- FINTAK Weekly Newsletter

- Posts

- BuuPass Secures Investment from Silicon Valley Legend Tim Draper

BuuPass Secures Investment from Silicon Valley Legend Tim Draper

A weekly digest of news, opinions and all things financial technology

Tim Draper , a well-known venture capitalist, has recently invested in BuuPass - Bus, Train & Flight bookings, a company from Kenya that operates a digital platform for booking bus tickets. This financial contribution is expected to drive BuuPass towards becoming a leading unicorn, in the field of transportation across Africa. The founders of BuuPass - Bus, Train & Flight bookings , Sonia Kabra and Wyclife Omondi , have welcomed this investment from Draper, which is his third in African startups.

Draper's decision to invest is a strong endorsement of BuuPass's mission to modernize the vast $100 billion market for long-distance travel in Africa. This investment was made during Draper's participation in the television show "Meet the Drapers," and it aims to boost BuuPass's growth by improving its technology and allowing it to serve more customers across the continent.

Airtel Africa Launches $100 Million Share Buy-back Program

Airtel Africa has initiated a share buy-back program aimed at reducing its share capital in 2024, as outlined in a regulatory filing submitted to the Nigerian Exchange. This move follows a previous announcement made in February after the publication of its nine-month results for the period ending on December 31, 2023.

The telecommunications giant disclosed that the share buy-back ,will return up to $100 million to shareholders over a maximum period of 12 months. However, the company clarified that no repurchases from the Nigerian bourse will be made.

Airtel Africa plans to execute the share buy-back in two phases, with the initial tranche commencing immediately and expected to conclude on or before August 31, 2024. The first tranche, totaling a maximum of $50 million, will be facilitated through an agreement with Citigroup Global Capital Markets Inc. , allowing on-market purchases of its ordinary shares with subsequent repurchases from Citi.

According to Airtel Africa, this strategic move reflects the significant progress made in recent years to diminish leverage and fortify the company's balance sheet. With ample cash reserves at the holding company level and consistent operating solid cash generation, Airtel Africa is positioned to enhance shareholder returns in line with its capital allocation policy.

Africa defies odds to become the world’s second fastest growing region

Africa is witnessing a major economic resurgence, set to outpace the global average growth rate, according to the African Development Bank Group (ADB). Dr. Akinwumi Adesina, the ADB President, has projected that Africa will host 11 of the world's 20 fastest-growing economies by 2024, with a notable mention that 15 countries are expected to grow by over 5%.

The continent's economic outlook is bright, as highlighted in the ADB's recent report, positioning Africa as the second-fastest-growing region globally.

This growth is underpinned by strategic financial initiatives such as :

Economic Growth: Africa is projected to become the world's second-fastest-growing region, with 11 of the 20 fastest-growing economies by 2024.

ADB Initiatives: Strategic initiatives include a capital increase to $208 billion, a $27 billion support for economic development, and a $750 million hybrid capital on the capital market.

Impactful Investments: The ADB's operations have directly impacted 400 million lives, focusing on infrastructure, health, and the pharmaceutical industry.

Sustainability and Self-Reliance: Efforts towards climate resilience and health sector support, including a $1.5 billion African Emergency Food Production Facility and the African Pharmaceutical Technology Foundation, underscore the ADB's commitment to the continent's future.

Global Support: The international community's backing highlights a collective optimism for Africa's path towards sustainable growth and prosperity.

Nigeria’s Naira woes point to a bigger problem in Africa

African currencies, notably the Nigerian naira, are experiencing a serious crisis, with steep devaluations impacting businesses, households, and shaking investor confidence across the continent. This economic instability is driven largely by rising inflation and a heavy dependence on imports, a situation exacerbated by temporary fixes such as aggressive interest rate hikes.

For a sustainable recovery, experts advocate for a fundamental shift towards market-determined exchange rates and a strategic push to boost exports and diversify economies beyond the traditional commodity dependence.

By addressing structural inefficiencies, such as inadequate infrastructure and high production costs, and capitalizing on market forces, African nations can create a conducive environment for investment. This approach will pave the way for a sustainable, export-driven economy, reducing the continent's vulnerability to external shocks and currency crises, marking a pivotal step towards economic stability and growth.

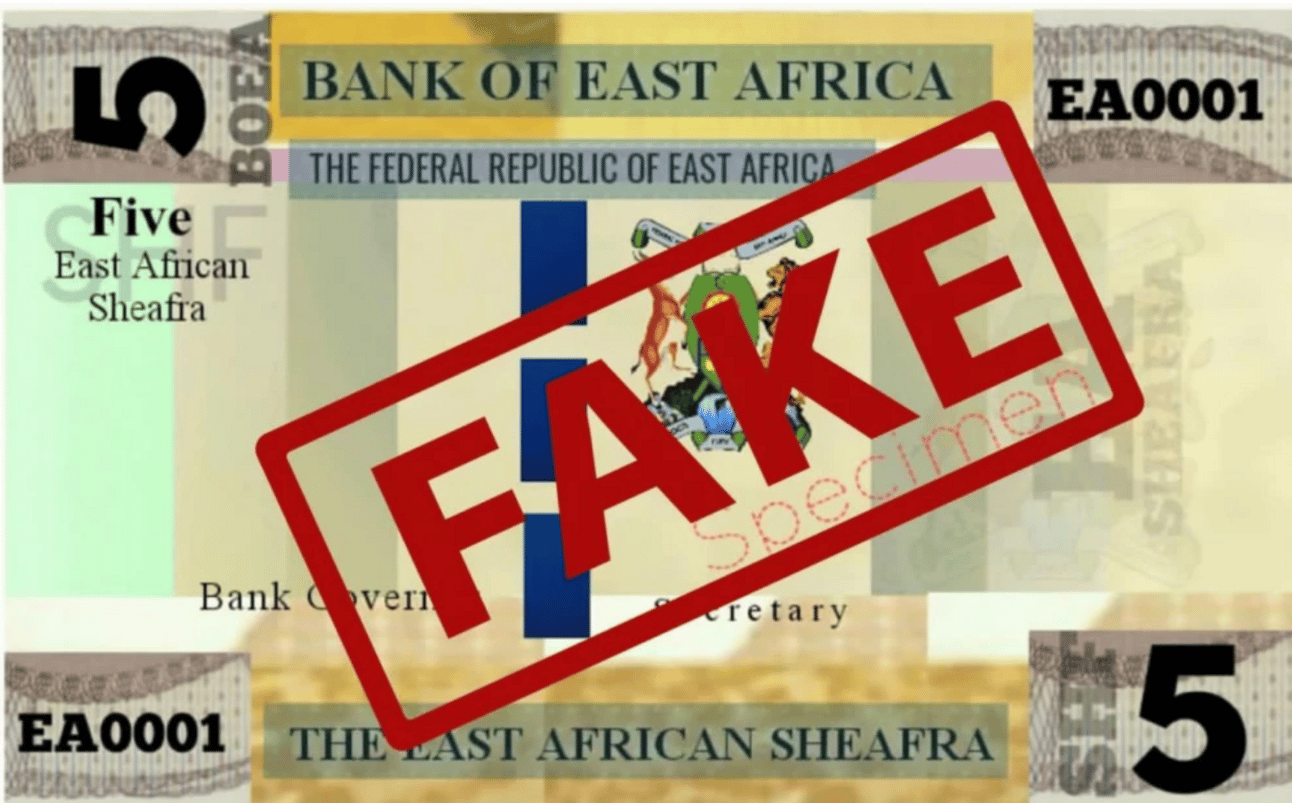

EAC Warns Against Fake Currency Announcement Amidst Ongoing Single Currency Efforts

The East African Community (EAC) Secretariat has warned the public sternly, cautioning against misleading information regarding launching a new common currency for the region, circulating on social media.

This clarification comes in the wake of a deceptive announcement made by an impostor account on X (formerly Twitter), which misleadingly received a grey government verification mark, leading to widespread confusion.

Esteemed media personality Larry Madowo highlighted the issue, revealing the challenges now faced by the EAC in rectifying this unwarranted confusion. Amidst efforts to foster regional economic unity, the EAC reiterates that the journey towards a single currency is very much alive but remains a work in progress, dismissing any claims of its realization as premature and unfounded.

In Summary:

EAC Secretariat clarifies: The journey to a single currency is ongoing; public should disregard social media rumors.

Fake announcement: An impostor X account falsely declared the introduction of a new East African currency, causing widespread misinformation.

Verification challenges on X: The incident sheds light on the complexities surrounding social media verification, following X's introduction of gold and grey checkmarks for official organizations and government entities.

Future of EAC currency: Steps towards a single currency continue, with EAC states harmonizing policies and establishing necessary institutions, aiming for a monetary union that promises reduced transaction costs and price harmonization across the region.

South African Digital Banks Continue to Embrace Eutelsat OneWeb LEO Connectivity

Eutelsat Group and Q-KON are expanding their successful partnership, bringing secure LEO satellite connectivity to even more digital banks across South Africa. Following positive results at an initial flagship branch, banks are enthusiastically rolling out the service to more locations, demonstrating the value of real-time connectivity for staff and customers.

This expanded rollout builds on the initial 2023 launch, where Eutelsat OneWeb was integrated into Q-Kon's Twoobii Smart Satellite Services. The service delivers crucial operational functions like the intranet, SD-WANs, data backhauls, Wi-Fi, and ATMs, alongside seamless redundancy for existing fiber networks.

Infrastructure Cyberattacks, AI-Powered Threats Pummel Africa

In 2023, Africa experienced a surge in cyberattacks, with a noticeable increase in ransomware attacks in Kenya and phishing incidents in South Africa, bucking the global trend of a downtrend in such attacks.

This year highlighted a concerning shift towards targeting critical infrastructure and the innovative use of artificial intelligence (AI) by cybercriminals to carry out sophisticated social engineering campaigns.

According to Kaspersky , AI is being exploited to create realistic phishing emails and fake identities, representing a significant evolution in cyber threat tactics. Business Email Compromise (BEC) attacks pose a persistent threat, especially to sectors like finance, telecom, government, and retail, with a staggering 80% of organizational breaches involving malware and 91% leveraging social engineering techniques. This scenario addresses the urgent need for organizations to boost their cybersecurity measures, particularly in a continent where internet access is predominantly via mobile devices, making mobile threats a growing concern.

IFC to offer climate risk advisory services to banks in Sh219m deal

The IFC - International Finance Corporation (IFC) is set to elevate the Kenyan banking sector's approach to climate change with a $1.5 million advisory project aimed at enhancing climate resilience.

This initiative seeks to equip Kenyan banks with the necessary tools and knowledge to navigate the increasing risks posed by climate change effectively. By focusing on climate risk assessment, management, and disclosure practices, the IFC seeks to align these financial institutions with the objectives of the Paris Agreement.

The project addresses critical challenges faced by banks, such as heightened loan defaults, rising insurance claims, and asset damage due to climate-related disasters. Through this initiative, Kenyan banks will be able to improve their climate-related risk assessments, develop comprehensive risk management strategies, align their operations more closely with international climate goals, and enhance their Environmental, Social, and Governance (ESG) reporting transparency.

Given the current lack of proficiency in ESG disclosure among most Kenyan banks, the IFC's project is timely and pivotal in fostering a more resilient and climate-aware financial sector.

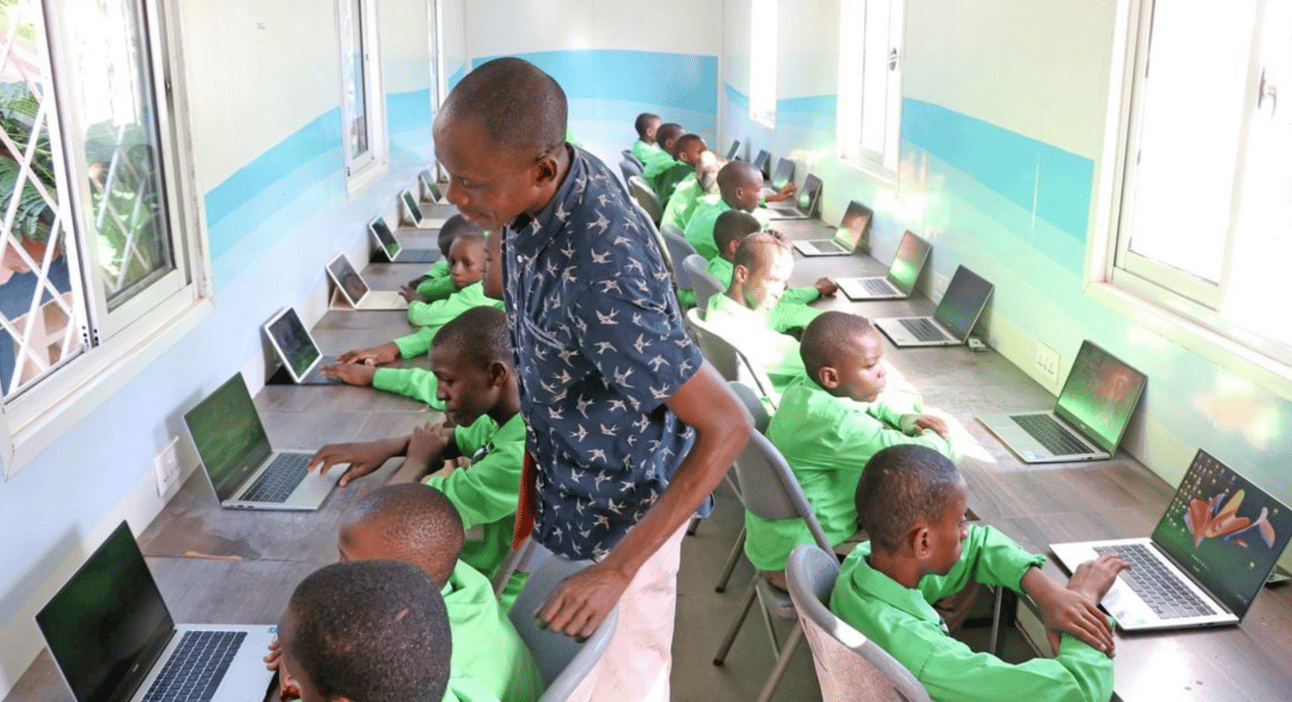

Digital literacy skills programme transforms young entrepreneurs

A recent survey of DigiTruck digital skills program participants reveals promising results.Nearly half of the participants reported an increase in earnings after acquiring skills in e-commerce, online marketing, and other internet-based professions.

The findings indicate a notable shift in income levels, with a reduction in those earning less than Sh10,000 per month by 25%. Furthermore, the program has facilitated the growth of both part-time and full-time employment opportunities, enabling participants to explore new career paths outside the traditional job market. Remarkably, 35% of individuals experiencing income growth have ventured into entrepreneurship, leveraging the digital skills learned to start their own businesses. This success story underscores the vital role of digital literacy training in empowering Kenyan youth, aligning with the country's objectives to enhance digital inclusion and foster opportunities within the burgeoning digital economy.

Nissan accused of dumping its electric car pioneers

Electric car owners of Nissan Motor Corporation Leaf vehicles express frustration and disappointment as the automaker announces the discontinuation of its app, citing the impending shutdown of the UK's 2G network. Critics accuse Nissan of abandoning its pioneers, leaving thousands of pre-2016 models without essential remote control functions.

To avoid inconveniences similar to those experienced by Nissan Leaf owners, especially in regions like Africa where network connectivity is still developing, electric vehicle (EV) manufacturers should consider the following strategies:

Future-Proof Technology: Implement technology that is adaptable to future network upgrades, such as modular hardware components that can be easily updated or replaced to stay compatible with new telecommunications standards (e.g., from 2G to 5G and beyond).

Diverse Connectivity Options: Instead of relying solely on one type of network connectivity, offer multiple options, including Wi-Fi and Bluetooth, to ensure that remote functions remain accessible even when cellular network connectivity is limited or evolving.

Offline Functionality: Design the EVs and their apps to retain essential functions even without network connectivity. For instance, basic remote controls and diagnostics could be performed via Bluetooth when the vehicle is within a certain range.

Upgrade Support and Services: Provide clear, affordable upgrade paths for owners of older models, ensuring they can access new features and network compatibility improvements without needing to purchase a new vehicle.

Invest in Infrastructure: Collaborate with governments, network providers, and other stakeholders to support and accelerate the development of telecommunications infrastructure in less developed markets. This could include investment in network technology or partnering to ensure that EV charging stations offer reliable connectivity.

Robust Customer Communication: Maintain open and transparent communication with customers regarding technological changes and their potential impacts. Offering advance notice and comprehensive support can help mitigate disappointment and frustration.

Localized Solutions: Recognize the unique challenges and needs of different markets, particularly in regions with developing infrastructure. Tailoring solutions, such as developing apps that require minimal data usage or are optimized for the most common network types in a region, can enhance user experience.

Moratorium on e-commerce tariffs extended for 2 years, draft WTO document says

The World Trade Organization (WTO) has taken a step towards promoting global digital trade stability by provisionally agreeing to extend the moratorium on e-commerce tariffs for an additional two years.

This decision, made during the 13th Ministerial Conference in Abu Dhabi, aims to prevent the imposition of customs duties on electronic transmissions until the next conference session. The extension of the moratorium is crucial for maintaining the momentum of electronic commerce as a vital engine for economic growth, innovation, and access to global markets for both businesses and consumers.

As digital transactions become increasingly integral to international trade, this move by the WTO shows its commitment to adapting to contemporary challenges and evolving trade landscapes. It also reflects the collective effort of member states to ensure a stable and predictable environment for businesses engaged in cross-border digital activities, amidst broader discussions on digital trade's implications for taxation and regulation. The agreement to revisit the moratorium at the 14th Ministerial Conference highlights the ongoing dialogue about the future of e-commerce and its regulation, demonstrating the international community's readiness to collaborate in fostering a dynamic and equitable digital trade ecosystem.

EU Pledges $150 Billion for Africa's Renewable Energy Transition

The European Union (EU) has taken a monumental step in supporting Africa's shift towards renewable energy by committing US$150 billion as part of a larger US$300 billion global initiative.

This funding aims to enhance sustainability and climate resilience across the continent. Announced by EU Ambassador to Zimbabwe, Mr. Jobst von Kirchmann, at the 5th International Renewable Energy Conference Expo 2024 in Victoria Falls, the initiative reflects on the EU's commitment to climate action and reducing emissions.

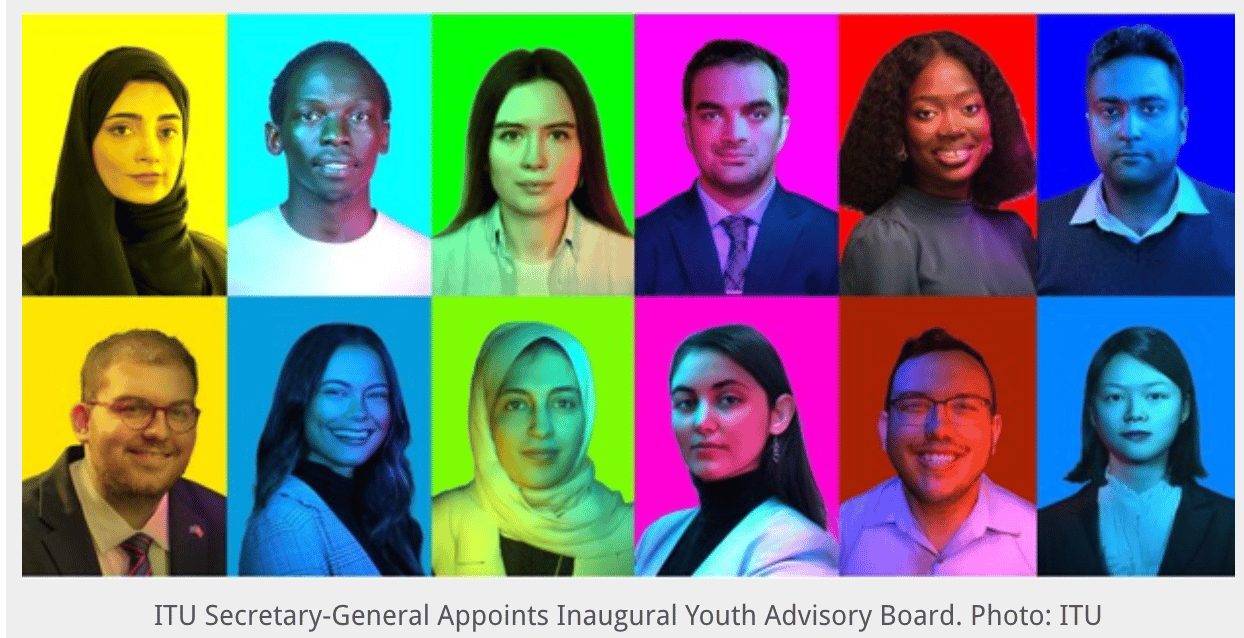

ITU Secretary-General appoints inaugural Youth Advisory Board

The International Telecommunication Union (ITU) has taken a step towards enhancing digital inclusion globally by appointing a Youth Advisory Board composed of 12 dynamic young leaders from around the world, aged 18-30. These individuals bring a wealth of expertise in various fields, including artificial intelligence, environmental issues, and telecommunications. Among the notable members are Clinton Oduor from Kenya, known for his machine learning expertise;

Daniella Darlington from Ghana, an AI innovator;

Maitha Aljamris from the UAE, a telecommunications specialist,

along with other experts from the US, Dominican Republic, Bahrain, Pakistan, Vietnam, Russia, Spain, Türkiye, and Azerbaijan.

This initiative refelcts on the ITU's commitment to leveraging youth insights to bridge the global digital divide. ITU Secretary-General Doreen Bogdan Martin highlighted the importance of including young voices to help connect the estimated 2.6 billion people still without internet access.

The board is tasked with providing fresh perspectives, offering innovative solutions to digital inclusion challenges, and ensuring ITU initiatives are more youth-inclusive. This move represents a significant effort to empower young leaders to contribute to shaping the future of digital connectivity and access, marking a critical step towards closing the digital divide and making technology more accessible to all.

US Cybersecurity Firm Taps Rwandan Talent

Tabiri Analytics, Inc. , a cybersecurity monitoring provider based in the United States, is actively recruiting personnel from Rwanda who have been trained through collaborations with esteemed institutions such as Carnegie Mellon University and other educational partners. The company's strategy is twofold: first, to offer cost-effective monitoring solutions to its clients; and second, to contribute to the socio-economic development of underserved communities, particularly in Africa.

In terms of operations, Tabiri Analytics collaborates with in-house IT staff or external IT services providers to alleviate the burden of continuous cybersecurity monitoring. This partnership allows clients to access cutting-edge cybersecurity services without the need to invest heavily in infrastructure or personnel.

Moreover, Tabiri Analytics plans to leverage its new pool of global talent to offer advanced cybersecurity services and integrate machine learning capabilities into its solutions. This approach enables the company to provide comprehensive cybersecurity services to clients in underserved markets at competitive prices, thus bridging the gap between cybersecurity needs and affordability.

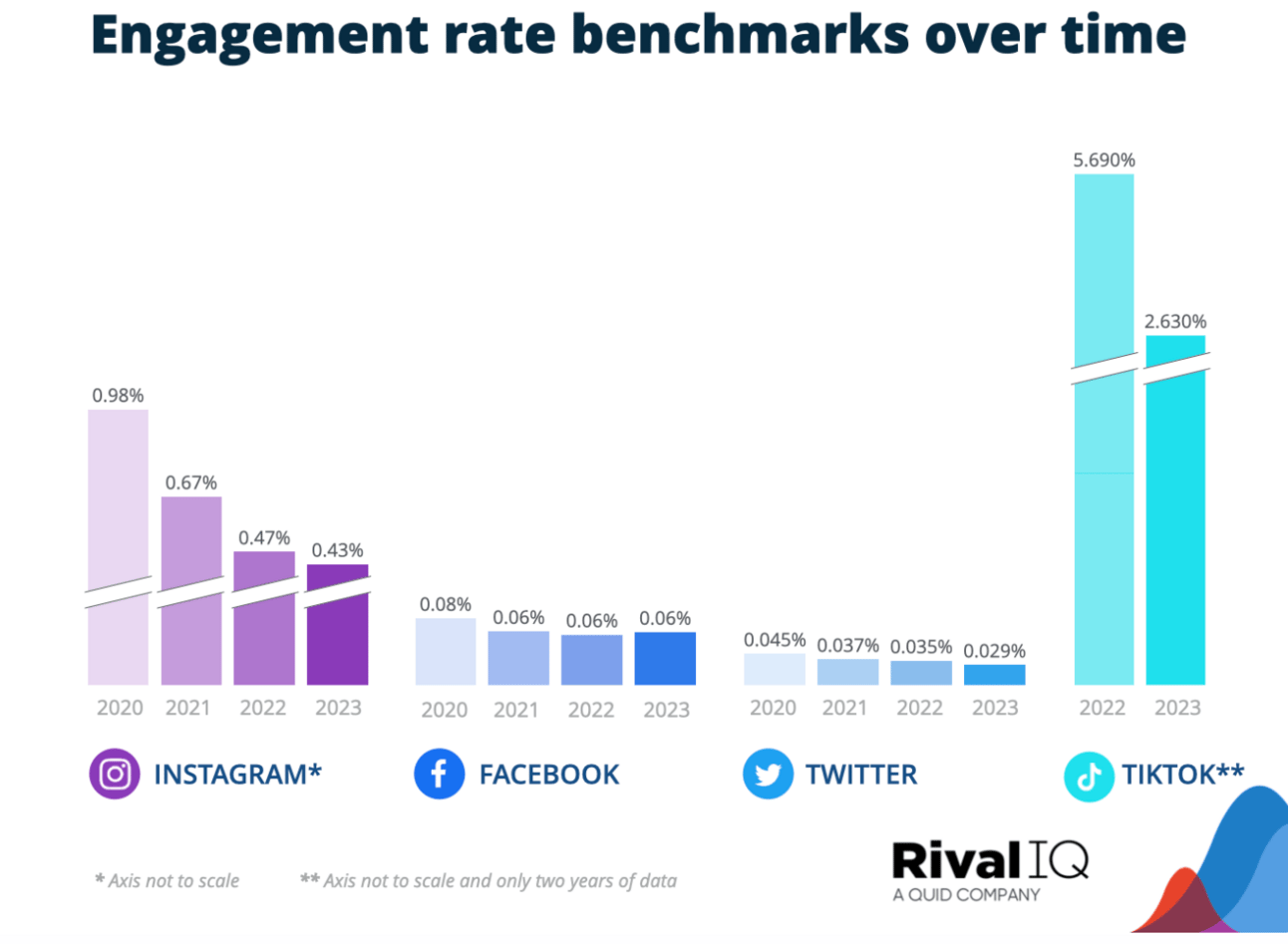

New Report Reveals Social Platform Performance Benchmarks for Brands Amid Changing Trends

A recent report by Rival IQ sheds light on the evolving landscape of social media engagement, offering valuable insights into brand performance across major platforms. Published on Feb. 29, 2024, the report provides comprehensive benchmarks based on over 5 million posts and 10 billion interactions, offering a glimpse into industry trends and average engagement rates.

READ THE REPORT: http://surl.li/kkfue

World Bank invests $20 Million in Digital Transformation in Africa

The World Bank has joined forces with Smart Africa to expand the Smart Africa Digital Academy - SADA (SADA) into a regional powerhouse as part of the Western Africa Regional Digital Integration Program (WARDIP). With a generous $20 million grant spanning five years, this initiative is set to catalyze the integration of digital markets across the continent, aiming to train 30,000 policymakers and decision-makers, with a special emphasis on achieving 40% female participation.

This ambitious scale-up seeks to nurture a new group of African leaders proficient in green and inclusive digital transformation strategies, ultimately contributing to the vision of a unified African Digital Market. Since its launch, SADA has been instrumental in bridging the digital divide, enhancing employability, and meeting the continent's growing digital talent needs, having already enriched over 7,000 beneficiaries from 35 countries with vital digital skills. This partnership reflects a shared commitment to digital transformation as a foundation for sustainable development and regional integration, promising to unlock unprecedented opportunities for innovation across Africa.

MTN Group appoints Ericsson to modernise core network

Ericsson and Mtn Group, Inc. have entered into an agreement to modernize the core network infrastructure of MTN’s affiliates in South Africa and Nigeria over a period of five years, aligning with Mtn Group, Inc. ’s MTN Unified Cloud Acceleration (MUNA) principles.

This partnership aims to ensure the readiness of MTN Nigeria’s and MTN South Africa’s network infrastructures for future 5G standalone capabilities. The modernized core networks will be powered by Ericsson’s cloud-native dual-mode 5G Core, enabling MTN Group to deliver innovative solutions for consumers and enterprises in Africa

Startbutton: Nigerian Startup Facilitates International Expansion and Compliance for Businesses

Nigerian startup Startbutton Africa is revolutionizing international expansion for businesses by acting as a "merchant of record," allowing them to accept payments in local currencies and manage compliance seamlessly, without the need for local offices.

Co-founded by Mallick Bolake and Kelechi Obi in 2022, Startbutton simplifies the complexities of expanding into new markets across Africa by enabling multinational businesses to accept payments in local currencies and settle them in foreign currencies like USD at prevailing rates.

With just a single API, merchants can accept payments in five African currencies and receive settlements in USD, along with regulatory coverage for entities needing local licenses in new markets.

EU Slaps Apple with €1.8bn Fine for App Store Music Streaming Restrictions

The European Union has fined Apple €1.8bn (£1.5bn) after upholding a complaint from Spotify regarding restrictive practices within its App Store, particularly concerning music streaming services.

The European Commission, after an investigation prompted by Spotify's complaint, found that Apple had violated competition law by imposing limitations on app developers, including restrictions preventing them from informing iPhone and iPad users about alternative subscription methods that bypass Apple's ecosystem.

Spotify contends that such restrictions favor Apple Music, Apple's own music streaming service, creating an uneven playing field in the market.

Spotify and other app providers have long criticized Apple's App Store for allegedly stifling competition, primarily by imposing a 30% fee on apps and in-app purchases.

Responding to pressure from the EU's Digital Markets Act (DMA), Apple has announced plans to enable EU customers to download apps onto iPhones outside of the App Store.

The DMA, introduced last year, aims to foster competition in sectors dominated by major tech firms like Apple , Microsoft , and Meta (formerly Facebook), by curbing their gatekeeping powers and promoting a more open digital marketplace.

Under the DMA, tech companies face significant fines of up to 10% of their turnover for non-compliance, with Meta potentially facing a penalty of 10% of its $120bn (£95bn) revenue.

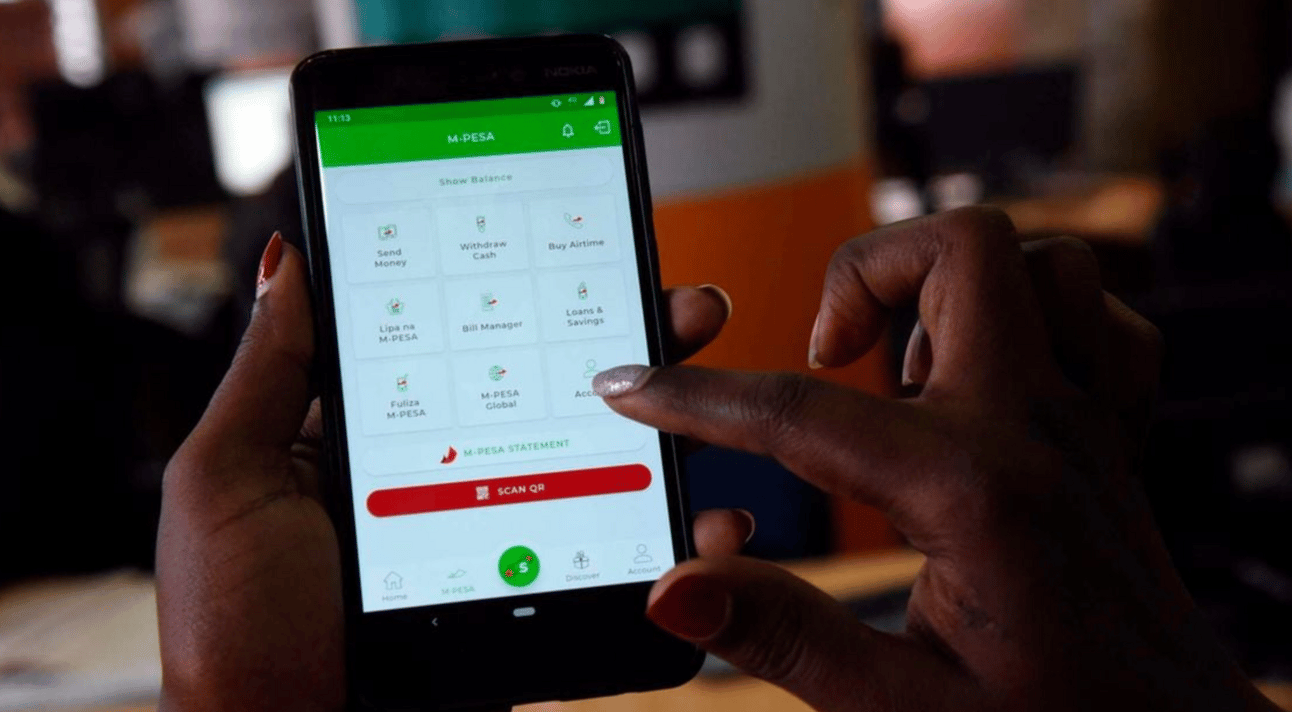

M-Pesa processes Sh700m Inua Jamii transfers in January

In January, Safaricom PLC 's M-Pesa processed Sh700 million for the Kenyan government's Inua Jamii cash transfer program, aiding 300,000 beneficiaries. This switch to M-Pesa follows President Ruto's December 2023 directive prioritizing convenience for recipients by eliminating the need for travel and bank fees. The Ministry of Labour and Social Protection released Sh2 billion for the Inua Jamii payout and Sh5.9 million for the complimentary NICHE program.

Beneficiaries must register for M-Pesa using their enrolled phone numbers to receive future payments. As of December, 207,000 individuals had already embraced the platform. The Ministry aims to complete the transition away from bank transfers by February. The remaining beneficiaries have this month to register for M-Pesa, or they risk losing access to their stipends.

Nigerian Property Tech Startup, Spleet, Braces for Employee Layoffs Amid Economic Challenges

The wave of layoffs in the tech industry persists as Nigerian property tech startup Spleet gears up for potential staff cuts in 2024. With the economic downturn in Nigeria, exacerbated by soaring inflation and currency devaluation, Spleet faces pressure from landlords increasing rents.

Despite raising $2.6 million in funding in 2022, the startup is grappling with dwindling revenue due to tenants reevaluating housing decisions. CEO Adetola Adesanmi, while not disclosing the exact number of affected employees, maintains that Spleet is not shutting down, but adapting to market challenges.

AI Revolutionizes Media Payments, Redefining Entertainment Transactions

The fusion of AI and entertainment is reshaping the financial landscape, particularly in media payments. AI algorithms are personalizing user experiences on streaming platforms, curating subscription plans, and bolstering security against fraud. The broader tech industry is witnessing AI's transformative power in optimizing subscription models, automating billing processes, and integrating blockchain for royalty payments.

AI has revolutionized media payments in several ways:

Personalized User Experiences: AI algorithms analyze user preferences and viewing habits to offer tailored subscription plans and suggest relevant content, enhancing user satisfaction and loyalty.

Fraud Prevention and Security Enhancement: AI-powered fraud prevention mechanisms swiftly detect anomalies in payment patterns, ensuring the security of financial transactions in the entertainment industry.

Subscription Monetization Strategies: Predictive analytics help optimize subscription plans and pricing models, while AI-driven retention strategies reduce churn rates and increase subscriber lifetime value.

Automating Billing and Payment Processes: AI streamlines backend processes such as billing cycles, invoicing, and payment reconciliations, resulting in cost savings for content providers and a seamless consumer payment experience.

Blockchain Integration for Royalty Payments: AI integrated with blockchain enables transparent and automated royalty distribution, ensuring accurate and timely payments to artists, musicians, and content creators while addressing issues of transparency and fairness.These advancements highlight how AI transforms media payments, making transactions more efficient, secure, and personalized

EMURGO Africa Unveils EMURGO Labs to support emerging Web3 technologies

EMURGO Africa , Cardano 's investment arm, launches EMURGO Labs, a new initiative to advance Web2 and Web3 organizations in Africa and beyond, promising a major leap in blockchain innovation and digital transformation.

EMURGO Labs emerges as a hub for pioneering Web2 to Web3 transitions, offering an extensive range of services, including blockchain solutions, custom software development, and UI/UX design. CEO Ahmed M. Amer emphasizes the lab's role in leveraging Cardano's technology to empower startups, corporations, and governments across various sectors. This move aims to foster global blockchain ecosystem growth and facilitate cross-border innovation, positioning EMURGO Labs at the forefront of the digital revolution.

Data as a Lifeline: How Garbal Empowers Herders in Niger

In Niger, a West African country grappling with the impacts of climate change and conflict, Garbal, a call center, offers a lifeline to the region's herders. This innovative service provides herders with vital, location-specific data such as weather forecasts, water levels, and market prices, all crucial for navigating the challenges posed by environmental changes and regional instability.

The initiative is led by American data scientist Alexander Orenstein , focusing on leveraging existing technologies to support the predominantly livestock-dependent population of Niger. Unlike many tech interventions that chase new, complex solutions, Garbal emphasizes practical, accessible technology applications that directly benefit the herders.

Garbal's approach, by providing herders with actionable data, aims not only to assist in the immediate term but also to preserve a way of life that has sustained communities in the Sahel for generations.

Revolut Simplifies Overseas Transfers with Mobile Wallets

Revolut , the global financial super app, has launched Mobile Wallets, making it faster and easier to send money internationally. Users can now send funds directly to bKash (Bangladesh) and M-Pesa (Kenya) using only the recipient's name, phone number, or email.

Why Mobile Wallets?

Convenience: Eliminate the hassle of complex account details.

Security: Reduce the risk of money being sent to the wrong account.

Choice: Gives users more options for how they send money.

This new feature is precious for expats and international students who regularly need to send money home. Revolut understands the importance of affordable, efficient cross-border transfers, and Mobile Wallets deliver precisely that.

Safaricom Sacco To Rebrand As It Sets Sights On Growth

Safaricom Sacco Ltd has unveiled plans for a comprehensive rebranding initiative to reflect its remarkable growth and diversified membership base since its inception in 2001. Transitioning from a modest assembly of 200 Safaricom PLC employees to a global community of 18,000 members, Safaricom Sacco is eyeing an ambitious target of 70,000 members by 2028. With assets soaring to Sh11.5 billion and a significant increase in member deposits and loans, Sacco is reshaping its identity to foster deeper connections with its stakeholders and to stride towards a future of securing and democratizing financial services for a broader audience.

This rebranding initiative marks a milestone in Safaricom Sacco Ltd's journey, reflecting its evolution from a corporate welfare entity to an accomplished financial sector player committed to inclusivity, growth, and service excellence.

BKN301 employs ‘White-Label’ Banking-as-a-Service solutions for traditional banks and fintech companies in MENA region

BKN301 Group, a prominent payment and Banking-as-a-Service provider in the MENA region, spearheads innovation with its 'White-Label' Banking-as-a-Service solutions, catering to traditional banks and Fintech companies alike.

Driven by a commitment to innovation, BKN301 has established White-Label solutions as the cornerstone of its strategy, offering seamless integration through APIs, rapid market entry, cost-effectiveness, brand customization, and access to cutting-edge financial technology.

Amid projections of the MENA Fintech market's robust growth at a CAGR of over 8% from 2024 to 2029, BKN301's suite of solutions is poised to sustain this momentum, underscoring the region's burgeoning demand for Fintech services.

Stiven Muccioli , Founder and CEO of BKN301 , emphasized the company's mission to lead innovation in the evolving MENA Fintech landscape. He highlighted the flexible and customized nature of their solutions, tailored to meet the evolving needs of financial sector entities.

BIC Achieves Double-Digit Growth in West Africa, Pledges Continued Innovation

BIC , a global powerhouse in stationery, lighters, and shavers, has unveiled its financial results for 2023, revealing remarkable double-digit growth in net sales across all divisions in the West African market.

The company's fourth-quarter and full-year performance showcased robust market performance in West Africa, with net sales soaring in its Human Expression (Stationery), Flame for Life (Lighter), and Blade Excellence (Shavers) divisions.

Gonzalve Bich , BIC’s Chief Operating Officer, attributed the success to the steadfast execution of their Horizon Strategy, emphasizing disciplined execution, innovation, and successful new launches as key drivers.

Moreover, BIC’s sustainability initiatives, including increasing the electricity supply from renewable sources, align with the region's growing emphasis on environmental responsibility, positioning it as a trusted and environmentally conscious brand.

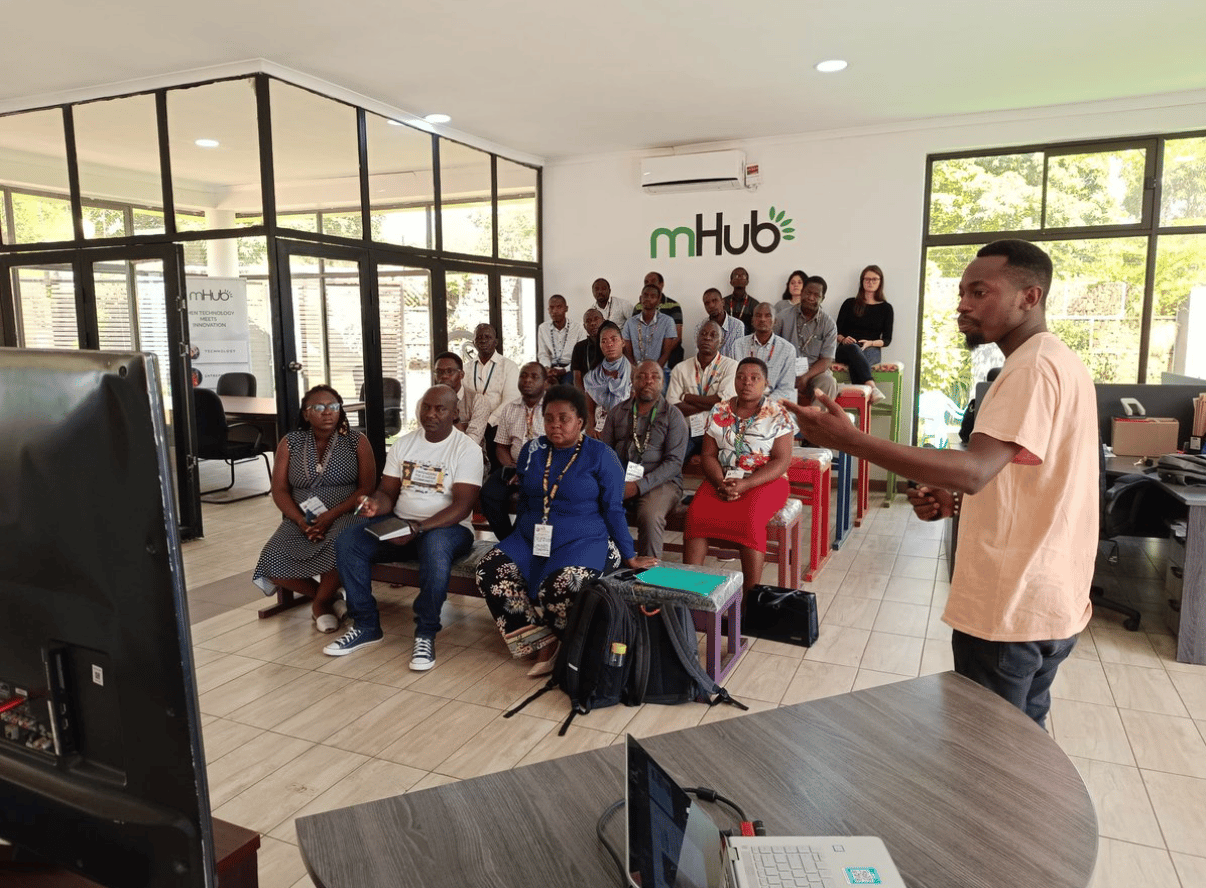

Why Malawi’s nascent tech ecosystem is ripe for growth

Malawi is witnessing a gradual transformation in its technology ecosystem, marked by several key developments and initiatives aimed at fostering innovation and technological advancement. Despite a low internet penetration rate of 24% in a population of 20 million, a lack of venture capital, and minimal presence of leading tech companies, efforts from various stakeholders are reshaping the narrative.

2024 Africa Smart Cities Congress: Malawi is set to host this event in July, showcasing smart city innovations from Malawi and across Africa. This decision highlights Malawi's efforts in smart city development, exemplified by the Mvera Innovation City project in Lilongwe.

Flutterwave's Market Entry: The African startup giant has received a license from Malawi's central bank for remittance payments, signifying a growing interest from external tech entities.

Government Initiatives: The Malawian government has implemented several policies aimed at boosting the tech sector, including the National Digitalisation Policy, Digital Economy Strategy, and Child Online Protection Strategy.

mHub and the Role of Incubators: mHub, one of Malawi's first digital hubs, alongside others like Ntha Foundation, plays a crucial role in nurturing tech innovation.

Regulatory Environment: The Malawi Communications Regulator Authority (MACRA) has been instrumental in creating a balanced regulatory framework that encourages innovation while ensuring compliance with laws.

International and Development Partnerships: Organizations like the UNDP's Accelerator Lab collaborate with the government to support innovations that align with the Sustainable Development Goals (SDGs), further boosting the tech ecosystem.

Startup Ecosystem Challenges and Opportunities: Despite facing challenges such as funding, regulatory complexities, and access to technical talent.

Sectoral Opportunities for Tech Disruption: Sectors such as agriculture, manufacturing, education, and healthcare are identified as ripe for technological innovation, suggesting a wide array of opportunities for startups and innovators.

The collective efforts of the government, regulatory bodies, incubators, international partners, and the startup community are crucial in driving Malawi towards becoming a notable tech hub in Africa.

Middle East Venture Capitalists Shift Focus to African Startups, UAE Emerges as Key Investor Hub

Venture capitalists in the Middle East increasingly focus on African startups, with the UAE emerging as a prominent investor hub in the region. Surpassing countries like China and France, the UAE now ranks third in investments in African startups, a trend expected to gain momentum throughout 2024.

The surge in Middle East-based investments marks a shift in the global startup landscape. While traditional powerhouses like the USA and UK continue to dominate funding in Africa, Middle East venture capitalists offer a unique advantage—government-backed funding. In an era of global funding shortages, investments from government-backed entities provide African startups with a more reliable source of capital, particularly for early-stage ventures seeking long-term investors.

Zoho Partners with J-Hub Africa to Support Kenyan Innovators

Zoho has formed a partnership with J-Hub Africa, based at Jomo Kenyatta University of Agriculture and Technology (JKUAT) (JKUAT), to support emerging innovators and entrepreneurs. Through this collaboration, individuals and startups linked to J-Hub Africa will receive Zoho Wallet Credits worth up to KES 100,000, which can be used across Zoho’s extensive suite of over 55 cloud-based products covering various business functions such as sales, marketing, HR, accounting, and collaboration. This initiative also includes access to Zoho One, a comprehensive platform offering integrated access to multiple Zoho solutions.

The partnership extends beyond financial support, with Zoho committing to provide training to JKUAT students in technology-related fields. This educational effort will focus on teaching students how to utilize cloud-based business technology effectively, with specific training on Zoho Creator for custom app development, Zoho CRM for sales and marketing management, and Zoho Books for financial management, ensuring compliance with local TIMS and VAT regulations.

The announcement was made during Zoholics Kenya, Zoho’s annual user conference held at the Hyatt Regency in Nairobi.

HCL Injects $20 Million into Edtech Firm Educational Initiatives in Secondary Round

HCL Education Group Pte. Ltd. has established its presence in the education technology sector by investing a substantial $20 million in Educational Initiatives (Ei) through a secondary round. This move not only sees HCL acquiring a minority stake from private equity firm Gaja Capital but also marks Ei's strategic expansion plans into new markets, including South Africa, Kenya, Ghana, and Saudi Arabia.

Educational Initiatives (Ei), a leading education software company, has secured a significant funding boost of Rs 166 crore (approximately $20 million) from the HCL Group in a secondary round investment.

With this infusion of capital, Ei aims to broaden its horizons by venturing into new markets such as South Africa, Kenya, Ghana, and Saudi Arabia, in addition to its existing operations in India, South Africa, Singapore, and the UAE. Furthermore, the company intends to diversify its offerings by exploring potential acquisitions of edtech product companies focused on enhancing learning outcomes.

Founded in 2001, Ei operates as a B2B entity, providing schools with a suite of assessment and adaptive learning products designed to improve learning outcomes for both teachers and students. Boasting over a million paid users, Ei has established partnerships with numerous schools, state governments in India, international organizations, non-profit entities, and CSR initiatives.

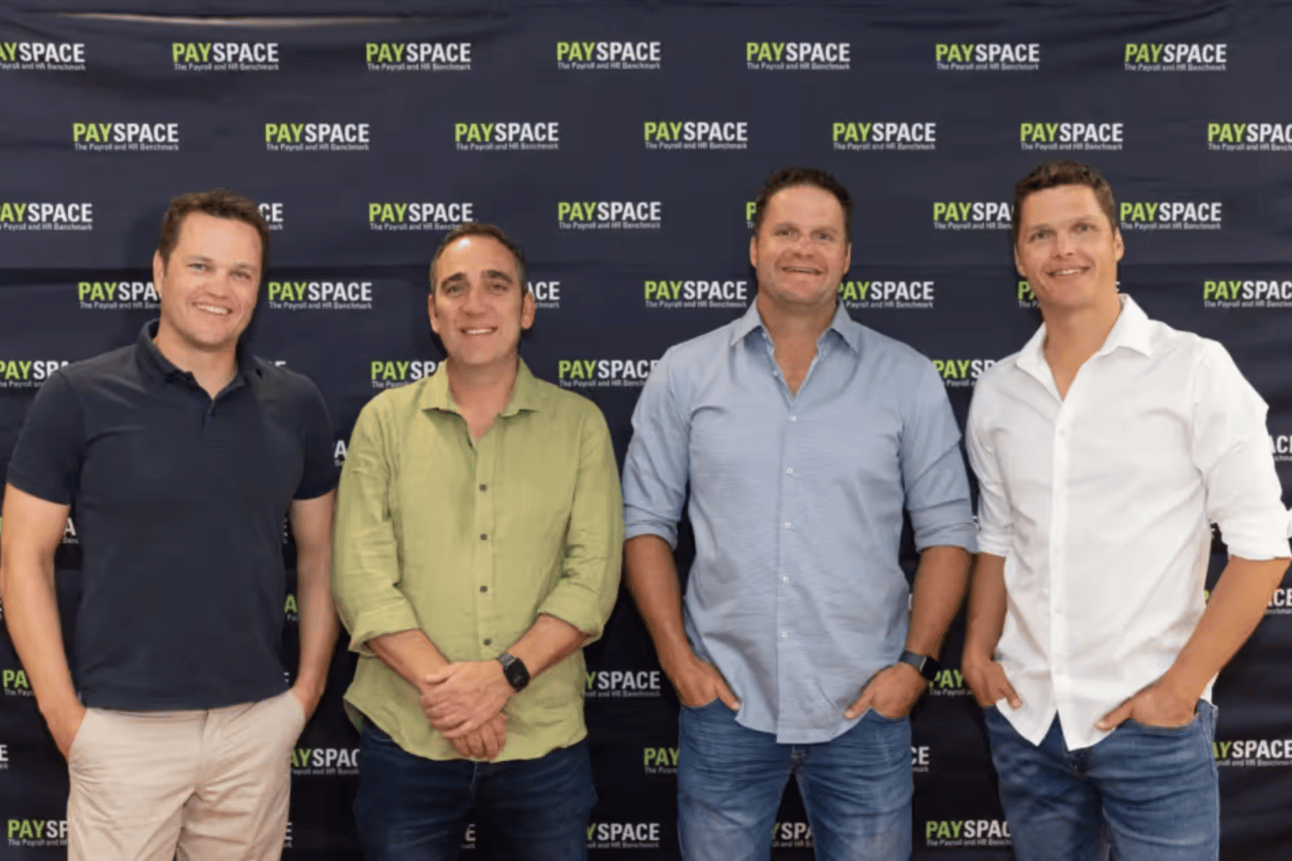

Deel acquires African-based HRTech company PaySpace

Deel , a $12 billion HR startup, has announced its acquisition of PaySpace , a leading African payroll and HR software company. This acquisition, Deel's largest to date, comes hot on the heels of its recent purchase of Munich's AI-driven "people development" startup, Zavvy .

Although the financial details of the PaySpace deal remain undisclosed, the acquisition is a significant milestone for Deel. PaySpace, known for its extensive clientele including heavyweights like Heineken and Coca-Cola Beverages, operates in 44 countries, offering Deel an unparalleled opportunity to deepen its footprint across Africa, Europe, Latin America, and the Middle East.

Founded in 2007, PaySpace has distinguished itself as a bootstrapped success story, eschewing the typical venture-backed startup path. It boasts over 14,000 customers and has seen a consistent annual growth rate of over 30%. With this acquisition, Deel aims to leverage PaySpace's established infrastructure and customer base to enhance its global talent hiring, payment, and management services.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 - 21,770💙𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply