- FINTAK Weekly Newsletter

- Posts

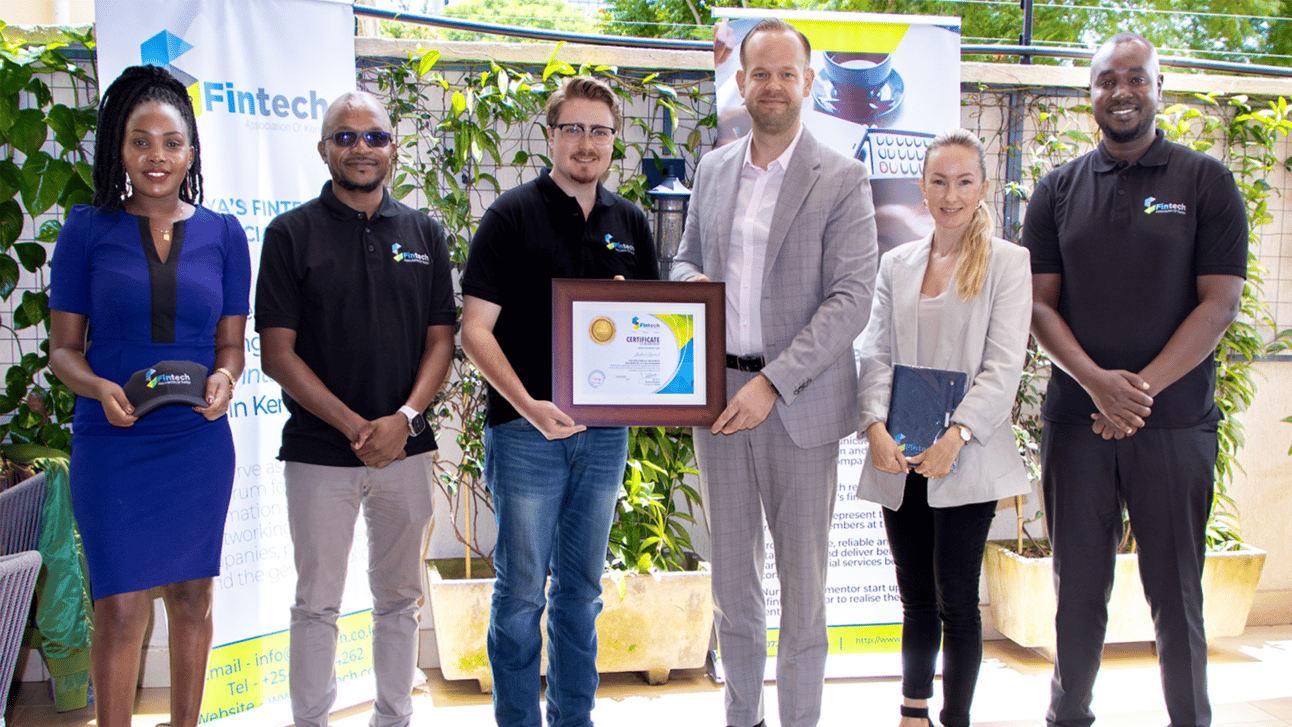

- Estonian Government-Backed Aufort has joined the Fintech Association of Kenya

Estonian Government-Backed Aufort has joined the Fintech Association of Kenya

A weekly digest of news, opinions and all things financial technology

Aufort, a leading fintech company from Europe, has made its way into Kenya's financial market and joined the Fintech Association Of Kenya (FINTAK). With a unique integration of blockchain and eCommerce, Aufort offers seamless buying, selling, sending, and receiving of physical gold in digital form. The gold is securely stored by reputable global companies, and vaults are regularly audited by regulated firms for compliance and transparency.

Established in 2014, Aufort operates in 30 European countries and continues to expand globally with Kenya as its most recent addition and soon-to-be launch in the UAE. Aufort aims to democratize access to innovative services and empower individuals and businesses in gold-backed digital transactions.

Duncun Motanya, Chairperson of FINTAK, has welcomed Aufort to the association and expressed excitement about the potential of its innovative platform to revolutionize the gold trade and utilize blockchain technology to enhance accessibility, affordability, and combat fraud.

Aufort's user-friendly solution caters to both novice and experienced investors, enabling swift digital transactions backed by real gold from trusted refineries like Argor-Heraeus, thus mitigating risks associated with fraud and inflation. Kenyans can now access gold, the world's most secure asset, conveniently through M-PESA, the most widely used payment method in Kenya.

CEO Bert-Ken Raudberg assures users of a secure blockchain-based account protected by Google 2-Step Verification, accessible through a user-friendly interface for gold transactions.

Through collaboration with FINTAK, Aufort aims to raise awareness about its platform and foster a conducive regulatory environment for its operations. FINTAK serves as a resource and forum for education, information sharing, and networking.

African Countries to Dominate the World's Top 10 Growing Economies

African nations are to top the list of the world's fastest-growing economies in 2024, with Niger, Senegal, Ivory Coast, DRC, and Rwanda leading the charge, according to a recent United Nations Economic Commission for Africa(ECA) report. Adam Elhiraika of the ECA highlights Africa's remarkable growth trajectory, positioning it as the most rapidly developing region after East and South Asia. Key growth drivers include a surge in hydrocarbon production in Niger and Senegal, robust infrastructure investments, and a thriving mining sector in the DRC, Ivory Coast, and Rwanda.

Despite facing challenges such as political instability and climate vulnerabilities, these economies are expected to showcase significant advancements in infrastructure, tourism, and agriculture, contributing to the continent's projected growth rate of 3.5% in 2024 and 4.1% in 2025. The report underscores the critical need for policy reforms and increased efforts to combat debt, inflation, and trade barriers to achieve sustainable development goals and harness Africa's full economic potential.

How EAC can boost exports to rest of Africa

The East African Community (EAC) has been called upon to prioritize investments in import substitution industries (ISIs). This initiative aims to fortify the bloc's position in the African Continental Free Trade Area (AfCFTA), promoting exports and reducing the trade imbalance caused by high import levels. A recent study by the East African Business Council underscores the critical need for EAC member states to leverage AfCFTA tools like the Pan African Payment and Settlement System (PAPSS) to bolster manufacturing, value addition, and product diversification.

With an eye on untapped market potential and the challenges of AfCFTA tariff liberalization, the EAC is at a pivotal moment in transforming its trade dynamics by focusing on sectors where it can compete more effectively on the African continent. This approach seeks to narrow the existing trade gap and positions the EAC as a formidable player in intra-African trade, harnessing opportunities for sustainable economic growth and integration.

Startups struggle, jobs dwindle – Can Africa's innovation scene bounce back?

The African start-up ecosystem faced a setback last year as a record 20 companies shuttered, and many others scaled back operations amidst a continent-wide funding drought, leading to widespread job losses. The funding crunch saw a sharp 31% decline in investments, falling to about $4.5 billion from the previous year's $6.5 billion. This financial shortfall forced many previously thriving start-ups to close doors or significantly downsize due to difficulties in securing follow-up funding, achieving market penetration, or navigating corporate governance issues.

This trend illustrates the urgent need for sustainable financial strategies within the African start-up landscape. Despite these challenges, there's a silver lining as most start-ups attracting investments are now led by Africans, signaling a shift towards local leadership in the continent's innovation scene. This pivot comes as the African Venture Capital Association highlights a growing confidence in homegrown solutions, marking a critical turning point for the future of African entrepreneurship amidst ongoing market difficulties.

South Africa Leads in the Fintech Sector

South Africa is at the forefront of fintech innovation, contributing to approximately 40% of Africa's fintech revenue and marking significant strides in digital wallet usage and financial inclusion. This transformation in the financial sector aligns with global trends towards digitization, offering convenience, security, and broadened access to financial services. Despite a decline in startup funding, South Africa's fintech scene is poised for dynamic growth in 2024, driven by regulatory changes, technological advancements, and a competitive market landscape.

The digital payment sector, in particular, has seen a surge in adoption, with over 50% of South Africans preferring digital wallets and contactless payments for their transactions. However, this rapid growth has also brought challenges, including a rise in contactless payment fraud. As the industry evolves, South Africa stands at a pivotal juncture, balancing innovation with security to ensure the sustainable development of its digital finance ecosystem.

Africa.Connected: Industry Giants Collaborate for Digital Inclusion

The Africa.Connected campaign, led by leaders from Vodacom , Vodafone, Telecel Ghana (formerly Vodafone Ghana) and Safaricom PLC, represents a unified effort to bridge the digital divide across Africa, a challenge highlighted by the COVID-19 pandemic. The initiative seeks to ensure universal digital access, emphasizing the need for improved network infrastructure, support for government digital initiatives, enhancement of digital literacy, and the promotion of digital adoption among businesses and societies. Leaders like Shameel Joosub, Ing. Patricia Obo-Nai, Peter Ndegwa C.B.S , Khalil F. Al Americani, Mohale Ralebitso and Sitho Mdlalose spotlight on the campaign's commitment to leveraging digital technology for economic recovery, social development, and digital inclusion across the continent.

They highlight the role of public-private partnerships in meeting the investment requirements for widespread internet access, aiming to boost economic value, create jobs, and enhance mobile connectivity. With nearly a billion people in sub-Saharan Africa still disconnected, the campaign addresses the urgency of digitalization for economic growth and the necessity of innovative solutions to connect the unconnected and underserved. Through collaborative efforts, Africa.Connected aims to overcome geographical and economic challenges, fostering a future that is fair, inclusive, and sustainable for all Africans.

UAE and Kenya Forge Digital Investment Partnership

IThe United Arab Emirates and Kenya have signed an Investment Memorandum, laying the groundwork for enhanced cooperation in digitalization and advanced technology sectors. This strategic agreement, signed by His Excellency Mohamed Hassan Alsuwaidi of the UAE and His Excellency CS ELIUD OWALO of Kenya, targets investments in digital infrastructure, artificial intelligence, and the potential development of large-scale data center projects in Kenya.

This collaboration aims to leverage Kenya's booming digital sector and the UAE's technological prowess to drive growth across various industries. With Kenya's digital economy on the rise, powered by a vibrant ICT sector and a burgeoning demand for cloud services, this partnership creates a "digital corridor," facilitating secure data exchange and fostering innovation between the two nations.

As they embark on this journey, the UAE and Kenya are setting a precedent for digital cooperation that promises to bridge the digital divide and propel both countries toward a future of technological advancement and economic prosperity.

$500 Million Digital Sukuk Initiative Launches in Nigeria to Revolutionize Ethical Investing

Nigeria's financial sector is on the brink of a major transformation with the launch of a groundbreaking $500 million Digital Sukuk initiative, a collaboration between The Alternative Bank and TK Tech Africa. This initiative marks a significant leap forward in ethical and Sharia-compliant investments, leveraging blockchain technology for issuing, trading, and settling Sukuk bonds.

Gbenga Awe from The Alternative Bank and Oludamola Akindolire of TK Tech Africa are at the forefront of this innovative venture, aiming to democratize access to wealth creation through digital means in commodities and precious metals. Targeting a broad demographic of urban, middle-to-high-income Nigerians, this initiative is poised to foster inclusive economic growth and set a new standard for financial innovation in Africa. With support from key industry players like the Lagos Commodities and Futures Exchange and the NASD OTC Securities Exchange, the Digital Sukuk initiative is celebrated for its potential to engage younger investors and contribute significantly to the region's economic development.

Unveiling the Unseen Challenges of Fintech in Africa: Overlooked Downsides Revealed

Fintech, the fusion of finance and technology, has long been hailed as Africa's economic savior, promising financial inclusion and empowerment. However, a deeper look reveals a complex reality often overlooked by mainstream media. In an illuminating essay, Lisa E. Carr sheds light on the hidden downsides of fintech in Africa.

Amidst the promises of financial inclusion, the proliferation of fintech platforms has led to fragmentation within Africa’s financial ecosystems, hindering interoperability and exacerbating financial exclusion among marginalized communities. Vulnerable populations, lacking access to smartphones and digital literacy, face further exclusion, while cybersecurity risks and dependency on external providers loom large. As Africa navigates its fintech journey, comprehensive solutions are needed to ensure equitable development and a resilient financial future.

Your Ad Campaign's New Best Friend

Google has unveiled its Gemini AI-powered chat-like tool, designed to redefine how businesses across Africa and the globe create Search Ads. This innovative tool promises to streamline online advertising, making it more accessible for businesses to connect with their customers effectively. Shashi Thakur, VP & GM of Search Ads & Ads on Google Experiences, emphasizes the potential of Gemini AI to simplify the ad creation process, especially for small businesses, by generating personalized ad suggestions through an interactive, conversational interface.

This breakthrough is expected to enhance ad quality significantly, with Google Ads users incorporating conversational experiences and seeing a 42% increase in launching search campaigns with high ad strength. Now available worldwide to English-speaking advertisers, with plans to expand language support, Google's Gemini AI marks a pivotal step towards empowering businesses with the tools they need to thrive in the digital marketplace.

Mastercard and Zenith Bank introduce new payment cards to accelerate financial inclusion

Mastercard and Zenith Bank Plc have introduced two payment solutions tailored to Nigerians' diverse financial needs. The Mastercard Naija Card and the World Elite Credit Card are set to catalyze the nation's push towards greater financial inclusion. While the Naija Card targets consumers previously outside the sphere of traditional banking services, as part of Mastercard's commitment to include more individuals in the digital economy, the Elite Credit Card is designed for the affluent, offering exclusive benefits across travel, lifestyle, and health.

This collaboration marks the introduction of Mastercard's first domestic card in Africa and brings the World Elite Credit Card to West Africa, promising to redefine the region's financial landscape with tailored, accessible, and premium banking solutions.

ChatGPT Now Shows Its Homework: OpenAI to Include Source Citations in Responses

OpenAI announced that ChatGPT - New! will now provide source citations for all responses in a groundbreaking move towards transparency and accountability in AI. This decision aims to enhance user trust and confidence in the information generated by the AI model, addressing concerns over accuracy and reliability.

OpenAI's decision to include source citations in ChatGPT responses marks a significant milestone in AI ethics and transparency. By providing users with links to the sources used, the AI model empowers individuals to verify the accuracy of information and make informed judgments. While the feature is accessible only to users of certain subscription plans, it reflects a commitment to responsible AI development and sets a new standard for transparency in the field.

Yango launches ‘Cargo Express’ to improve delivery of large items across Africa

Yango Delivery, an African logistics startup, introduces Cargo Express, a new feature to improve the delivery of large items across key African metropolitan areas. This innovative addition addresses issues like unclear pricing and operational inefficiencies, offering transparent pricing and streamlined service.

The introduction of Cargo Express by Yango Delivery represents a significant advancement in urban logistics in Africa. This feature, accessible via the Yango app, provides customers with transparent pricing and efficient delivery of oversized items. Ireoluwa Obatoki, Head of Business Development for Africa at Yango, emphasizes the company's commitment to leveraging technology to enhance delivery services, catering to the increasing demand for reliable transport of bulky items.

Pepkor Launches +more Digital Rewards Programme to Revolutionize Shopping Experience

Pepkor Holdings Limited, a major retail player in Southern Africa, introduces +more, a digital loyalty program spanning over 5,000 stores to enhance customer savings and convenience in everyday purchases. With a focus on providing instant savings, exclusive deals, and personalized offers, +more represents a significant step towards meeting the region's evolving needs of value-conscious consumers.

Pepkor's launch of the +more digital rewards programme marks a strategic move to address the increasing demand for convenient and rewarding shopping experiences in Southern Africa. With a digital-first approach, +more offers customers seamless access to exclusive deals and discounts across various retail brands, catering to diverse consumer preferences. Barbara-Jeanne Slazus, Head of Loyalty at Pepkor, underscores the programme's significance in helping customers navigate economic challenges, emphasizing its role in putting tangible savings back into their pockets.

Chris Wulf-Caesar Rejoins Unilever Ghana as CEO

A recent report by Rival IQ sheds light on the evolving landscape of social media engagement, offering valuable insights into brand performance across major platforms. Published on Feb. 29, 2024, the report provides comprehensive benchmarks based on over 5 million posts and 10 billion interactions, offering a glimpse into industry trends and average engagement rates.

Unilever Ghana appoints Chris Wulff-Caesar as its new CEO, marking his return to the company where he began his illustrious career in the FMCG industry. Wulf-Caesar's extensive experience and leadership acumen make him a strategic choice to lead Unilever Ghana into a new era of success, focusing on talent development and sustainable business practices.

Chris Wulf-Caesar's appointment as CEO of Unilever Ghana heralds a new chapter for the company, emphasizing its commitment to nurturing homegrown talent and driving sustainable business growth. With a career trajectory that began as a management trainee at Unilever, Wulf-Caesar's journey has come full circle, reflecting his deep-rooted connection to the company.

His hands-on experience across various sectors within Africa's consumer goods industry and his leadership achievements at esteemed organizations like Accra Brewery Limited and FrieslandCampina Nigeria positions him as a transformative leader poised to steer Unilever Ghana towards greater heights.

WorldBank To Continue Backing Ethiopia's Financial Inclusion Initiative

The World Bank has pledged ongoing support for Ethiopia's National Financial Inclusion Strategy, a pivotal initiative to boost economic prosperity and inclusivity. Spearheaded by Senior Economist Michael O'Sullivan, the World Bank's commitment focuses on enhancing financial accessibility for millions, with a particular emphasis on gender inclusivity through initiatives like the Network of Ethiopia's Women in Finance (NEWFin).

This strategy, revised for the 2021-2025 period alongside key stakeholders, seeks to revolutionize Ethiopia's financial landscape, promoting broader economic participation, especially among women. With Ethiopia experiencing a notable uptick in financial inclusion, backed by increased digital financial services, this collaborative effort between the World Bank and the Ethiopian government marks a significant stride towards sustainable development and economic empowerment across the nation.

Google DeepMind CEO Demis Hassabis gets UK knighthood for services to artificial intelligence

Sir Demis Hassabis, the CEO and co-founder of DeepMind, has been knighted in the U.K. for his remarkable achievements in artificial intelligence (AI). This honor recognizes his pivotal role in advancing AI technologies and fostering global AI ecosystems, positioning him as a leading figure in the industry.

Demis Hassabis is renowned for his pioneering work in artificial intelligence, which has granted him knighthood in recognition of his noble contributions to the field. From his early achievements as a chess prodigy to his innovative developments at DeepMind, Hassabis has consistently pushed the boundaries of AI innovation.

Born in London in 1976, Hassabis demonstrated extraordinary talent from a young age, achieving master status in chess during his teenage years. His academic journey led him to excel in computer science at the University of Cambridge and later pursue a PhD in cognitive neuroscience from University College London (UCL).

In 2010, alongside Shane Legg and Mustafa Suleyman, Hassabis co-founded DeepMind, a venture that would revolutionize AI research and development. Under his leadership, DeepMind achieved remarkable milestones, including the creation of AlphaGo, an AI system that defeated the world champion in the strategy board game Go.

AfCFTA Collaboration Targets Economic Integration Across Africa

The African Continental Free Trade Area (AfCFTA) Secretariat and N Gage Consulting have entered into a Memorandum of Understanding (MoU) aimed at bolstering the implementation of the AfCFTA, particularly focusing on North Africa and Arabic-speaking countries. This partnership was officiated by AfCFTA Secretary-General H.E. Mr. Wamkele Mene, alongside Mr. Karim Refaat and Dr. Sherif Fahmy, PhD from N Gage Consulting.

The AfCFTA, the world's largest free trade area, seeks to remove trade barriers across African nations to unify a market of 1.3 billion people with a combined GDP of $3.4 trillion, thereby fostering intra-African trade, economic integration, and contributing to the continent's sustainable development by creating jobs and reducing poverty.

The MoU outlines a commitment to enhancing cooperation through various activities like webinars, roundtable sessions, public-private dialogues, and a series of monthly newsletters aimed at raising awareness about the AfCFTA's goals and its Guided Trade Initiative. These efforts aim to showcase how the AfCFTA can stimulate trade among member states. Furthermore, the partnership will support the preparation and execution of the AfCFTA Business Forum, The Intra African Trade Fair (IATF), and various capacity-building programs for member states. These initiatives are designed to leverage the AfCFTA to boost intra-African trade and utilize Public-Private Partnership (PPP) projects to encourage investment in infrastructure, thereby positioning the AfCFTA as a key instrument for trade liberalization, sustainable development, economic diversification, and industrialization.

Infobip Report: Chatbots Got Smarter, Customers Got Chattier

Infobip's analysis of over 473 billion digital communications interactions in 2023 reveals a major shift towards conversational customer experiences, highlighted by the rapid development and integration of generative AI technologies. This shift is marked by a 137% increase in mobile app messages, a 73% rise in social media messages, and a 63% growth in chat app messages, indicating consumers' growing desire for deeper connections with brands across various stages of the customer journey, including marketing, commerce, and support.

For customer support, WhatsApp is the dominant platform, with 90% of support messages delivered through the app. However, there's a notable diversification in the use of chat apps like Messenger, Viber, and Line, showcasing an increase in their utilization for conversational support. This includes the adoption of conversational AI for personalized customer service, exemplified by the Megi Health Platform and insurance firm LAQO leveraging AI to enhance the customer experience.

In marketing, there's a 29% increase in mobile app messaging and significant activity on platforms like Telegram, Line, Viber, and Messenger, along with a notable rise in WhatsApp usage across various regions, including a 421% increase in the Asia Pacific. RCS Business Messaging is emerging as a new channel for conversational marketing, indicating a broader adoption of these platforms for engaging customers.

The data from Infobip underscores a global trend towards omnichannel adoption and the refinement of the end-to-end customer journey through conversational threads on chat apps or RCS. With the advent of interactive AI, a federation of chatbots and AI algorithms is expected to further personalize the customer journey, triggering actions at optimal points.

Will Deloitte's License Spark a Rush to Ethiopia's Exchange?

Deloittehas become the first entity to receive a securities investment adviser license in Ethiopia, marking a great step ahead of the country's Securities Exchange launch set for the third quarter of this year. The license was applied for through Deloitte's Nairobi office, with an office now established in Ethiopia for capital market operations. Tewodros Sisay of Deloitte expressed enthusiasm about contributing to the growth of Ethiopia's capital market and supporting local businesses.

The upcoming securities exchange will debut with the listing of 10% of Ethiotelecom, alongside other State-owned enterprises being assessed for listing. The Ethiopian Capital Markets Authority (ECMA) anticipates the introduction of various capital market entities such as investment banks and broker/dealers. ECMA's director-general, Brook Taye, emphasized the importance of Deloitte's licensing in accelerating the market's development and expressed expectations for further applications from Nairobi-based entities, highlighting the close economic ties anticipated between Kenya and Ethiopia in this venture.

Aella Credit Becomes Aella Microfinance Bank, Expanding Services

Aella Credit has officially rebranded to Aella Microfinance Bank, marking a significant evolution in its journey to provide innovative and inclusive financial services in Nigeria. Since its establishment in 2015 by Akin Jones, Aella has grown to serve over 2 million users, backed by notable US venture funds like Y Combinator and 500 Global. The rebranding aligns with Aella's commitment to delivering superior banking experiences and enhancing financial security for its customers, in adherence to the Central Bank of Nigeria's regulations.

Aella Microfinance Bank aims to offer Nigerians safer banking services, low-interest loans, free transfers, and high-interest savings plans. The name change reflects the company's response to the financial challenges faced by Nigerians, further emphasized by its recent acquisition of Flourish MFB. Additionally, Aella MFB is set to contribute to the government's student loan scheme, leveraging ledger technology for transparent and efficient loan disbursement. This rebranding signifies a deepened commitment to financial inclusion and the provision of advanced banking solutions to the Nigerian market.

The risks and rewards of generative AI in software development

Keith Pitt, CEO of Buildkite, delves into the potential impact of generative AI on software development. Pitt, a seasoned developer, explores the promises and pitfalls of this emerging technology, shedding light on its transformative potential.

Key Highlights:

End to Grunt Work: Generative AI promises to automate mundane tasks like syntax checking and code formatting, allowing developers to focus on higher-level tasks.

Framework Reinvention: AI is poised to revolutionize software frameworks by automating boilerplate code generation and suggesting optimizations, enhancing productivity.

Rise of Generalists: Proficiency in specific languages may become less critical as AI can generate code in any language, elevating the importance of creativity and innovation in software development.

Revolution in Testing: AI-powered testing automation is set to disrupt traditional testing practices, offering benefits in quality assurance and security testing.

Citizen Development: Low-code/no-code tools will see a significant boost from AI, enabling users to sketch workflows and receive code instantaneously.

Downsides and Risks: Pitt acknowledges potential risks such as over-testing, skills degradation, and trust deficits due to reliance on AI-generated code.

Future Outlook: While AI may not render developers obsolete, it will reshape their roles, pushing them towards innovation and higher-value tasks.

Pitt urges developers to embrace the transformative potential of AI while remaining vigilant about its limitations and challenges.

Experts Call for Global Blue Economy Partnership at RCEP Youth Dialogue

At the 2024 Regional Comprehensive Economic Partnership Youth Dialogue on Regional Cooperation in Marine Economy in Haikou, Hainan province, experts emphasized the urgent need for a global blue economy partnership to enhance marine governance and address its current fragmentation. Amid rising maritime tensions and threats to ocean sustainability, such as the Red Sea crisis disrupting global trade and overfishing endangering marine resources, the dialogue highlighted the crucial role of maritime transport in international trade.

China's special envoy for climate change, Liu Zhenmin, pointed out the significant challenges in global marine governance, including the need for improved coordination among different governing bodies managing fishery, environmental protection, and scientific research. Suggestions for boosting China-ASEAN marine ecosystem conservation were proposed, including establishing joint committees, protected areas, and initiatives for sustainable marine development.

Additionally, the concept of a China-ASEAN blue carbon trading market was introduced. The dialogue, themed “Building a Blue Economy Partnership Together”, stressed multilateral collaboration to manage ocean sustainability effectively, with China’s experience in shipbuilding and fishery management highlighted as valuable to neighboring countries in building their blue economy. The event was co-hosted by several institutes and organizations, underscoring the collective effort to promote oceanic sustainability and economic prosperity through the blue economy.

AT&T Data Leak: Over 7.6 Million Current Users and 65.4 Million Former Users Impacted

AT&T has announced a significant data breach impacting approximately 7.6 million current and 65.4 million former customers, with sensitive information now circulating on the dark web. The telecom giant has responded swiftly, resetting the passcodes of all active accounts compromised in the breach.

The exposed data, dating back to 2019 or earlier, includes personal details such as names, addresses, phone numbers, birth dates, and Social Security numbers. Following an alert from TechCrunch, triggered by a security researcher's findings, AT&T has launched a full-scale investigation to probe the breach, involving both in-house and external cybersecurity teams. This incident casts a shadow over previous denials from AT&T regarding a claimed 2021 breach by hacker group ShinyHunters.

The company is currently working to determine the breach's source and is set to offer credit monitoring services to those affected as it navigates this cybersecurity crisis.

But Can we teach AI to Play Nice in Cybersecurity?

Here is an exploration of the intricate relationship between artificial intelligence (AI) and cybersecurity, highlighting the immense potential for defense and the alarming risks posed by malicious exploitation of AI-driven tools. Bocetta emphasizes the need for a strategic and ethical approach to navigating this evolving landscape, urging organizations and individuals to harness AI's defensive capabilities while mitigating its vulnerabilities.

In short:

AI as a Defense Tool: Bocetta underscores AI's role as a powerful ally in fortifying cybersecurity defenses, citing its ability to automate threat detection, conduct predictive analytics, and enhance incident response.

Automated Threat Detection can swiftly detect and analyze threats, including phishing attacks, transforms cybersecurity from a reactive discipline to a proactive strategy.

AI in Adversarial Hands: Despite its defensive potential, AI also empowers cyber adversaries with sophisticated tools for crafting sophisticated phishing attacks, automated hacking, evading detection systems, and conducting surveillance and espionage.

To effectively leverage AI in cybersecurity, Bocetta advocates for strategic approaches that prioritize the development of AI models to counteract AI-driven threats, ethical considerations in AI development, and ongoing education and awareness.

"The genius at the heart of AI—its ability to sift through mountains of data, actually spot a needle in a haystack, and act on threats before they blossom into full-scale emergencies—it's undeniable. However, here's the rub—every part of that impressive arsenal? It's also up for grabs by the other side, and can (and will) arm them to launch attacks of unprecedented sophistication and elusiveness, the likes of which we've thankfully never seen up to now."

It's the Prosumer Era: Content Creation is Key

Shant Oknayan, vice president, TikTok Global Business—Asia, Oceania and Africa, highlights the emergence of the 'Prosumer'—consumers who are not just passive recipients of content but active creators and shapers of marketing narratives. This shift is a response to the digital savviness and creative demands of consumers in the aftermath of global events like the COVID-19 pandemic. With a significant portion of APAC consumers actively engaging in content creation and discussion, brands are recognizing the need for a creative, scalable approach to content to connect meaningfully with their audience.

Prosumers are seeking authentic, personalized content and are creating their own to foster communities around shared interests. To stay relevant, brands must adopt strategies that resonate with Prosumers by optimizing and adapting their content to fit different platforms and engaging with platform communities to enhance campaign relevancy. Success in this evolving digital marketplace requires leveraging the '5+1Vs of content and creativity', focusing on volume, velocity, validity, variety, vitality, and value. Samsung Electronics' #HRZoneWorkout campaign exemplifies effective Prosumer engagement, showing the potential for brands to forge deeper connections and drive brand loyalty through immersive and interactive content strategies. In this new era, creativity and engagement are paramount, urging brands to continuously innovate and maintain an always-on approach to content creation.

Nestle SA To Invest $132 Million In African Business Development

Nestlé has announced an investment of R2.5 billion ($131 million) over the next five years to bolster Black-owned businesses and sustainable agro-processing in eastern and southern Africa.

This initiative, which was unveiled following the Second Black Industrialists and Exporters Conference in South Africa, aims to enhance sustainable procurement practices and supplier partner development within Nestlé's value chain. Mota Mota, a spokesperson for Nestlé, emphasized the company's commitment to promoting inclusive economic growth and entrepreneurship in the region.

Minister Ghita Mezzour Boosts Gitex Africa Morocco: Doubles Startup Participation, Fuels Digital Innovation

Minister Ghita Mezzour, PhD, Delegate to the Head of Government in Charge of Digital Transition and Administrative Reform, has announced significant advancements for the upcoming second edition of Gitex Africa Morocco. Doubling the participation of Moroccan startups to 200, compared to 100 in the previous edition, the Ministry has provided substantial support through the "Morocco 200" initiative, funding 95% of their costs.

Scheduled for May 29 to 31 in Marrakech, the event aims to bolster digital growth in Morocco, positioning the nation as a prominent digital hub regionally and continentally.

LogRhythm and Dataproof Join Forces to Elevate Cybersecurity in Africa

LogRhythm has partnered with DataProof Communications Communications to deploy advanced Managed Security Operations Center (SOC) services across the continent. This collaboration aims to boost cyber resilience amidst Africa's rapid digital transformation, expected to inject nearly $180 billion into the regional economy by 2025.

LogRhythm's SOC services, known for transforming disparate data into actionable insights, will provide Dataproof's clientele, including governments and public sector entities, with comprehensive IT environment visibility and robust cybersecurity measures.

Highlighting the partnership's focus on affordability and efficiency, Thapeli Matsabu, CEO of Dataproof, emphasizes the selection of LogRhythm for its cost-effective, unified threat detection and management platform. This initiative is set to enhance security operations with streamlined incident investigation and response, addressing the escalating threat landscape and ensuring critical data protection across Africa.

Ebury and dLocal Team Up to Boost Financial Services in Africa's High-Growth Markets

Ebury , a UK-based financial services firm, has joined forces with dLocal, a global payment platform known for its expertise in emerging markets to enhance financial accessibility across Africa. This strategic partnership is set to unlock new opportunities for businesses venturing into the African continent's burgeoning markets. The collaboration aims to simplify international transactions through tailored payment solutions and leveraging dLocal's expansive banking network, offering transparency, liquidity, and competitive rates crucial for businesses expanding into new territories.

With Ebury's extensive fintech services and dLocal's innovative payment systems, this alliance marks a pivotal step towards fostering economic growth and financial inclusion in Africa's high-potential markets, reflecting both firms' commitment to supporting the continent's economic dynamism.

Women-led SMEs leverage blockchain to bridge MENA and Sub-Saharan Africa

Women-led small and medium-sized enterprises (SMEs) in the Middle East and North Africa (MENA) and sub-Saharan Africa face significant barriers to cross-border trade, hindering their potential for economic empowerment and access to international markets. Amidst these challenges, blockchain technology emerges as a groundbreaking solution, offering new avenues for financial independence and market access.

Blockchain promises to bridge the economic disconnect by eliminating trade barriers and facilitating secure, transparent transactions, between these geographically proximate regions and catalyze socio-economic change. Initiatives like Boom's integration of decentralized AI for credit scoring exemplify the transformative power of blockchain in providing women entrepreneurs with the tools they need for growth.

Report: Technology and Data are Africa’s Most In-demand Skills – Outsized Talent-on-Demand Report 2024

Outsized , an on-demand talent platform operating in Africa, the Middle East, and Asia-Pacific, has released its third annual Talent-On-Demand report, revealing the growing demand for skilled talent in Africa. The report highlights that technology-related and data skills are the most sought-after on the continent, reflecting a global shift towards a more data-informed and technology-driven business environment. With a surge in freelancer registrations and fierce talent competition, the report provides insights into Africa's evolving freelancer landscape, including earning potential and trends to watch in 2024.

Briefly:

Growing Demand for Talent: Outsized's report shows a surge in demand for independent skilled talent in Africa, driven by the need for agility, cost flexibility, and access to critical skills. Technology-related and data skills are identified as the most sought-after skills on the continent.

Top Skills in Africa: In 2023, technology and data skills such as project management, business intelligence, data analytics, and data science were in high demand. Finance-related skills like accounting and financial analytics also ranked among the top skills sought by employers.

Freelancer Landscape: Economic challenges led to a focus on cost-effective, quality skills in the region, resulting in longer retention and contracts for top talent. African freelancers are among the most experienced globally, with an average of 9.5 years of experience.

Earning Potential: Freelancers with digital transformation skills earned the highest average day rate of $392, followed by technology implementation and business analytics. African freelancers earned the second-highest day rate globally at $316.

Trends to Watch in 2024: The report identifies three key trends shaping Africa's talent landscape in 2024: navigating economic uncertainty, enhancing operational efficiency, and Africa's leap towards automation and innovation, particularly in fields like cybersecurity analysis, data science, and AI specialization.

Cognition Seeks $2 Billion Valuation for AI Coding Tool

Cognition, a company initially focused on cryptocurrency, has shifted its focus to developing an AI tool for writing code and is now in talks to raise funds at a valuation of up to $2 billion. This valuation would significantly increase its worth to almost six times its previous valuation in a matter of weeks. Silicon Valley venture firms, including Founders Fund, which is already an investor, are considering investing in this round. Cognition recently introduced Devin, its AI coding tool capable of autonomously performing complex coding tasks, such as creating custom websites.

This development is seen as a major advancement in AI, potentially leading to the automation of software development tasks. This fundraising effort occurs alongside other AI companies seeking substantial valuation increases, with examples including the Canadian startup Cohere and the French AI model developer Mistral. Meanwhile, tech giants like Google, Microsoft, and Meta are also actively developing their own AI large language models (LLMs), underscoring the competitive landscape in AI development, which demands significant investments in computational power and research talent.

ACI and AFS Partner to Deliver Modern, Secure Payment Solutions Across the Middle East and Africa

ACI Worldwide, a leader in global real-time payments software, has formed a strategic 10-year partnership with Arab Financial Services (AFS), a key provider of digital payment solutions and fintech services in the Middle East and Africa. This collaboration aims to transform the digital payment infrastructure across these regions. AFS, regulated by the Central Bank of Bahrain and owned by 37 banks and financial institutions, offers a wide range of services to over 60 clients in more than 20 countries. Its offerings include card processing, merchant acquiring, and various fintech and value-added services.

Santhosh Rao, Senior Vice President of MEASA at ACI Worldwide, stated that the partnership would make ACI's advanced payment software solutions accessible to an extensive network of banks, financial institutions, and merchants, facilitating digital transformation and innovation across the region. This alliance will utilize ACI's Enterprise Payments Platform, noted for its security, flexibility, cloud readiness, and support for multiple languages and currencies, to drive modernization in retail banking and enhance service capabilities and efficiency for AFS's banking and fintech customers.

Air Connect offers wireless connectivity for South African businesses

CMC Networkshas launched Air Connect, a Wireless to the Business (WTTB) solution, offering wireless connectivity to businesses across South Africa. This innovative solution leverages radio waves to provide reliable, high-speed connectivity, catering to diverse business needs and ensuring continuity even in challenging environments. With installation times ranging from 3 to 10 days, Air Connect serves as a rapid deployment option, ideal for businesses awaiting fiber buildouts or as a backup in SD-WAN overlay deployments. Geoff Dornan, CTO at CMC Networks, highlights the solution's scalability, quick installation, and unwavering reliability, underscoring the company's commitment to meeting evolving customer demands and facilitating seamless business operations.

Green to Blue: Dimension Data Rebrands as NTT Data, entering East Africa

Dimensions Data (Now NTT Data), a technology provider in East and West Africa, is set to undergo a rebranding to NTT Data in this month, following approval from the Communications Authority of Kenya (CA)Kenya. This change aims to introduce NTT Data's globally recognized services to the East African region, encompassing a broad spectrum of offerings in consulting, applications, infrastructure, connectivity, and operations.

The rebranding was announced by Richard Hechle, the Managing Director of Dimension Data for East and West Africa, who expressed enthusiasm for the future as NTT Data. Hechle highlighted the merger of legacy and experience with a fresh emphasis on growth and innovation, promising a superior client experience through high-quality, platform-delivered managed services. The transition to NTT Data marks a commitment to both maintaining a strong local presence and accessing a wider array of global resources.

NTT Data plans to offer an expanded portfolio of services and industry-specific solutions catering to sectors like retail, financial services, manufacturing, pharmaceuticals, and mining. This includes a comprehensive suite of digital assets, cutting-edge technologies, and tailored solutions designed to meet the dynamic needs of clients with precision and agility.

Hechle also stressed the importance of investing in local talent development and staying current with technological advancements, particularly in the realm of Artificial Intelligence. The rebranding initiative is anticipated to facilitate growth and open new investment opportunities in East and West Africa, with strategic plans to explore emerging markets such as Ethiopia and Rwanda.

This Week in Fintech, in a Flash 🚀

AI Innovations and Expansions 🤖

Elon Musk's Big Move: xAI's chatbot Grok is now accessible to all premium subscribers on the social media platform X, enhancing user experience and steering away from ad reliance.

Revolutionizing Healthcare with mPharma: Utilizing cutting-edge technology to make essential medications and healthcare services more accessible across Africa, promising better health outcomes with the support of AWS.

Financial Tech Breakthroughs 💳

Zeeh Africa's Loan Recovery Solution: Introducing a game-changing Global Standing Instruction (GSI) technology for efficient loan recoveries, set to transform the lending landscape.

PayAngel Enters Kenya: Aiming to improve the way diaspora remittances are handled by allowing fast, free transfers to local bank accounts or M-pesa wallets, promising a positive impact on the economy.

Trade and Investment News 🌍

Karcher's Kenyan Expansion: Investing in a regional distribution center to streamline operations, reflecting commitment to local and regional clients.

Africa Energy Bank's Launch: Set to channel $5 billion into fossil fuel projects, highlighting African nations' pursuit of their financial and energy agendas.

Policy and Government Initiatives 🏛️

White House Sets AI Usage Guidelines: Introducing rules for federal agencies to ensure responsible AI deployment, emphasizing transparency and public interest.

Economic Indicators and Insights 💹

Kenyan Shilling's Remarkable Recovery: Gaining ground against the US dollar, offering relief to consumers by potentially lowering the cost of imports.

Kenya's Banking Sector Dividends: Remaining flat amid challenging economic conditions, reflecting a cautious approach to capital preservation.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲

23,890+💙S𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply