- FINTAK Weekly Newsletter

- Posts

- Africa Prosperity Champions: Kenya's business magnate Julius Mwale honored with Social Infrastructure Award in Ghana

Africa Prosperity Champions: Kenya's business magnate Julius Mwale honored with Social Infrastructure Award in Ghana

A weekly digest of news, opinions and all things financial technology

Julius Mwale, a successful industrial entrepreneur and investor with a 20-year track record, has received an award in recognition of his transformative contributions and investments in health, particularly for establishing the Mwale Medical and Technology City (MMTC) in Kenya. He invested over $2 billion in building the city with a 100% green concept. MMTC has expanded into 12 African countries with a vision to build 18 smart cities and empower around 800 million people by 2050.

The chairman of the Africa Prosperity Network praised Mwale's decision to invest in a major health facility and make it accessible to ordinary Kenyans. MMTC's achievements align with the goals of the African Continental Free Trade Area (AfCFTA), promoting economic collaboration and integration. The award ceremony, hosted by President Nana Akufo-Addo of Ghana, acknowledged a few distinguished individuals, including 𝑷𝒂𝒕𝒓𝒊𝒄𝒊𝒂 𝑺𝒄𝒐𝒕𝒍𝒂𝒏𝒅, 𝑴𝒐𝒉𝒂𝒎𝒆𝒅 𝑨𝒍𝒊, 𝑷𝒓𝒆𝒔𝒊𝒅𝒆𝒏𝒕 𝑨𝒍𝒂𝒔𝒔𝒂𝒏𝒆 𝑸𝒖𝒂𝒕𝒕𝒂𝒓𝒂, 𝑪𝑬𝑶 𝒐𝒇 𝑨𝒇𝒓𝒊𝒆𝒙𝒊𝒎 𝑩𝒂𝒏𝒌, 𝑪𝒓𝒆𝒂𝒕𝒊𝒗𝒆 𝑬𝒏𝒕𝒓𝒆𝒑𝒓𝒆𝒏𝒆𝒖𝒓 𝑴𝒓. 𝑬𝒂𝒛𝒊, 𝒂𝒏𝒅 𝑬𝒈𝒚𝒑𝒕’𝒔 𝒅𝒆𝒑𝒖𝒕𝒚 𝑺𝒑𝒆𝒂𝒌𝒆𝒓 𝑴𝒐𝒉𝒂𝒎𝒎𝒆𝒅 𝑬𝒍 𝑬𝒏𝒆𝒊𝒏. The event aimed to celebrate extraordinary leadership in Africa and was attended by influential figures from various sectors.

Read more:http://tinyurl.com/y3cvhp7b

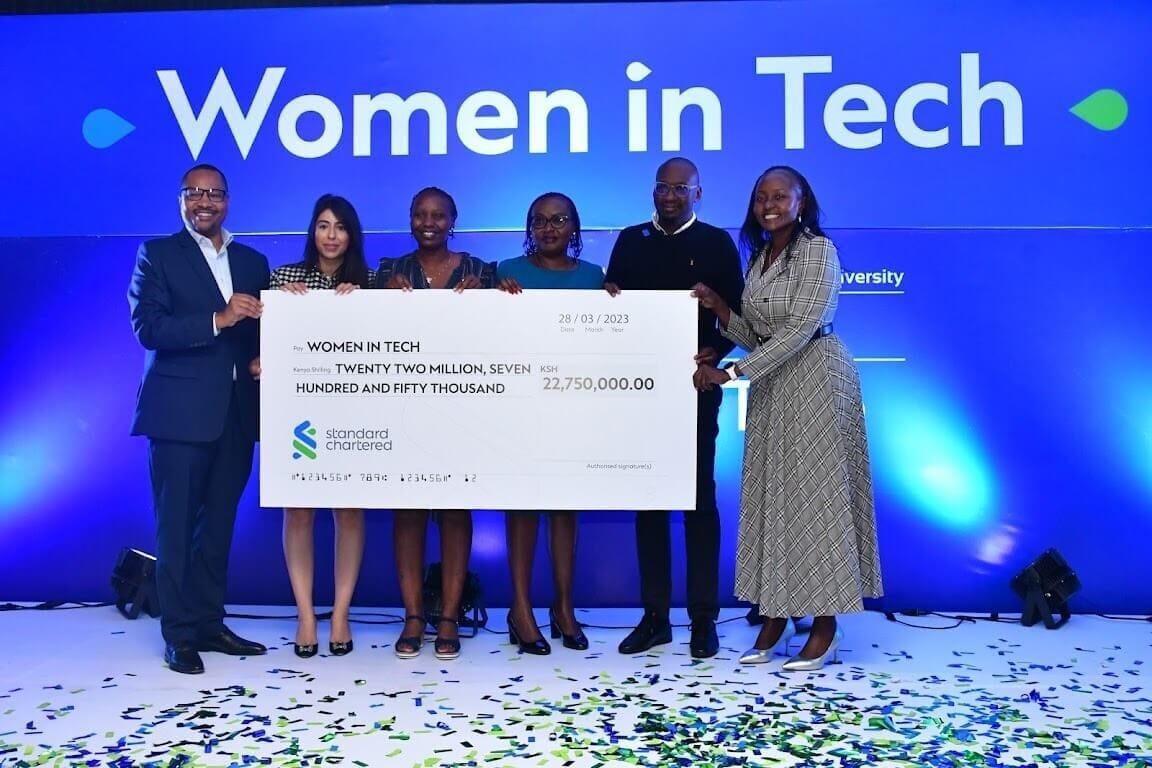

Village Capital and Standard Chartered Bank join forces to bridge the gender funding gap in tech through a partnership investing in women-led startups.

The innovative "pilot facility" targets alumni of Standard Chartered's Women in Tech program, focusing on early-stage, impact-driven ventures.

This initiative directly addresses the significant disparity in financing access faced by women entrepreneurs compared to men.

Village Capital , with its expertise in underserved markets, and Standard Chartered, with its established Women in Tech program, aim to create a more inclusive and equitable entrepreneurial ecosystem.

5 surprising things to know from Davos 2024 that Shape the Future of Fintech

While AI dominates headlines, a closer look at Davos 2024 reveals deeper narratives shaping the future of technology and its impact on finance. Here are 5 key takeaways for the Fintech Association of Kenya:

1. Bridging the Analogue-Digital Divide:

Despite our digital immersion, much of the world remains offline. Scaling technology's impact requires mindful integration, not immediate replacement.

The EDISON Alliance's progress in closing the digital divide offers valuable lessons for Kenyan Fintech initiatives.

2. Preparing for the Quantum Economy:

Quantum computing's applications, from sensing to navigation, are arriving now, impacting the global economy by 2030.

Invest in a skilled, interdisciplinary workforce to prepare for the quantum revolution.

3. Space Technology for a Sustainable Planet:

Earth imaging systems powered by AI can revolutionize our transition to a sustainable economy, from tracking deforestation to disaster response.

Frameworks like ITU's deorbiting strategies ensure space sustainability for all countries to benefit.

4. AI Augmenting Our Humanity:

AI is transforming industries, creating new pathways for healthcare, education, and public services.

The Women's Health Initiative leveraging AI holds immense potential for Kenya's healthcare sector.

5. Continuous Dialogue for Inclusive Benefits:

Measured, inclusive conversations considering technology, governance, and societal well-being are crucial to harnessing AI's benefits ethically.

The AI Governance Alliance's resources and "agile governance" approach can guide Kenyan Fintech's responsible AI development.

Read more:http://tinyurl.com/2f5e5mpd

Hedging Against Shilling Wobbles: Kenyans flock to dollar ventures as shilling falls.

Kenyan investors are seeking refuge in the greenback, with a significant rise in US dollar-denominated investments as the Kenyan shilling faces headwinds. This trend signals growing concern about the weakening of local currency and highlights the adaptability of Kenya's financial sector.

Dollar Fever Grips Investors:

Domestic and diaspora investors are increasingly turning to dollar-based products like money markets and fixed-income funds to protect their wealth from shilling depreciation.

Fund managers are responding to this demand by launching new forex investment vehicles.

Regulatory approval reflects the surge, with the Capital Markets Authority (CMA) greenlighting several dollar-denominated funds in 2023.

Numbers Tell the Story:

Dollar-denominated fund assets under management grew from Ksh5.1 billion ($31.4 million) in September 2022 to Ksh12.3 billion ($75.7 million) by Q3 2023, a 141% increase.

This trend encompasses diverse offerings, including money market funds, fixed-income funds, and even Sharia-compliant options.

Read more:http://tinyurl.com/3pv7zd2j

Cyber Threats and Corruption Top Kenya's Business Risks - Report.

Kenya faces heightened business risks in 2024 as cybersecurity, corruption, and policy shifts take center stage, according to the latest Risk Barometer by Allianz. With an alarming 59% of respondents citing data breaches as their top cyber threat, Kenya's economy lost at least Sh25 billion to cybercrime in 2022, with an expected 14% annual increase.

The report unveils the growing challenges posed by poor cybersecurity in mobile devices, a shortage of cyber professionals, and the risk faced by smaller companies relying on IT outsourcing. Joining cyber threats, corruption persists as a major concern, draining Sh600 billion from the GDP. The report also highlights the evolving risks of natural catastrophes, with Africa and the Middle East witnessing a surge in this category.

Read more:http://tinyurl.com/29tu6xen

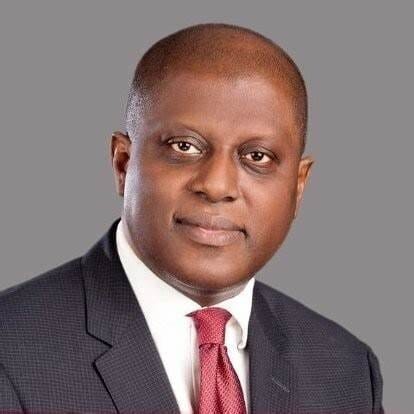

Transformative Economic Policies Under Central Bank of Nigeria's New Leadership: 𝐀 𝐋𝐨𝐨𝐤 𝐢𝐧𝐭𝐨 𝐍𝐢𝐠𝐞𝐫𝐢𝐚'𝐬 𝐅𝐮𝐭𝐮𝐫𝐞

𝐍𝐞𝐰 𝐋𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐚𝐭 𝐂𝐁𝐍: Dr. Olayemi Cardoso, the newly appointed governor of the Central Bank of Nigeria (CBN), faces the formidable task of curbing high inflation and rescuing the naira from severe devaluation.

𝐎𝐫𝐭𝐡𝐨𝐝𝐨𝐱 𝐌𝐨𝐧𝐞𝐭𝐚𝐫𝐲 𝐏𝐨𝐥𝐢𝐜𝐲: A shift towards conventional monetary policy is evident under Cardoso's leadership, marking a departure from the unorthodox strategies of his predecessor, Godwin Emefiele.

𝐏𝐨𝐥𝐢𝐜𝐲 𝐅𝐨𝐜𝐮𝐬: Cardoso emphasized the CBN's commitment to price and exchange rate stability to boost sustainable economic growth in his address at the Chartered Institute of Bankers of Nigeria.

𝐈𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐍𝐚𝐢𝐫𝐚 𝐕𝐚𝐥𝐮The CBN, under Cardoso, targets an inflation rate reduction to 21% and aims to restore the value of the naira.

𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐑𝐚𝐭𝐞 𝐏𝐫𝐞𝐬𝐬𝐮𝐫𝐞: With inflation hitting 28.92% in December, its highest in 27 years, there's mounting pressure on the CBN to raise interest rates.

𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 𝐟𝐨𝐫 𝟐𝟎𝟐𝟒: Cardoso anticipates a decline in inflationary pressures due to improved agricultural productivity and easing global supply chain issues.

𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐨𝐟 𝐈𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧-𝐓𝐚𝐫𝐠𝐞𝐭𝐢𝐧𝐠 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤: The CBN's new strategy involves clear communication, using monetary policy tools, and collaboration with fiscal authorities.

𝐅𝐨𝐫𝐞𝐱 𝐌𝐚𝐫𝐤𝐞𝐭 𝐚𝐧𝐝 𝐍𝐚𝐢𝐫𝐚 𝐕𝐚𝐥𝐮𝐚𝐭𝐢𝐨𝐧:Efforts are underway to improve liquidity in the forex market, with the CBN working to unify multiple exchange rates to foster transparency.

𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐆𝐫𝐨𝐰𝐭𝐡 𝐏𝐫𝐨𝐣𝐞𝐜𝐭𝐢𝐨𝐧𝐬: The Federal Government of Nigeria anticipates a real GDP growth of 3.76% in 2024, slightly higher than the 3.75% estimated for 2023.

𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐎𝐮𝐭𝐥𝐨𝐨𝐤: Despite some challenges, investors have cautious optimism, especially in the ICT and manufacturing sectors.

Read more: http://tinyurl.com/6h9zv723

Powell's Tightrope Walk: Inflation Tamed, But When Will Rates Ease?

On Wednesday afternoon(31st Jan), the Fed is set to announce its latest policy decision. Investors expect the central bank will leave interest rates unchanged in a range of 5.25% to 5.50%. Investors will be closely watching for any commentary during Fed Chair Jerome Powell's conference on Wednesday about when the Federal Reserve may begin cutting rates.

Since Jerome Powell's last speech in December, the market outlook has undergone a significant change. Initially, investors anticipated a rate cut by the Federal Reserve in March due to strong economic growth, but they later moderated these expectations.

Currently, with inflation at its lowest in almost three years, several Wall Street analysts predict that the Fed is likely to start reducing interest rates soon. Andrew Hunter, Deputy Chief US Economist at Capital Economics, suggested in a recent client note that the Fed should acknowledge its success in controlling inflation and begin easing its stringent policies.

Investor opinions on the timing of this rate cut remain divided. As of last Friday, market data from the CME FedWatch Tool indicated a 47% likelihood of a rate cut in March. This probability increases to 88% by May.

Michael Gapen, a US economist at Bank of America, expects the Fed to adopt a more neutral tone in its post-meeting statement regarding policy tightness, which could imply a subtle shift towards easing. However, Gapen notes that despite a cooling labor market and faster-than-expected inflation decline without a significant rise in unemployment, the Fed is not yet ready to clearly communicate its future plans.

AFRICA must BRACE itself for a possible Trump RETURN.

Trump's African Shadow Looms: Could his return usher in an era of trade wars, isolationism, and uncertainty for the continent?

The African Tech Startups Funding Report - 2023 by Disrupt Africa

African 🌍Tech Startups Funding 💸 Report 2023 : A Challenging Year for

Growth.Trends Highlights :

💰 Funding declined, with a total of 406 startups raising $2.4B in 2023.

📉 Active investors fell by almost 50%, and M&A activity decreased.

🔝 South Africa, Nigeria, Kenya, and Egypt remained the major funding markets.🚀 Despite challenges, Africa's tech ecosystem continues to innovate and spread its reach.

BYD enters Rwanda with launch of Atto 3

BYD, a prominent Chinese electric vehicle manufacturer, has recently announced its expansion into Rwanda, representing a significant step in the company's global outreach and its dedication to promoting sustainable transportation. Headquartered in Shenzhen, Guangdong Province, BYD, which stands for "𝐁𝐮𝐢𝐥𝐝 𝐘𝐨𝐮𝐫 𝐃𝐫𝐞𝐚𝐦𝐬," has gained recognition for its innovative contributions to the automotive industry, especially in electric vehicles (EVs). The company has established itself as a leader in the new energy vehicle (NEV) market, consistently topping global NEV sales charts.

Read more: http://tinyurl.com/yc5mzbb2

UNCTAD Raises The Alarms On Escalating Disruptions To Global Trade.

UNCTAD sounds alarm over plummeting trade due to:Black Sea conflict: 42% drop in Suez Canal traffic in just two months.Red Sea attacks: Houthi activity disrupts shipping, leading to suspended Suez transits by major players and a 67% drop in container ship traffic.Climate change: Panamanian Canal facing pressure.

Skyrocketing shipping costs:Shanghai to Europe rates more than tripled (256% increase).US West Coast rates also surged 162%, despite not using Suez.

Bottom line: Trade disruptions from conflict and climate are squeezing global supply chains, pushing up shipping costs and threatening economic stability.

Read more:http://tinyurl.com/d54yxudm

Start-ups powering up Africa’s solar energy ecosystem.

Despite Africa's abundant sunshine and vast potential, only 1% of its energy comes from solar. Enter ambitious startups like SunCulture, GridX Africa, and Bboxx, bringing innovative solutions to rural farmers, remote communities, and businesses.

Despite Africa's abundant sunshine and vast potential, only 1% of its energy comes from solar. Enter ambitious startups like SunCulture, GridX Africa, and Bboxx, bringing innovative solutions to rural farmers, remote communities, and businesses.

🌞 𝑲𝒆𝒚 𝑯𝒊𝒈𝒉𝒍𝒊𝒈𝒉𝒕𝒔:

SunCulture 💧🌱: Equips farmers with solar-powered irrigation systems, boosting yields and income for 89% of users.

GridX Africa 🌍🔋: Provides off-grid solar power to farms, lodges, and construction projects across East Africa.

Bboxx ☀️💡: Offers pay-as-you-go solar solutions, democratizing access to clean energy for millions.

⚡ 𝑪𝒉𝒂𝒍𝒍𝒆𝒏𝒈𝒆𝒔:

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐧𝐠 💰: Scaling solar projects requires more investment from public and private financiers.

𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐝 𝐌𝐚𝐢𝐧𝐭𝐞𝐧𝐚𝐧𝐜𝐞 🛠️: Remote location makes maintaining solar systems a hurdle.

🔑 𝑺𝒐𝒍𝒖𝒕𝒊𝒐𝒏𝒔:

𝐎𝐝𝐲𝐬𝐬𝐞𝐲 𝐄𝐧𝐞𝐫𝐠𝐲 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬 🌐📊: Streamlines procurement and offers software to remotely monitor and optimize solar assets.

𝐔𝐒-𝐀𝐂𝐄𝐅 𝐢𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐯𝐞 🌱🌟: Catalyzed early-stage clean energy projects, proving its effectiveness.

𝐂𝐚𝐭𝐚𝐥𝐲𝐭𝐢𝐜 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 💵🌍: More significant investments are needed to reach UN's clean energy goals.

🌟 𝑶𝒖𝒕𝒍𝒐𝒐𝒌:

With innovation and increased support, Africa's solar energy sector has the potential to light up the continent, empower communities, and combat climate change. 🚀🌍✨

Read more:http://tinyurl.com/4bheen63

Ghana Surprises Analysts With Africa’s First Rate Cut of 2024.

The Bank of Ghana cut its benchmark interest rate for the first time since 2021, as it expects inflation to keep slowing.

The monetary policy committee on Monday lowered its key rate to 29% from 30%, ending a pause in place since September. Only three of 10 economists polled by Bloomberg predicted the move.

Annual inflation softened to a 21-month low in December of 23.2% from 26.4% a month earlier. It expects the deceleration to continue with inflation forecast to reach around 13% to 17% by year end, Governor Ernest Addison told reporters Monday in the capital, Accra.

The cut was the first by an African central bank so far this year.

Read more:http://tinyurl.com/kzxj3snt

Digital Payment Growing Significantly in Nigeria And Other African Countries, Hit 46% – Report.

A recent EBANX report highlights the significant role of emerging economies, including Brazil, India, Kenya, and Nigeria, in driving the global digital market. This growth is largely attributed to the increase in online purchases made through instant payments, transfers, and various alternative payment methods, while traditional card payments continue to maintain their strength in the digital space.

In Africa, a notable shift towards digital payments has been observed, with penetration rates doubling from 23% to 46% in many countries over the last eight years. The continent is poised for its next major advancement in digital commerce, propelled by widespread cell phone usage and the continuous integration of local, alternative payment methods into the online realm. Notably, mobile money has achieved near-universal penetration in countries like Kenya, playing a crucial role in this digital transformation.

Source: FinTech Magazine

Read Report Here:http://tinyurl.com/mbckb3my

🌍 Global Economy Braces for Slowdown - Africa Grapples with Limited Growth under Strained Conditions 📉

World GDP growth forecast to dip from 2.7% in 2023 to 2.4% in 2024 📊.

Africa's growth predicted to be modest, marginally increasing from 3.3% in 2023 to 3.5% in 2024 🌱.

Challenges ahead: Tighter financial strings, geopolitical unrest, and climate change impact 🌪️💸.

Global inflation showing signs of relief, yet soaring food prices raise alarm over food security 🍲📈.

Sluggish investment and trade trends could curb key growth drivers 🚧💹.

Central banks navigating the tough terrain of stabilizing inflation, growth, and financial health ⚖️💰.

Fiscal opportunities dwindling amidst rising interest rates and liquidity constraints 📉💼.

Emphasis on multilateral cooperation to fast-track Sustainable Development Goals (SDGs) progress 🤝🌐.

Read more:http://tinyurl.com/yc65uaey

Jospong and EKI Partner to Attract $1 Billion Carbon Investment by Reducing Methane.

Key highlights:

Jospong and EKI Energy Services Ltd (EnKing International) @EKIEnergy signed a Memorandum of Understanding (MoU) to develop projects generating carbon credits from Jospong's waste management operations.

These carbon credits will be sold in carbon markets, attracting up to $1 billion in investment and creating 1,000 jobs by 2030.

EKI will provide technical assistance for project implementation, leveraging their expertise in climate change solutions.

This collaboration is seen as a major milestone for Ghana, positioning it as a leader in climate action.

Jospong is already implementing a project to reduce methane from landfills, generating compost and creating jobs.

The agreement aligns with Article 6 of the Paris Agreement for international cooperation on carbon markets.

Ghana's high organic waste content makes it particularly suited for composting and methane reduction projects.

In essence, Jospong and EKI are joining forces to turn waste into money and jobs through carbon trading, contributing to Ghana's climate leadership and economic development.

Read more:http://tinyurl.com/y5rcz48s

Global watchdog Proposes New Ethics Code to Combat Greenwashing.

Companies that make environmental, social, and governance (ESG) claims will soon be held to a higher standard, thanks to a proposed new ethics code. The International Ethics Standards Board for Accountants (IESBA) is proposing revisions to its ethics standards for auditing sustainability information from companies.

What is greenwashing?

Greenwashing is the practice of misleading investors or consumers about a company's environmental or social impact. This can be done through false or exaggerated claims about a company's sustainability practices.

Why is this new code important?

Trillions of dollars have flowed into investment funds touting green credentials, but many of these claims are misleading. The new ethics code is designed to help combat greenwashing by ensuring that companies' ESG claims are accurate and verifiable.

What are the key features of the new code?

The new code spells out best practice for verifying a company's sustainability claims. It includes detailed instructions in areas such as:

Accounting for the impact of corporate actions on emissions

Relying on outside experts

Identifying and tackling conflicts of interest

How will the new code be implemented?

The proposed standards will be open for public consultation until May. If approved, they will be adopted by accounting firms around the world.

What impact will the new code have?

The new code is expected to have a significant impact on the way companies report their ESG performance. It will make it more difficult for companies to get away with greenwashing, and it will help to ensure that investors have access to accurate and reliable information.

Read more:http://tinyurl.com/4med62rm

Paymob and Mastercard team up to boost the adoption of digital payments in the MENA region.

Paymob , the leading financial services enabler in the Middle East, North Africa, and Pakistan (MENA-P), has partnered with Mastercard to accelerate digital payment acceptance across the MENA region.

The strategic omnichannel partnership will leverage Paymob’s payments infrastructure and Mastercard’s payments technology to scale the adoption of low-cost solutions among micro, small and medium-sized businesses (MSMEs) in key markets. The agreement includes the acceleration and enablement of Tap on Phone, e-commerce gateway and payment links solutions. The collaboration’s focus on low-cost solutions will fast-track mass adoption of digital acceptance among smaller businesses while addressing use cases previously not served by existing solutions.

Read more:http://tinyurl.com/y8tp6uh9

Zimbabwe threatens to arrest Starlink users.

Zimbabwean authorities are threatening to arrest anyone selling or using Elon Musk’s Starlink satellite internet services. Starlink is banned in Zimbabwe because the country does not allow unlicensed telecoms providers. The regulator is insisting that Starlink must wait for permission and follow proper processes before starting operations, claiming the frequencies it uses could disrupt other services.

In South Africa, Icasa has also warned that importing and using Starlink equipment in the country is “illegal” and must stop. Starlink does not have a licence to operate in South Africa, Icasa emphasised last November.

Read morehttp://tinyurl.com/msf7577f

Kenyan Agri-Fintech Startup, Apollo Agriculture, Secures $10 Million Investment for Sustainable Growth in Africa.

💰 Significant Funding: Apollo Agriculture lture, a Kenyan agri-fintech startup, has secured a major $10 million investment from Swedfund and ImpactConnect. This injection of funds is poised to accelerate the company's rapid growth and amplify its impact across Africa. 🌍

🌱 Mission and Growth: With a mission to boost small-scale farmers' profitability and promote sustainable agriculture in Africa, Apollo Agriculture has demonstrated impressive growth since its inception. 📈

🚀 Expanding Reach: CEO Eli Pollak reveals that the new investment will enable Apollo to broaden its operations, potentially serving 400,000 additional farmers and fast-tracking the company's expansion. 🌾

💼 Previous Financial Milestones: Apollo Agriculture previously secured a $9.5 million loan from the U.S. International Development Finance Corporation (DFC) and raised significant funds through debt and Series B funding rounds. 🏦

👩🌾 Empowering Farmers: Launched in Kenya and expanding to Zambia, Apollo has empowered over 170,000 farmers, including a substantial number of female farmers. The platform offers vital financing and tools for profitable farming, notably enhancing crop yields. 🌿

🤖 Innovative Technology: Utilizing machine learning-powered credit models and automated technology, Apollo Agriculture efficiently serves small-scale farmers, providing them with essential farm products and financial services. This innovation has reached over 350,000 farmers in Kenya and Zambia. 🛠️🌾

Read more:http://tinyurl.com/2p8vbxak

Visa opens applications for its Africa Fintech Accelerator Program.

Visa launched the second cohort for its Africa FinTech Accelerator program.

The program aims to provide mentorship, training and networking opportunities to startups in Africa, the digital payments firm said in a Monday (Jan. 29) press release. It is accepting applications until Feb. 29.

Open to seed to Series A startups operating in Africa, the Visa Africa FinTech Accelerator program’s second cohort focuses on those working on unlocking money movement; embedded finance; empowering merchants and small- to medium-sized businesses (SMBs); payment infrastructure; the future of finance; and sustainable and inclusive finance, according to the release.

Apply here:http://tinyurl.com/5n7dv6uk

Nigeria’s Data Protection Regulator Probes into 17 Instances of Data Breaches

The Nigeria Data Protection Commission (NDPC) is actively investigating 17 significant data breach cases spanning various sectors, including finance, technology, education, government, logistics, and gaming, as revealed by Vincent Olatunji, the Commission's National Commissioner.

The reported cases, currently under scrutiny, emerged from diverse sectors, showcasing the widespread vulnerability to data breaches. Private and public institutions, including banks such as 𝐙𝐞𝐧𝐢𝐭𝐡, 𝐅𝐢𝐝𝐞𝐥𝐢𝐭𝐲, 𝐚𝐧𝐝 𝐆𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐓𝐫𝐮𝐬𝐭, 𝐚𝐬 𝐰𝐞𝐥𝐥 𝐚𝐬 𝐞𝐧𝐭𝐢𝐭𝐢𝐞𝐬 𝐥𝐢𝐤𝐞 𝐁𝐚𝐛𝐜𝐨𝐜𝐤 𝐔𝐧𝐢𝐯𝐞𝐫𝐬𝐢𝐭𝐲, 𝐋𝐞𝐚𝐝𝐰𝐚𝐲 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞, 𝐎𝐩𝐚𝐲, 𝐌𝐞𝐭𝐚, 𝐚𝐧𝐝 𝐃𝐇𝐋, have faced investigations for alleged data breaches.

Nigeria's efforts in the data protection ecosystem have gained international recognition, with the country now admitted to the Global Privacy Assembly, comprising about 130 nations. Additionally, Nigeria actively participates in the Network of African Data Protection Authorities (NADPA).

As Nigeria aligns with global standards in data protection, Kenya and other African countries should emulate such initiatives towards securing sensitive information and fostering a privacy-compliant environment.

Read more:http://tinyurl.com/2b9y9dm4

Nigerian Edtech Startup AltSchool Africa Launches in Kenya, Aiming to Boost African Tech Opportunities.

Nigerian edtech startup, AltSchool Africa has launched in Kenya, its second East African country. The startup, which has 60,000 students in over 100 countries, provides courses aimed at fast-tracking entry into global tech roles. The CEO of AltSchool Africa, Adewale Yusuf, points out that Kenya currently ranks behind Nigeria in terms of learner enrollments, hence the need to set up shop in the country.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

1. AltSchool Africa provides courses in software engineering, and it now has five schools: Engineering, Data, Business, Product, and the Creative Economy with courses ranging from sales to digital marketing, fintech product management, and data engineering.

2. The startup has broadened its scope since launching in 2021 by providing one-year diploma courses.

3. The startup provides virtual education for its learners, but it has leveraged partnerships to build a community for its learners in Nigeria, and it plans to do the same in Kenya.

4. AltSchool Africa raised $1 million in a pre-seed round in 2022 that had Nigerian entertainers, Folarin Balogun (Falz) and Akitoye Balogun (Ajebutter), as investors.

5. AltSchool Africa's mission is predicated on expected growth in jobs requiring technical skills, but over the past two years, startups and large technology companies have laid off thousands of employees and instituted hiring freezes.

The startup began by providing one-year diploma courses in software engineering but has since broadened its scope to include courses in sales, digital marketing, fintech product management, and data engineering.

Read more: http://tinyurl.com/4fhrbff2

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲

𝟏𝟖,𝟓𝟓𝟏 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply