area (AfCFTA) Secretariat

Kathleen Quartey Ayensu, the Chair of the NAPRM-GC, emphasized the importance of supporting the AfCFTA National Coordinating Office in Accra to ensure that Ghanaian businesses are informed about and can capitalize on the vast continental market.

This announcement was made during a knowledge empowerment workshop organized by the NAPRM-GC for the District Oversight Committees (DOCs) of the African Peer Review Mechanism (APRM) in the Volta Region. The workshop aimed to provide the DOCs with knowledge about Ghana's Targeted Review on the AfCFTA and corporate governance, and their role in facilitating intra-African trade under the AfCFTA initiative.

This review provides an opportunity to strengthen good governance practices for the Micro, Small, and Medium Enterprises (MSMEs), which constitute the backbone of the Ghanaian economy. According to the Ghana Enterprise Agency (GEA), the MSME sector, comprising 1.7 million of the estimated 2.1 million businesses in Ghana, employs 2.5 million people and contributes 75% to the national GDP. Empowering these businesses to seize the AfCFTA opportunities will lead to increased foreign exchange earnings, national income, and numerous employment opportunities.

Fidelity Bank Announces Major Capital-Raising Plan

Fidelity Bank PLC is set to launch a significant capital-raising initiative on June 20, 2024, which includes a ₦29.6 billion (approximately $19.9 million) rights issue and a public offer, totaling ₦127.1 billion (approximately $85.6 million).

This initiative aims to bolster the bank's share capital base in line with the Central Bank of Nigeria's revised minimum capital requirements introduced on March 28, 2024.The rights issue will offer 3.2 billion ordinary shares at ₦9.25 per share, in the ratio of 1 new share for every 10 shares held as of January 5, 2024. Additionally, the public offer will make 10 billion ordinary shares available to the general public at ₦9.75 per share.

To provide comprehensive details and engage with potential investors, Fidelity Bank will hold a 'Facts Behind the Offer' presentation at the Nigerian Exchange on June 20, 2024.

This capital-raising effort is part of Fidelity Bank's broader strategy to drive sustained growth, diversify its earnings base, and comply with the CBN's capital requirements, thereby positioning the bank for future expansion and stability.

Nigerian Banks Ranked on ESG Practices and Reporting

A recent survey conducted by Nigeria's Independent Project Monitoring Company (IPMC) LIMITED (IPMC) Limited has ranked Nigerian banks based on their Environmental, Social, and Governance (ESG) practices and reporting. The survey evaluated 29 banks in Nigeria, using a comprehensive analysis of global rating standards and specific nuances of the Nigerian business landscape. The evaluation was benchmarked against leading global ESG rating companies such as S&P Global and MSCI Sustainability Ratings.

Zenith Bank Plc and Access Bank Plc emerged as the top performers in the survey, demonstrating strong commitments to integrating ESG practices into their operations. Fidelity Bank PLC was ranked fourth, with a score of 57.73%, indicating significant progress in adopting sustainable practices.

At the launch of the ESG report in Lagos, Mr. Robert Ode Odiachi, Managing Director of IPMC, emphasized the growing need for banks to incorporate ESG practices, particularly in risk management and reporting.

Rukaiya el-Rufai, Special Adviser to the President on the National Economic Council and Climate Change, highlighted that companies prioritizing ESG are contributing to a more sustainable and equitable world, while also positioning themselves for better financial performance.

The survey results underscore the increasing importance of ESG considerations in the Nigerian banking sector. Financial institutions are striving to align their operations with global sustainability standards and meet the evolving expectations of stakeholders. The rankings reflect the banks' efforts to integrate ESG practices into the

Central Banks Hesitate to Lower Interest Rates

This week, central banks worldwide are expected to announce their positions on interest rate cuts, and their decisions will be closely monitored by investors. Despite the recent easing projections by the Federal Reserve, policymakers in countries like the UK and Australia are hesitant to reduce borrowing costs due to ongoing worries about inflation.

Investors will also be keeping a close eye on various economic data releases, including U.S. retail sales, Chinese economic indicators, and inflation figures from the UK and Japan. These reports will play a pivotal role in shaping global monetary policies.

Although it was anticipated that June would witness the beginning of global rate cuts, central banks seem reluctant to proceed. While Canada did make the first cut among the Group of Seven on June 5, the European Central Bank's cautious cut, coupled with a higher inflation forecast, suggests limited enthusiasm for further easing.

The decisions made this week will reflect the different stages of global monetary policies. It's expected that Brazil and Paraguay will maintain their current borrowing costs, while Chile may slow its rate cuts. According to Bloomberg Economics, major central banks are likely to keep interest rates unchanged, despite earlier indications of potential cuts.

SA’s biggest Green Hydrogen Project Woos Japanese Investors

HIVE Hydrogen South Africa is seeking $5.9 billion investment from major Japanese corporations for its green ammonia project in South Africa. The project has attracted interest from industry giants and is set to open in 2029, producing 1 million tons of hydrogen annually for export to Japan and South Korea.

The project's strategic location and the increasing global demand for green energy solutions make it an attractive investment for Japanese investors.

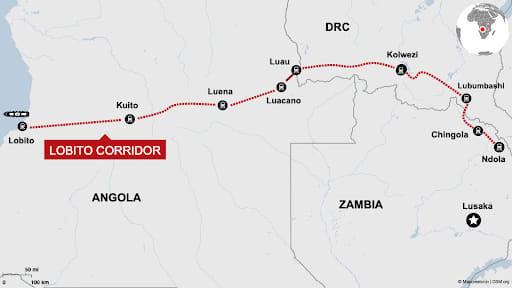

G7 Leaders Invest in Africa's Future with the Lobito Corridor Project

The Lobito Corridor is a project supported by the G7's Partnership for Global Infrastructure and Investment (PGII). It is part of an initiative by the world's leading economies to provide an alternative to China's Belt and Road Initiative. The PGII's goal is to create economic corridors and make investments in sectors such as transportation, clean energy, agriculture, and IT services to promote economic development in the region.

US President Joe Biden has emphasized the PGII's focus on "transparency, high standards, quality, and sustainability," which sets it apart from other infrastructure initiatives. European Commission chief Ursula von der Leyen has also highlighted the PGII's "sustainable" and "non-predatory" approach, addressing concerns about China's debt-trap diplomacy.

The investment in the Lobito Corridor is crucial as the West aims to secure access to critical raw materials essential for clean energy technologies, which are abundant in the region. The project has the potential to transform African trade and transportation by connecting regional markets to global ones.

Italy's commitment to the PGII project aligns with Prime Minister Meloni's pledge for a "non-predatory" approach to the African continent, despite her government's firm stance on illegal immigration, a contentious issue across the G7 nations.

Absa Bank to Host 10,000 Women Entrepreneurs at InspireMe Conference 2024

Absa Bank Kenya Business Banking Director Elizabeth Wasunna (Right) and International Trade Centre SheTrades Hub Regional Coordinator for East and South Phyllis Mwaura during the launch of The Absa InspireMe conference.

The Absa InspireMe Conference 2024 is a major event organized by Absa Bank aimed at empowering and inspiring women entrepreneurs. The conference will bring together an impressive 10,000 women entrepreneurs from across the region.

The conference promises to be a platform for networking, learning, and sharing experiences among the attendees. It will feature keynote speakers, panel discussions, and workshops covering various aspects of entrepreneurship, such as business strategy, finance, marketing, and leadership.

Absa Bank aims to provide women entrepreneurs with valuable resources, insights, and connections to help them overcome challenges and achieve greater success in their ventures.

South Sudan Tax Dispute Delays Cargo at Kenya Port

Cargo bound for South Sudan is accumulating at Kenya's Port of Mombasa due to a dispute over a new mandatory tax. Kenyan customs agents are refusing to collect the 46,375 shilling ($360) levy imposed by the South Sudan Revenue Authority, citing it as a violation of Kenyan laws. This has resulted in delays in clearing over 1,000 containers, according to Roy Mwanthi, chairman of the Kenya International Freight and Warehouse Association.

Meanwhile, the arbitrage strategy of trading Taiwan Semiconductor Manufacturing Co.'s Taipei shares against its US-listed American depositary receipts (ADRs) is becoming less viable. The ADRs have risen 66% this year, compared to a 55% increase in Taipei shares, due to high demand driven by artificial intelligence enthusiasm.

The ADRs are trading at a significant premium, partly because they are more accessible to foreign investors and included in major indices and ETFs, unlike the Taipei shares which require special regulatory approval for conversion.

IEA Reports $240 Billion Needed for Africa's Energy Access by 2030

The International Energy Agency (IEA) has reported that over $240 billion is needed by 2030 to address the lack of electricity for over 600 million Africans and to provide clean cooking solutions for more than 1 billion people. The IEA supports the G7 initiative, which has pledged $420 million to boost Africa's energy infrastructure. The G7 includes Canada, France, Germany, Italy, Japan, the UK, the US, and the EU.

The IEA's report, "Clean Energy Investment for Development in Africa," emphasizes the need for increased investment in clean energy projects to meet Africa's growing energy demands and climate goals. The report highlights that Africa currently attracts only 3% of global energy spending, despite its vast energy.

To meet the region's energy needs and development goals, annual energy investment must more than double to over $240 billion by 2030, with around 75% directed towards clean energy. Key investment areas include energy access, the power sector, and emerging industries like critical minerals and clean energy technology manufacturing.

Access Bank Acquires Africa Banking Corporation

Access Bank HQ

Access Bank Plc has successfully acquired Tanzania’s African Banking Corporation as part of its strategic expansion in East Africa. This acquisition will see the African Banking Corporation Tanzania's operations integrated with Standard Chartered Tanzania’s consumer, private, and business banking operations to form a new entity named Access Bank Tanzania. The move aligns with Access Bank's goals of enhancing financial inclusion, offering a diversified product range, and improving customer experience.

Access Bank CEO Roosevelt Ogbonna expressed enthusiasm about the opportunities this acquisition brings, aiming to leverage combined strengths for exceptional financial solutions. John Imani, Managing Director of African Banking Corporation, highlighted that the new entity will revolutionize Tanzania’s banking landscape by enhancing service offerings and driving economic growth and financial inclusion.

This acquisition is part of Access Bank's broader strategy to solidify its presence in the region, following previous expansions, including acquiring a 100% stake in Transnational Bank in Kenya. Access Bank now operates in over 22 countries.

Ethiopia Welcomes Foreign Investment

The Ethiopian government has proposed new banking laws allowing foreign lenders to operate within the country, removing long-standing restrictions. This initiative follows a series of economic reforms aimed at opening up state-controlled sectors to foreign investment. The National Bank of Ethiopia has been updating its regulatory framework to align with international standards, enhancing corporate governance, risk management, and financial stability.

This liberalization is expected to increase competition, efficiency, and innovation in the banking sector, benefiting Ethiopia's economy. With a population of over 120 million, Ethiopia offers a lucrative market for foreign banks, particularly Kenyan ones. The entry of foreign banks is anticipated to boost foreign capital inflows, create jobs, and support digital and financial inclusion goals in the country.

Why Launching in Multiple Countries is Key for African Startups

Africa's startup ecosystem is rapidly evolving, driven by innovative entrepreneurs leveraging technology to address the continent's unique challenges. However, for these startups to truly thrive and scale, a pan-African approach is essential. Expanding across multiple African countries offers several strategic, financial, and operational advantages:

Market Expansion and Diversification: Access to diverse markets allows startups to tap into larger consumer bases, diversify revenue streams, and reduce reliance on any single market, which is crucial given economic volatility and regulatory uncertainties.

Risk Mitigation: Operating in multiple countries provides a buffer against currency fluctuations, political instability, and regulatory changes, ensuring business continuity and resilience.

Competitive Advantage: Early expansion into new markets can establish brand recognition, build customer loyalty, and create barriers to entry for competitors.

Talent Acquisition and Knowledge Transfer: Expanding across borders opens access to a wider talent pool and facilitates the cross-pollination of ideas and best practices, fostering innovation.

Attracting Investment: Startups with a pan-African vision and successful track records in multiple markets are more attractive to local and international investors.

Despite these benefits, challenges such as navigating complex regulatory landscapes, diverse cultural contexts, and logistical hurdles remain. However, with careful planning, strategic partnerships, and a deep understanding of local markets, these challenges can be overcome.

Successful examples of pan-African expansion include companies like Jumia Group , Flutterwave , and Andela , which have achieved growth and recognition across the continent.

Navigating Geopolitical Tides: Africa’s Path to Trade Resilience and Growth

Africa has shown resilience despite global challenges. In 2023, economies expanded by 3.2%, down from 4% in 2022. The African Continental Free Trade Area is seen as key to boosting trade, economic integration, and promoting sustainable growth and climate resilience.

The positive outlook is driven by global growth, fiscal measures, and investment in infrastructure. Africa's strategic response and proactive measures set a strong foundation for future growth, supported by AfCFTA and multilateral institutions.

South Africa’s Chatbot Boom: Digital Natives Lead the Communication Revolution

South Africa's tech-savvy young people are leading the rapid adoption and innovation of chatbot technology, positioning the country as a leader in utilizing these AI-powered platforms to transform business communication and customer engagement.

With over 60% of the population under the age of 35, South Africa's youthful demographic is uniquely positioned to embrace and shape the future of technology, especially in the field of communication. This trend is evident in how Generation Z is influencing the way people communicate, compelling businesses to adapt their strategies to cater to this influential demographic.

The rise of Artificial Intelligence and Generative AI is providing businesses with new ways to interact with their customers, particularly through the use of AI-powered chatbots. These platforms are becoming increasingly common as part of organizational communication strategies, taking over some functions of call center agents and providing seamless, 24/7 customer support.

As the largest consumer demographic in the world, Generation Z's demands and preferences are prompting businesses to integrate chatbots with Natural Language Processing (NLP) capabilities into their systems. These advanced chatbots can generate accurate data and insights that guide organizations in making informed business decisions and personalizing customer interactions.

Furthermore, young entrepreneurs in South Africa are also using chatbot technology to enhance their businesses, not only in engaging with customers but also in gaining powerful data insights to inform strategic decisions.

Meta To European Regulators: You're Ruining Our Bot

Meta has put its plans for launching an AI assistant in Europe on hold after facing objections from Ireland's Data Protection Commission (DPC), the lead privacy regulator for Meta in Europe. The DPC requested that Meta delay training its large language models using public content posted by users on Facebook and Instagram profiles across Europe. While Meta expressed disappointment with the request, stating it had already incorporated regulatory feedback, the company agreed to pause its plans.

Meta had recently started notifying European users about collecting their data to train AI models and offered an opt-out option in an attempt to comply with European privacy laws. However, Meta argued that if regulators don't allow it to use European users' data to train its AI models, it can only deliver an inferior product experience tailored to local cultures and languages.

Meta claimed that competitors like Google and OpenAI have already used data from European users to train their AI models.

This integration is expected to significantly enhance the performance and scalability of Cardano's services and provide Cardano developers with access to Huawei Cloud's extensive computational capabilities. Additionally, this alliance will expand Cardano's visibility and usability by providing it with a presence in Huawei's Marketplace, which is frequented by numerous leading global enterprises. Both parties are enthusiastic about this partnership and believe that it will have a transformative impact on the blockchain and Web3 sectors by enhancing the interoperability of Cardano's offerings and increasing its appeal to developers and businesses.

UN: World Debt Approaching 100 Trillion Threatening Global Economy

In a new report titled "A World of Debt 2024: A Growing Burden to Global Prosperity," the United Nations outlines the gravity of the situation, particularly for developing nations. The report reveals that public debt, including domestic and external government borrowing, has increased by $5.6 trillion from the previous year.

The UN warns that this debt burden is becoming unsustainable for billions of people, with 3.3 billion individuals residing in countries where interest payments exceed spending on either education or health. In Africa, the average person's spending on interest ($70) surpasses that of education ($60) and health ($39) per capita. Alarmingly, 769 million Africans live in countries where interest payments outweigh investments in either education or health, accounting for nearly two-thirds of the entire population.

The UN warns that this debt burden also undermines the fight against global warming, as developing countries are currently allocating a larger proportion of their GDP to interest payments (2.4%) than to climate initiatives (2.1%).

To address this crisis, the UN is proposing an overhaul of the global financial system and the availability of faster cash for poorer developing nations. The report calls for expanding contingency finance to provide greater liquidity in times of crisis, as well as a plan to revamp the global financial system and boost the UN Sustainable Development Goals (SDG) stimulus package.

Find the report here

Open Banking In Africa: Challenges & Opportunities For Future Growth

Africa, being one of the largest unbanked regions globally, is on track to become a prominent player in the fintech industry. This is propelled by the low presence of bank branches and a significant increase in smartphone usage. In this rapidly changing environment, the B2B fintech sector, specifically the open banking market, offers an appealing investment opportunity for both innovators and investors.

The B2B fintech space in Africa provides a solid protection against the risk of consumer adoption, primarily due to the low levels of disposable income and the historically poor customer acquisition cost (CAC) to lifetime value (LTV) ratios for businesses targeting consumers. Venture funding in this sector has experienced extraordinary growth, with over $1.9 billion in funding in 2022, and a remarkable compound annual growth rate (CAGR) of over 34%.

The open banking market is a particularly attractive sub-sector for investment, with a huge global total addressable market (TAM) estimated to reach $100 billion by 2031. Moreover, the African open banking market is relatively fragmented, with entrants emerging in North, West, and South Africa, offering a favorable Serviceable Addressable Market (SAM).

The regulatory landscape for open banking in Africa is favorable, as these initiatives are mostly market-driven, with minimal up-front licensing or capital commitments required. Additionally, the increasing potential for mergers and acquisitions (M&A) in the open banking space has attracted the attention of investors, with over $3 billion in M&A activities since 2019.

You've Heard of Elf on a Shelf,

Now Get Ready for a Flight, on Light

A Sunseeker Solar Craft, Airborne

While planes running on sunlight won't be ferrying vacationers soon, their prototypes—often unmanned—offer promising new alternatives for high-risk aerial surveillance and emergency telecommunications in disaster areas. Industry giants, telecom companies, venture investors, and military agencies are investing millions in developing these planes and their technology.

Eric Raymond, a solar-aircraft designer who has been experimenting with solar flight since 1979, likens this phase to the early days of aviation, with various stakeholders exploring the planes' capabilities and economic viability. Solar planes harness the sun's energy through panels covering their wings and sometimes their entire bodies. The main advantage is their free, emission-less power, making them environmentally friendly compared to fuel-burning jets. Solar planes, theoretically capable of perpetual flight if paired with efficient batteries, have become more feasible due to advancements in battery technology.

However, today's solar aircraft are lightweight, slow, and struggle with adverse weather and heavy loads. For instance, Dave Corfield of BAE Systems notes that their Phasa-35 solar plane uses about as much power as a domestic hair dryer during nighttime flights. Despite these limitations, solar planes offer unique advantages over traditional aircraft, such as the ability to fly autonomously at high altitudes for extended periods, capturing high-resolution imagery and providing broadband internet.

These solar planes present a compelling future for aviation, potentially revolutionizing surveillance, telecommunications, and disaster response.

Report: Audiences Suspicious of AI-powered Newsrooms

Figurines with computers and smartphones are seen in front of the words "Artificial Intelligence AI" in this illustration taken, February 19, 2024. REUTERS/Dado Ruvic

52% of US and 63% of UK respondents indicated they would feel uneasy reading news primarily generated by AI. The survey, which polled 2,000 people in each country, also found that respondents were more comfortable with AI being used in the background to improve the productivity of journalists.

The public's reluctance to trust AI-generated news content is worsened by concerns over fake news, with 59% of respondents expressing worry about misinformation on the internet. This percentage was even higher in countries holding elections this year, reaching 81% in South Africa and 72% in the United States.

Another challenge facing news organizations is the public's typical reluctance to pay for news subscriptions. The survey found that in 20 nations, only 17% of respondents indicated they paid for online news, a percentage that has remained constant over the last three years despite some growth during the pandemic.

Google’s Privacy Sandbox Accused of User Tracking by Austrian Non-Profit

Google's Privacy Sandbox is facing criticism from privacy non-profit noyb for allegedly using deceptive tactics to track users. Despite being presented as an improvement over invasive third-party tracking, Privacy Sandbox is accused of enabling Google to track users within the browser.

Noyb has filed a complaint alleging that Google is misleading users about its ad privacy features. The organization also accuses Google of using "dark patterns" to increase consent rates. This latest backlash highlights the ongoing challenges Google faces in balancing business interests and user privacy concerns.

In case you missed these too:

Payments 💳

Visa Introduces Subscription Manager: Visa has launched a new subscription manager to simplify recurring payments for cardholders, enhancing user convenience and control over their subscriptions.

InsurTech 🛡️

Egyptian Insurtech Mal Bazaar Secures FRA Approval: Mal Bazaar has received approval from the Financial Regulatory Authority (FRA) and launched a new platform aimed at revolutionizing the insurance sector in Egypt.

Market Highlights 📈

Elizabeth Rossiello Named 2024's Fintech Leader of the Year Finalist: Elizabeth Rossiello has been recognized as a finalist for the prestigious Fintech Leader of the Year award, highlighting her contributions to the industry.

MultiChoice Group Reports YoY Results: Multichoice has released its year-on-year financial results, showcasing the company's performance and strategic growth over the past year.

FirstBank Ghana Expands Agent Banking: FirstBank Ghana has expanded its agent banking network to enhance financial inclusion, providing greater access to banking services for underserved com

AgriTech 🌾

Zambian Agri-Tech Emsika Services Ltd (eMsika) Eyes East African Market: eMsika, a Zambian agri-tech company, is expanding its operations into the East African market, aiming to enhance agricultural productivity and market access for farmers.

RegTech 🏛️

AfriLabs and Korea-Africa Foundation Sign MOU: AfriLabs has signed a Memorandum of Understanding (MOU) with the Korea-Africa Foundation to boost innovation and collaboration between African and Korean tech ecosystems.

Energy Management ⚡

Vodacom Achieves ISO 50001 Certification: Vodacom has achieved ISO 50001 certification for world-class energy management, demonstrating its commitment to sustainable energy practices.

Additional Updates 🌐

Finland and Kenya Strengthen Ties: Finland and Kenya have strengthened their trade ties, focusing on boosting Africa's trade and economic development.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya. If you're interested, please don't hesitate to get in touch. Please email us at 𝐩𝐫@𝐟𝐢𝐧𝐭𝐞𝐜𝐡𝐚𝐬𝐬𝐨𝐜𝐢𝐚𝐭𝐢𝐨𝐧.𝐚𝐟𝐫𝐢𝐜𝐚 with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 - 31,101+💙S𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply