- FINTAK Weekly Newsletter

- Posts

- President Ruto to Lead The 'Connected Africa Summit 2024'

President Ruto to Lead The 'Connected Africa Summit 2024'

A weekly digest of news, opinions and all things financial technology

President William Ruto is set to lead the Connected Africa Summit 2024 from April 21st to 25th at Uhuru Gardens, Nairobi, with over 10,000 delegates from around the globe, including special dignitaries like the outgoing African Union Chairperson Moussa Faki, African Development Bank Group Dr. Akinwumi Adesina, President of the World Bank Group, Ajay Banga, and American Ambassador to Kenya, Meg Whitman.

The summit, convened by Kenya's Ministry of ICT, aims to develop a strategic framework for Africa's digital economy in response to the rapidly evolving global tech landscape. Discussions will focus on leveraging the digital economy for economic growth and addressing key challenges such as the digital divide, cybersecurity, and data protection.

The event will also explore how technology can support the African Continental Free Trade Area and contribute to sustainable development, with the digital economy expected to significantly impact Africa's GDP by 2025.

Find out more Here

4 Kenyans named among Forbes Africa 30 Under 30 Class of 2024

Forbes Africa has recently released its 2024 "30 Under 30" list, celebrating the achievements of young visionaries across the continent. This year's selection includes four inspiring Kenyans who are making significant contributions in their respective fields, ranging from environmental sustainability and education to healthcare and social development. These leaders exemplify the vibrant entrepreneurial spirit that is vital for driving growth and innovation in Africa, the continent with the youngest population and one of the fastest-growing markets in the world.

Alex Mativo - At 29 years old, Mativo is the CEO and Co-founder of multiple ventures including E-LAB, which specializes in converting e-waste into consumer products. His initiatives not only provide employment but also help clean the environment by preventing the disposal of potentially harmful electronic waste.

Ayushi Chandaria - A 26-year-old founder of the Design Thinking Program at United States International University - Africa, Chandaria is dedicated to empowering students through a human-centered approach to problem-solving. Her program focuses on interdisciplinary education that helps students understand and apply design principles effectively.

Kenneth M. Njeru - The 25-year-old Director and Founder of Africa Afya Healthcare, Njeru originally focused on healthcare sector investments but has expanded to offering technological solutions to healthcare facilities. His efforts aim to elevate healthcare services across Africa through strategic partnerships.

Arooj Sheikh - At 28, Sheikh founded Beyond Kenyan Bars Foundation , an organization committed to assisting women, girls, and children affected by the criminal justice system. Her work focuses on restoring dignity and hope to facilitate successful reintegration into society.

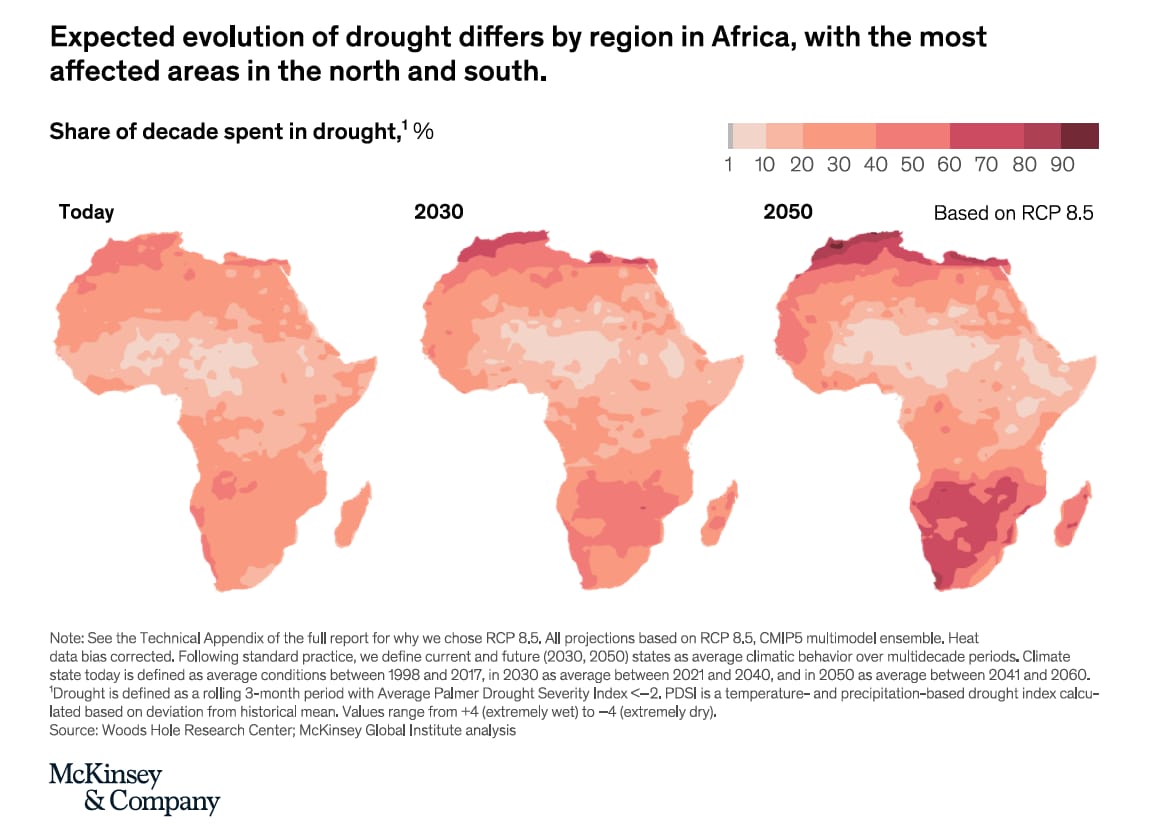

How African cities can learn from each other about building climate resilience

The impact of climate change in Africa is becoming more pronounced, particularly in urban areas where millions are affected by adverse weather conditions such as harmful dust from harmattan winds and extreme weather events like cyclones and droughts. In response to these challenges, several African cities have adopted innovative strategies to enhance their resilience against environmental shocks:

Green Infrastructure in Durban: After experiencing severe flooding, Durban, South Africa, turned to green infrastructure solutions. The city focused on restoring wetlands, which act as natural sponges during storms, and planting mangroves to reduce coastal erosion and enhance biodiversity.

Rainwater Harvesting in Nairobi: Nairobi, Kenya, faced its driest year on record in 2022, leading to significant water shortages. A grassroots movement emerged to promote rainwater harvesting, empowering residents, businesses, and schools to collect and store rain during wet seasons. This initiative is supported by awareness campaigns and microloans for installing rainwater tanks, particularly in low-income areas.

Green Solution to Storm Flooding: Additionally in Durban, South Africa, the city has implemented bioswales, which are shallow, landscaped channels filled with vegetation, to combat storm-related flooding. These bioswales capture and filter stormwater runoff, effectively reducing its volume and speed before it enters the drainage systems.

African cities are increasingly sharing best practices and learning from each other, fostering a collaborative approach to overcome the challenges posed by climate change. This collective effort aims to transform cities into adaptive, resilient communities capable of thriving in the face of climate-related shocks and stresses.

Risk Management Experts Gather in Nairobi to Tackle Financial and Climate Challenges

Over 70 risk professionals from various sectors met at Equity Bank Limited's Headquarters in Nairobi on April 12 to discuss complex risk management strategies. Hosted by the Global Association of Risk Professionals (GARP), the meeting featured insights from leaders in financial and climate risk management. Key speakers included Raheel Qureshi of Petrocam Kenya and Allan Anyona of Family Bank Ltd, who emphasized the importance of using advanced statistical techniques and leveraging data science for effective risk management.

The discussions covered diverse topics, such as the volatility of foreign exchange, the use of data science in risk monitoring, market risk limits, and the impact of interest rate fluctuations on economies. The event highlighted the need for a multidisciplinary approach to risk management, incorporating insights from fields like behavioral science and cybersecurity.

Edgar Mwandawiro, the Chief Risk Officer of SBM Bank Kenya , emphasized the importance of effective communication for risk managers. He urged them to simplify reports for their boards and focus on providing forward-looking insights rather than just current risk statuses. Mwandawiro highlighted the dual role of risk management as both a compliance necessity and a value-adding function. He also stressed the need for risk managers to evaluate and measure their organization's risk culture actively.

The summit also stressed the significance of sustainable development and climate resilience in economic planning. The GARP aims to hold these forums quarterly to enhance risk management practices in the region.

Mastercard and Onafriq partner on Africa’s payment ecosystem

Mastercard and Onafriq have partnered to expand digital financial services in Africa. The collaboration aims to provide secure, innovative, and cost-effective payment options for consumers and SMEs. The partnership is grounded in an omnichannel approach to accelerate the adoption of digital financial services throughout the continent. By combining Mastercard's global reach and Onafriq's regional expertise, this partnership will significantly influence Africa's financial landscape, providing SMEs and consumers with more reliable and innovative ways to engage in the economy.

The partnership is part of Mastercard's strategy to integrate 1 billion people into the digital economy by 2025, significantly expanding digital financial access in regions most in need. With Sub-Saharan Africa hosting 835 million registered mobile money accounts, making up 48 percent of global users as of 2024, this partnership promises to boost financial inclusion by expanding digital financial services, including mobile money transactions and cross-border payments.

Binance executive tracked to Kenya, extradition underway

Nadeem Arjarwalla, a Binance executive, is currently being pursued by the Nigerian government after he escaped custody and fled to Kenya. Arjarwalla was initially detained in Nigeria along with another executive, Tigran Gambaryan, on charges of money laundering related to allegations of manipulating the Nigerian naira. Following his escape from Nigeria on March 22, using a Kenyan passport, authorities are investigating how Arjarwalla managed to leave the country as his UK passport was still held by Nigerian officials.

The Nigerian government, working with Interpol and Kenyan police, is seeking to extradite Arjarwalla back to Nigeria. Meanwhile, Gambaryan has pleaded not guilty to the charges and remains in detention, with a court case adjourned until April 19. Amidst these events, Binance has withdrawn from the Nigerian market, ceasing all transactions involving the Nigerian naira and delisting naira trading pairs on its platform. This action follows criticism from the governor of the Central Bank of Nigeria, who cited concerns over illicit transactions and suspicious financial flows involving crypto exchanges, specifically targeting Binance.

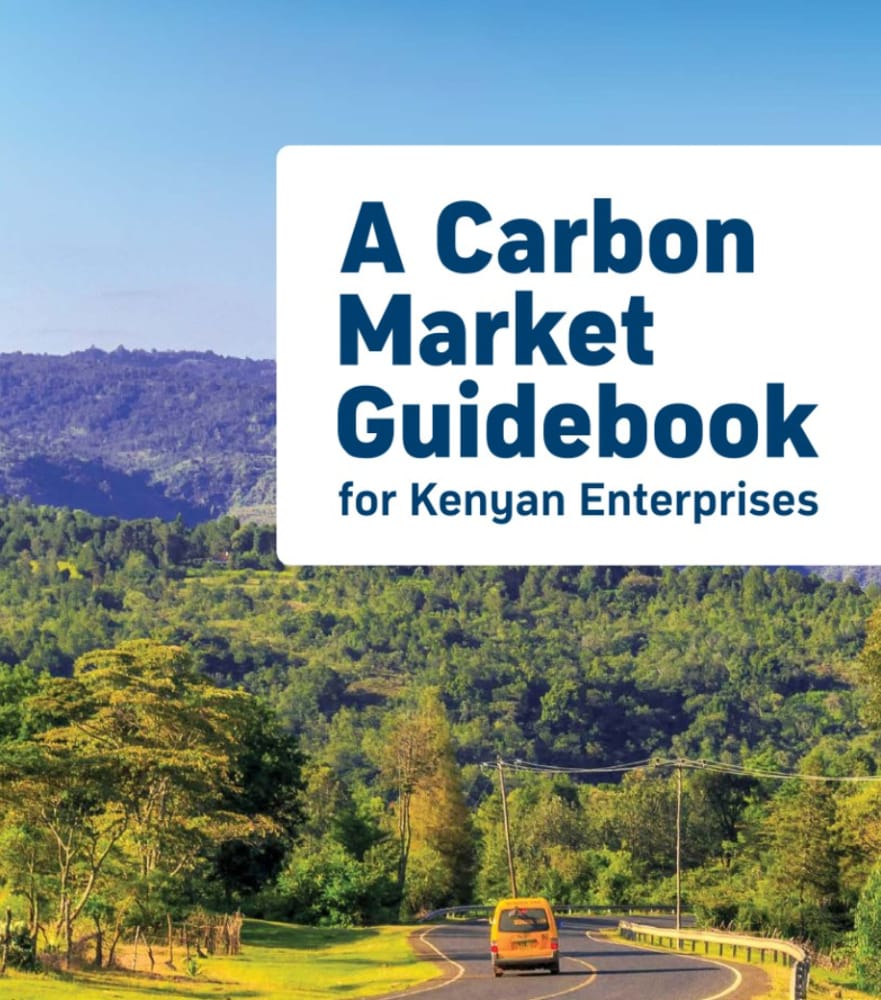

Kenya and The World Bank Unveil Carbon Market Guidebook For Enterprises

Kenya Private Sector Alliance (KEPSA), in collaboration with the World Bank, has launched the Carbon Market Guidebook for Kenyan Enterprises. This guidebook is a comprehensive step-by-step guide for Kenyan enterprises in various industries, including agriculture, waste environment, forestry, trade, banking, insurance, manufacturing, energy, transportation, construction, and hospitality. The guidebook will help these enterprises navigate the complex and fast-evolving landscape of carbon markets.

Stephen Odua, the director of business environment at Kenya's Ministry of Investments, Trade and Industry, emphasized the lack of participation in carbon markets by Kenyan enterprises due to limited understanding and the need for significant capacity building. A manual has been released, providing practical steps for private sector organizations interested in developing projects that can mitigate greenhouse gas emissions.

Alice Githinji, the deputy CEO of the Kenya Private Sector Alliance, stated that engaging in carbon markets could help local companies contribute to Kenya's climate change mitigation and adaptation goals. The manual includes detailed procedures and rules for companies to quantify and issue certified carbon credits.

Find the Guidebook Here

VKAV Secures $60 Million for First Fund, Backed by Major Institutional Investors

Verod-Kepple Africa Ventures (VKAV) has successfully closed its first fund at $60 million, attracting major institutional investors such as SBI Holdings, Toyota Tsusho Group, Sumitomo Mitsui Trust Bank, Japan International Corporation Agency, and JICT - Japan ICT Fund. Additional investors from Japan like Taiyo Holdings Co Ltd and C2C GLOBAL EDUCATION JAPAN, as well as SCM Capital from Nigeria, also participated in the fund's final close. VKAV, a joint venture between West Africa-based Verod Capital Management and Kepple Africa Ventures, aims to provide crucial capital for African companies at growth stages, particularly those transitioning to Series A and B funding rounds.

The fund will focus on three key areas: enhancing digital infrastructure, solving inefficiencies in business-consumer interactions, and creating markets that spur economic opportunities, reflecting the dynamic shifts in Africa’s economy and population. The VKAV team supports its portfolio companies in various aspects including fundraising, partnerships, governance, and legal matters, with a strong emphasis on operational excellence to prepare companies for further financing and successful exits. So far, VKAV has invested in companies such as Moove Africa, KOKO Networks, and mTek Services.

This strategic support is increasingly vital as these businesses navigate the complex macroeconomic environment in Africa and expand globally.

Are Kenyan Regulators Out of Touch?

“50% of Kenyans believe science has become politicized in Kenya. 63% say that the government and organizations funding research wield excessive influence over scientific endeavors,” stated the 2024 Edelman Trust Barometer report

According to the report, a great number of Kenyans are skeptical about government regulators' understanding of emerging technologies, with 56% believing that these regulators are not well-equipped to handle the regulation of technological innovations. This has led to a higher trust in non-governmental organizations (NGOs), with 76% of locals preferring NGOs to integrate innovation into society over the government.

Additionally, the report highlights that 72% of Kenyans would have more trust in technology-led changes if there were collaborations between businesses and the government. Concerns about the politicization of science were also notable, with half of the respondents feeling that scientific research in Kenya has become too influenced by politics, mainly due to the government and organizations funding research having excessive control over scientific endeavors.

Pula raises $20M to provide agricultural insurance to farmers in Africa, Asia and Latin America

PULA, an insurtech company based in Kenya, has provided insurance coverage to more than 15.4 million farmers in Asia, Africa, and Latin America since its establishment in 2015. Pula recently secured a $20 million Series B funding led by BlueOrchard Finance Ltd as part of its InsuResilience plan. With this funding, Pula intends to expand its coverage to livestock and establish new partnerships.

Pula aims to provide insurance solutions to a hundred million smallholder farmers by integrating insurance into the products of over 100 partners. Pula's co-founders, Thomas Njeru and Rose Goslinga, stated that their insurance products have helped farmers increase their farm investments, improve yields, and enhance household savings.

Red Sea attacks to shrink Africa’s trade volume, worsen its macroeconomic stability

Ongoing attacks by Iran-backed Houthi rebels on commercial vessels in the Red Sea are causing significant economic threats to Africa, especially North and East African nations. About 15% of global maritime traffic is affected, leading to critical disruptions. These attacks come amidst the Covid-19 pandemic and the ongoing conflict in Ukraine, which have already led to economic challenges in many African countries.

The Afrexim Bank report forecasts a stark reduction in trade volumes for the region by mid-year. Key African countries, including Egypt, Ethiopia, Djibouti, and Kenya, are particularly vulnerable to these attacks, and it may lead to compounding food, debt, and energy crises. The bank calls for intensified international efforts towards a peaceful resolution to the Israel-Palestine conflict to mitigate the economic repercussions for Africa.

US to renew AGOA trade pact with Africa

A group of U.S. senators from both parties recently introduced a bill to extend the African Growth and Opportunity Act (AGOA), which aims to provide duty-free access to the U.S. market for 40 Sub-Saharan African nations. The AGOA program, which was originally established in 2000 and is set to expire next year, is proposed to be extended until 2041. The Biden administration supports the renewal of AGOA, recognizing the strategic economic and geopolitical benefits of strengthening ties with African nations.

AGOA has been a crucial aspect of the economic relations between the U.S. and Africa, allowing over $10 billion of African exports to enter the U.S. market without duty fees in 2022 alone, according to the U.S. Trade Representative's office. The program not only supports African economies but also serves U.S. interests by lessening dependence on Chinese commodities, particularly in the face of increasing global competition for Africa's vital minerals. Although AGOA enjoys broad bipartisan support as a measure to counter China's growing influence in Africa, there is ongoing discussion in Washington about the need to update the program to better align with current economic and strategic realities.

Insurers, regulators in Africa reiterate need for prioritizing ESG

At the CEO summit organized by Continental Reinsurance in Victoria Falls, African insurance industry leaders emphasized the need to prioritize ESG compliance. The summit brought together executives to discuss the impacts of climate change, demographic shifts, and evolving market demands on the insurance sector.

The theme, "Unity in diversity: Harmonizing growth and responsibility in African insurance," reflects the sector's focus on integrating ESG factors into business strategies. The summit stressed the importance of adapting business practices to accommodate social diversity and environmental constraints. Discussions focused on innovative approaches to insurance, including addressing the needs of underserved populations like the disabled.

Microsoft's Security Patch...Needs a Patch?

The US Cyber Safety Review Board's investigation into the Chinese hacking incident last year has revealed a troubling series of missteps on the part of Microsoft. The tech giant's failure to safeguard a critical cryptographic key enabled hackers to exploit vulnerabilities in Outlook accounts, compromising the email security of senior US officials.

The breach, deemed preventable by the review board, has sparked calls for a comprehensive overhaul of Microsoft's security culture. In response, Microsoft has pledged to strengthen its security practices and implement robust measures to thwart future cyber threats. However, the incident serves as a reminder of the persistent threat posed by nation-state cyber actors and highlights the imperative for heightened cybersecurity vigilance.

OpenAI Expands Japan Presence, Appoints Former Amazon Executive to Lead Enterprise Growth

OpenAI appoints Tadao Nagasaki, a former president of Amazon Web Services (AWS) Japan arm to lead its efforts in attracting enterprise clients in Japan. With the opening of a new office in Tokyo, OpenAI aims to capitalize on the market potential in the fourth-largest economy by releasing a customized GPT-4 model tailored for Japanese language users. The company boasts 2 million weekly active users in Japan, with notable enterprise clients such as Daikin Industries Ltd., Rakuten Group Inc., and a Toyota Motor Corp. affiliate.

OpenAI is strategically positioning itself in Japan's market with the appointment of a former Amazon Web Services executive to drive its enterprise expansion efforts. The move underscores OpenAI's commitment to tapping into the burgeoning demand for AI solutions in one of the world's largest economies.

With a significant user base of 2 million weekly active users in Japan and a roster of prominent enterprise clients including Daikin Industries Ltd., Rakuten Group Inc., and a Toyota Motor Corp. affiliate, OpenAI is well-positioned to capitalize on the growing adoption of AI technologies in the country.

Google Photos to Offer New Feature to Free Up Storage Space

Google's Photos App is set to introduce a new feature called 'Recover Storage' to address storage space issues for Android users. This feature is set to be updated in version 6.78 of the Photos app, which will enable users to compress existing photos and videos stored in the app's cloud storage, helping them reclaim storage space. While the feature is not yet available, it was discovered by PiunikaWeb and tipster AssembleDebug in the app's code.

Users will be able to access the feature through the 'Manage storage' menu once it's launched in future updates.

Germany’s Conjuncta to Unlock Africa’s Green Hydrogen Potential at Invest in African Energy (IAE) 2024

Conjuncta GmbH is leading the way in renewable energy investment in Africa. Dr. Stefan Liebing, the CEO and Partner of Conjuncta, will be presenting at the Invest in African Energy (IAE) 2024 conference in Paris, discussing the emerging green hydrogen markets in Africa.

Conjuncta's $34-billion green hydrogen project in Mauritania, in collaboration with Infinity Power, is expected to position Africa as a major hydrogen exporter to Europe. The project's first phase is expected to launch by 2028 with an electrolysis capacity of 400 MW, producing 8 million tons of green hydrogen annually, using 10 GW of clean energy.

In addition to the Mauritania project, Conjuncta is also working on a green hydrogen production facility in Angola, in partnership with Sonangol, that aims to leverage hydropower for hydrogen production.

The IAE conference, organized by Energy Capital & Power, will take place on May 14-15, 2024, and aims to connect African energy sectors with global investment opportunities. Dr. Liebing's presentation will be a crucial platform to discuss investment strategies and partnerships that can accelerate Africa's transition to a green energy economy.

EAC set for fastest economic growth as Sub-Saharan Africa recovers in 2024

East African economies are expected to drive growth across Sub-Saharan Africa in the coming years, with the East African Community projected to experience robust growth rates of 5.3% in 2024 and 5.8% in the following two years. The industry and services sectors are expected to contribute almost three-quarters of the region's economic activity in 2024, driving the expected rebound. While the entire Sub-Saharan region is expected to recover, the growth in Western and Central Africa is expected to lag slightly. Meanwhile, Nigeria's economic outlook is improving with government-led reforms, projecting growth rates of 3.3% in 2024 and 3.6% in 2025-2026. South Africa and Angola are also on paths to recovery with targeted reforms being implemented.

Africa's on the hackers' crosshairs – report reveals threats

A recent report by Check Point Software Technologies Ltd revealed that eight African countries are among the top 20 most targeted by cyber criminals globally. These countries include Kenya, Ethiopia, Zimbabwe, Maldives, Uganda, Angola, Morocco, and Nigeria. The report highlights the increasing threat of cybercrime in Africa, with Check Point identifying the use of Virtual Hard Disk (VHD) files by cybercriminals to distribute the Remote Access Trojan (RAT) Remcos as a significant concern. The evolving tactics of cyberattacks underscore the importance of organizations adopting proactive cybersecurity measures to safeguard against such threats.

South Korea to host major AI safety summit

South Korea is set to host the second global AI Safety Summit on May 21-22, following the inaugural event held in Britain at Bletchley Park. The summit aims to build on the "Bletchley Declaration," an agreement between countries like the U.S. and China to cooperate on AI safety. The event comes at a time of increasing concern about the potential risks posed by rapid advancements in artificial intelligence technology.

Lee Jong-Ho of South Korea's ministry of science and information and communication technology emphasized the importance of establishing global norms and governance to harness technological innovations for the benefit of humanity.

The Summit will take place on May 21st - 22nd 2024.

Global Tech Africa Conference Launches Initiative to Support African Startups

CEO YD Company, Dr. Yetty Ogunnubi (left); President, Ascend Studios Foundation/Implementing Partner, GTA, Dr. Inya Lawal; Director General NITDA, Kashifu Inuwa Abdullahi and Co-Founder, ONE AFRICA, Dr. Olori Boye-Ajayi.

The Global Tech Africa (GTA) Conference has launched the 2024 Deal Room initiative to foster investment in African startups. This initiative, backed by the Nigeria Startup Act, aims to leverage the fourth industrial revolution for growth and development across the continent. Scheduled for July 24-26 at the Landmark Event Centre in Lagos, the conference is themed "Global Collaborations, Local Transformations" and will feature collaboration with One Africa. The Deal Room is designed to boost innovation, support emerging startups, and contribute to economic growth in Africa. Key speakers include Dr. Inya Lawal of Ascend Studios Foundation and Olori Boye-Ajayi of One Africa, who both highlight the conference's focus on facilitating impactful partnerships and advancing the tech ecosystem.

"This year's GTA Conference promises to be a dynamic platform where global collaborations will catalyse local transformations in Africa's tech scene. I anticipate impactful discussions, actionable initiatives, and significant strides towards advancing our tech ecosystem." said Dr. Inya.

The GTA Conference is an initiative of the Future Map Foundation and is supported by several prominent organizations, including NITDA, the US Consulate, and Business Sweden.

X's (Formerly Twitter) Surprise Blue Check Surge Sparks User Confusion

The Global Tech Africa (GTA) Conference has launched the 2024 Deal Room initiative to foster investment in African startups. This initiative, backed by the Nigeria Startup Act, aims to leverage the fourth industrial revolution for growth and development across the continent. Scheduled for July 24-26 at the Landmark Event Centre in Lagos, the conference is themed "Global Collaborations, Local Transformations" and will feature collaboration with One Africa. The Deal Room is designed to boost innovation, support emerging startups, and contribute to economic growth in Africa. Key speakers include Dr. Inya Lawal of Ascend Studios Foundation and Olori Boye-Ajayi of One Africa, who both highlight the conference's focus on facilitating impactful partnerships and advancing the tech ecosystem.

"This year's GTA Conference promises to be a dynamic platform where global collaborations will catalyse local transformations in Africa's tech scene. I anticipate impactful discussions, actionable initiatives, and significant strides towards advancing our tech ecosystem." said Dr. Inya.

The GTA Conference is an initiative of the Future Map Foundation and is supported by several prominent organizations, including NITDA, the US Consulate, and Business Sweden.

African Startups Solving Global Challenges Invited to Apply for GSA Africa

The Global Startup Awards Africa is inviting applications from African startups committed to tackling significant global issues. Target sectors include e-health, agri-tech, fintech, mobility and logistics, green-tech, and women in tech. Participants will compete through four main stages, advancing from national to regional levels, and culminating at the GSA Africa Summit in Addis Ababa, Ethiopia.

This summit will bring together ambassadors, investors, business leaders, and government officials, providing a networking platform to celebrate and promote innovative African entrepreneurs. Winners gain exclusive access to the Global Startup Awards Alumni Network and the GIIG Africa fund, offering further networking, mentoring, and international collaboration opportunities.

SAG-AFTRA Strikes AI Rights Deal for Artists

SAG-AFTRA has brokered a tentative agreement with major record labels to protect artists from the unauthorized use of AI to replicate Hollywood artists. The deal mandates clear consent, minimum compensation, and increased benefits for member artists. This initiative aims to ensure that technology enhances creativity while preserving the authenticity of human expression in music.

This deal ensures minimum compensation and increased benefits for artists, aiming to uphold the authenticity of human expression in music creation. With members set to vote on ratifying these protections later this month, this agreement signifies a pivotal step in regulating technology's role in the entertainment industry.

African Payment Systems Trend Forecast 2024

Africa is set to experience significant economic growth in 2024 with the help of its burgeoning fintech sector. Mobile payment systems are central to this development, as they have become a mainstay in financial transactions across the continent. Companies like Dalapay are at the forefront of this mobile payment revolution, tailoring mobile money services that enhance accessibility and convenience for millions.

Digital banking infrastructure investments are rising, expanding services beyond traditional banking and improving transaction speed, efficiency, and financial record-keeping. Digital wallets, Dalapay's E-Wallet service, and the integration of QR codes and super apps are setting new standards in convenience, making comprehensive financial services available on single platforms.

Dalapay also pioneers in providing advanced solutions for high-volume transactions and cross-border payments, which are vital for the region's economy. With operations across over 20 African countries, Dalapay's robust platform continues to evolve, ensuring that as Africa's digital economy grows, it remains at the cutting edge of payment processing technology.

Africa's E-commerce Landscape: Growth, Challenges and Opportunities

Africa's ecommerce sector is projected to experience significant growth, with the number of online users expected to exceed half a billion by 2025, achieving a 40% penetration rate. This reflects a steady 17% compound annual growth rate from previous years. By 2040, ecommerce in Africa is anticipated to be predominantly mobile-based, aligning with the current trend where Africa leads in mobile internet usage, comprising 69% of its total web traffic as of 2021.

Despite these advances, the ecommerce market in Africa faces challenges. Many African consumers lack access to formal banking, with nearly half of adults without a bank account and low credit card penetration rates at around 2%. Consequently, cash remains the dominant payment method, although mobile payments are on the rise. Countries like Kenya and South Africa have higher bank account penetration rates, but overall, financial inclusion remains low.

Local online marketplaces are prevalent, with numerous platforms operating within and across national borders. This local preference poses challenges for multinational ecommerce businesses.

Revenue from online sales of grocery, personal care, fashion, and electronics products continues to grow, with fashion and electronics expected to generate significant sales by 2025, amounting to $13.4 billion and $11.2 billion respectively. This growth underscores the rising importance and potential of ecommerce in Africa, driven by mobile accessibility and evolving consumer habits.

ALX Ventures ignites tech entrepreneurship in South African youth

ALX Ventures, a division of African Leadership International, launched in South Africa this month to empower tech entrepreneurs with digital and entrepreneurial skills. The program combines technology training with interpersonal skills development, offering participants a comprehensive educational pathway from idea to investment. With over 97,000 graduates and an ambitious goal to enroll 100,000 learners in early 2024, ALX Ventures aims to significantly impact Africa's tech landscape.

Tech, Finance, and Beyond: 2024 Layoffs Hit Multiple Industries

The year 2024 begins with a wave of layoffs across various sectors in the United States and Canada, indicating a continuation of the trend seen in 2023. Companies are striving to control costs amid uncertainty surrounding potential rate cuts by the Federal Reserve. From technology firms to financial services, consumer and retail, health, manufacturing, natural resources, and automakers, layoffs are impacting a wide range of industries. Major players like Amazon , Alphabet, Microsoft, eBay , IBM, PayPal , Block Inc, Citi, Morgan Stanley , Nasdaq , The Estée Lauder Companies Inc. , Wayfair, Macy's, Levi Strauss & Co, Nike , Novavax, Lockheed Martin, United Parcel Service, Piedmont Lithium, TC Energy, Enbridge, and Tesla are among those implementing significant job cuts.The scale and scope of these job cuts, affecting thousands of employees, highlight the complex dynamics shaping the labor market in 2024.

Nigeria to Boost Electricity in Underserved Areas with $750 Million World Bank Loan

Nigeria is taking steps to enhance electricity access in underserved areas with the backing of a $750 million loan from The World Bank. The loan, allocated under the Distributed Access through Renewable Energy Scale-up (DARES) project, will support the subsidy of solar mini-grid developers and operators. The initiative aims to bolster electricity supply for households and businesses by incentivizing private sector-led renewable energy projects.

Additionally, performance-based grants will be provided to eligible mini-grid operators to encourage the expansion of their customer base. Spearheaded by the Rural Electrification Agency (REA) and the Lagos State Electricity Board (LSEB), the DARES project reflects Nigeria's growing commitment to renewable energy, with the country attracting over $2 billion in investments for the sector over the past decade. This initiative aligns with recent changes in Nigeria's electricity sector, which include a substantial increase in electricity tariffs for urban residents.

Meta Brings AI to WhatsApp: Limited Tests in India Reveal Potential for Disruptive Change

WhatsApp is testing 'Meta AI', a chatbot experience powered by Meta’s Llama large language model in India. Meta AI provides personalized recommendations, creative collaborations, and informative responses directly within the WhatsApp platform. Leveraging Meta’s investment in large language models and integration with Bing Search, Meta AI harnesses advanced technology to deliver comprehensive responses and recommendations. WhatsApp's extensive user base, especially in India, serves as the ideal testing ground to refine and democratize this innovative feature.

Meta AI is integrated seamlessly into WhatsApp and represents a significant leap forward in conversational AI technology. Users can leverage its capabilities to plan trips, seek educational assistance, or indulge in creative exchanges, tapping into a wealth of possibilities limited only by imagination and the AI model's capabilities. Furthermore, Meta AI faces inherent challenges common to AI chatbots, including accuracy and reliability concerns. WhatsApp actively collects user feedback to fine-tune the AI's performance, underscoring the importance of ongoing refinement.

WhatsApp's foray into AI-powered assistants heralds a transformative shift in messaging dynamics, offering a glimpse into a future where AI seamlessly enhances everyday interactions. As Meta AI evolves, it could redefine the role of messaging apps and reshape communication norms. While currently in the testing phase in India, the eventual global rollout of Meta AI raises ethical questions regarding AI bias, misinformation, and its impact on human interaction. Meta and industry stakeholders must navigate these challenges to ensure responsible AI integration.

Huawei Cloud Joins Cardano Ecosystem To Scale Web3 Solution in Asia, Africa

The recently announced partnership between the Cardano network and Huawei's Cloud is a strategic move aimed at boosting Cardano's blockchain capabilities and promoting the adoption of Cardano-based Web3 solutions across Asia and Africa. As part of this collaboration, EMURGO, Cardano's blockchain partner, will establish a Cardano Validator Node on Huawei Cloud, integrating Huawei's advanced cloud computing resources into Cardano's blockchain ecosystem.

This integration is expected to significantly enhance the performance and scalability of Cardano's services and provide Cardano developers with access to Huawei Cloud's extensive computational capabilities. Additionally, this alliance will expand Cardano's visibility and usability by providing it with a presence in Huawei's Marketplace, which is frequented by numerous leading global enterprises. Both parties are enthusiastic about this partnership and believe that it will have a transformative impact on the blockchain and Web3 sectors by enhancing the interoperability of Cardano's offerings and increasing its appeal to developers and businesses.

AfriLabs and Saudi Ministry of Investment Forge Partnership to Boost Tech Innovation Across Africa and Saudi Arabia

AfriLabs, a network of technology and innovation hubs, has signed a Memorandum of Understanding with the Ministry of Investment of Saudi Arabia. The partnership aims to drive innovation-led growth, facilitate market access, and create new opportunities for startups and investors in both Africa and Saudi Arabia. The MoU establishes a cooperative framework to enhance direct investment and support for technology startups and connect key stakeholders across the two regions.

“We are delighted to formalize our partnership with the Ministry of Investment of Saudi Arabia, to drive innovation-led growth, foster meaningful collaboration and open up new markets between Africa and Saudi Arabia. This MOU opens up new avenues for cooperation, investment, and knowledge exchange, unlocking immense potential for both regions.”

The partnership between AfriLabs and the Ministry of Investment of Saudi Arabia promises to unlock immense potential for both regions, providing necessary licensing, regulatory support, and investor services. The collaboration will not only create new opportunities for startups and investors but also ensure inclusive growth and prosperity through international cooperation.

Smart Cities: The Future of Urban Development in Africa

Smart cities are emerging as vital solutions for the complex challenges posed by rapid urbanization and inadequate infrastructure in African cities. These cities harness technology, data, and innovation to enhance efficiency, sustainability, and the quality of life for their residents. At the heart of smart city initiatives in Africa is the development of robust infrastructure that improves connectivity and mobility. Investments are being made in advanced transportation systems and digital infrastructure to ensure seamless public service delivery and enhance citizen engagement.

Sustainable urban planning is another cornerstone of smart cities, emphasizing environmentally friendly practices and resource efficiency. Initiatives include the adoption of green building standards, energy-efficient facilities, and sustainable water management to mitigate climate change effects. Urban areas also incorporate green spaces to improve air quality and biodiversity, which helps in cooling urban areas and providing recreational spaces.

Governance in smart cities utilizes technology to streamline processes and foster citizen involvement in decision-making. Digital platforms facilitate the delivery of public services and offer avenues for feedback, making governance more transparent and accountable. Moreover, these cities are breeding grounds for innovation, with hubs and incubators that support startups and technology companies, driving economic growth and job creation in the digital sector.

Resilience and disaster management are prioritized to shield cities from the adverse effects of natural calamities through infrastructure like flood barriers and advanced warning systems. These measures enhance the preparedness and response to emergencies, protecting vulnerable communities. Additionally, smart cities focus on inclusive and equitable development to ensure all residents have access to housing, opportunities, and essential services, thus addressing social inequalities and enhancing the overall quality of urban life.

World Bank Warns: Widening Income Gap Threatens Development Progress

Smart cities are emerging as vital solutions for the complex challenges posed by rapid urbanization and inadequate infrastructure in African cities. These cities harness technology, data, and innovation to enhance efficiency, sustainability, and the quality of life for their residents. At the heart of smart city initiatives in Africa is the development of robust infrastructure that improves connectivity and mobility. Investments are being made in advanced transportation systems and digital infrastructure to ensure seamless public service delivery and enhance citizen engagement.

Sustainable urban planning is another cornerstone of smart cities, emphasizing environmentally friendly practices and resource efficiency. Initiatives include the adoption of green building standards, energy-efficient facilities, and sustainable water management to mitigate climate change effects. Urban areas also incorporate green spaces to improve air quality and biodiversity, which helps in cooling urban areas and providing recreational spaces.

Governance in smart cities utilizes technology to streamline processes and foster citizen involvement in decision-making. Digital platforms facilitate the delivery of public services and offer avenues for feedback, making governance more transparent and accountable. Moreover, these cities are breeding grounds for innovation, with hubs and incubators that support startups and technology companies, driving economic growth and job creation in the digital sector.

Resilience and disaster management are prioritized to shield cities from the adverse effects of natural calamities through infrastructure like flood barriers and advanced warning systems. These measures enhance the preparedness and response to emergencies, protecting vulnerable communities. Additionally, smart cities focus on inclusive and equitable development to ensure all residents have access to housing, opportunities, and essential services, thus addressing social inequalities and enhancing the overall quality of urban life.

World Bank Warns: Widening Income Gap Threatens Development Progress

Tesla, facing declining sales and increasing competition in the electric vehicle market, has announced plans to lay off more than 10% of its global workforce, as revealed in an internal memo seen by Reuters. The decision comes as Tesla grapples with falling demand and pricing pressures, particularly in key markets like China. CEO Elon Musk emphasized the company's focus on cost reductions and productivity enhancements amid preparations for future growth. The decision reflects Tesla's ongoing efforts to streamline operations and improve profitability amidst challenging market conditions.

Gen Z Wants Banking Apps, Not Banking Appointments

Gen Zs are expected to constitute a third of the workforce and see a substantial increase in disposable income and spending power, partly due to a projected $90 trillion wealth transfer from older generations.

The PYMNTS Intelligence study presented at the PSCU Member Forum in San Antonio highlighted that Gen Z values highly mobile-centric banking services. This generation frequently switches banking providers to access services better suited to their mobile-first lifestyle, such as peer-to-peer (P2P) payments, immediate financial product availability, and integrated mobile financial services without the need for navigating multiple apps.

Despite the high priority placed on attracting Gen Z by credit unions, many lack offerings in key areas desired by this demographic, such as crypto investments and modern debit card solutions. Only a minority of credit unions plan to introduce products like BNPL (Buy Now, Pay Later), which are seen as essential tools by Gen Z consumers.

The research emphasizes the necessity for credit unions and banks to adapt by offering personalized, seamless mobile experiences to not only attract Gen Z customers but also to meet the evolving needs of all digitally-engaged consumers. Failure to adapt could result in losing this critical demographic to more digitally agile competitors, such as FinTechs and neobanks.

Twelve Innovative South African Startups Chosen for Injini-Mastercard Foundation EdTech Fellowship

Twelve startups have been picked for the Injini Mastercard Foundation EdTech Fellowship, a program designed to support South African educational technology innovators. The fellowship offers financial assistance, grants, mentorship, and market access. The selected startups will receive tailored support focused on educational innovation, impact measurement, fundraising, and commercial strategy. They will also engage with experts and receive course access from Carnegie Mellon University's Human-Computer Interaction Institute. Each startup will receive equity-free funding of over ZAR1 million.

Digital Loans: A Lifeline for Kenyan Farmers, But at What Cost?

Digital loans are emerging as a crucial source of financial support for Kenyan farmers, supplementing traditional avenues such as banks, SACCOs, and government initiatives like the Hustler Fund. These loans are instrumental in securing vital agricultural inputs like seeds, fertilizer, pesticides, as well as covering labor expenses. While access to credit remains pivotal for farmers, concerns over high interest rates, asset loss, and climate-related risks persist, impacting loan uptake.

These loans, facilitated through platforms like M-PESA Africa , KCB Bank Group, and M-Pesa's Fuliza, are instrumental in securing essential inputs such as seeds, fertilizer, and pesticides, as well as covering labor expenses.

For farmers utilizing irrigation, challenges persist in accessing loans due to inadequate collateral, especially for those leasing land. These factors highlight the complex dynamics influencing farmers' decisions regarding credit acquisition in Kenya's agriculture sector.

WhatsApp lowers minimum age in Europe to 13

Meta, the parent company of WhatsApp, has revised the minimum age requirement for WhatsApp users in Europe from 16 to 13, aligning it with the age restriction in the United Kingdom announced earlier in February.

The decision has drawn criticism from children's rights advocates, who argue that it exposes young users to various online risks. Despite objections, Meta defends the change, emphasizing the platform's safety measures and control options for users. This move is part of Meta's broader strategy to lower age restrictions across its platforms, although it has faced scrutiny for its approach to teen safety in the past.

Africa at an AI Crossroads: Challenges and Opportunities Abound

Africa is navigating its position in the global artificial intelligence (AI) landscape, spurred by recent events like tech billionaire Paul Graham's controversial remarks. Concerns over cultural representation and economic equity are driving African nations to shape their AI policies. While challenges such as loss of cultural perspective and job displacement loom large, African governments are formulating national AI strategies to foster local talent and innovation, albeit hindered by funding constraints.

However, despite these initiatives, funding remains a significant obstacle hindering Africa's AI sector from realizing its full potential. While global investment in AI surges, Africa needs help attracting a proportional share, impeding its ability to innovate and compete globally.

This Week in a Flash🚀

Market Outlook 📈

Kenyan Shilling Tops Sub-Saharan Africa Currency Rankings

The Kenyan Shilling is highlighted as the best-performing currency in Sub-Saharan Africa, appreciating by 16% this year according to the World Bank's latest Africa Pulse Report. Proactive monetary policies from the Central Bank of Kenya and success in the Eurobond market are key contributors.

Startup Scene 🚀

Pan-African VC Verod Kepple closes its first fund at $60M

Verod-Kepple Africa Ventures has closed a $60M fund, set to bolster up to 21 startups across Africa, focusing on digital infrastructure and market efficiencies.

Partnerships and Collaborations 🤝

Daktari Smart Telemedicine Program Expansion

Gertrude’s Children’s Hospital collaborates with the M-PESA Africa Foundation to provide pediatric care in Kenya's underserved regions through telemedicine.

Botswana and Estonia Partner to Develop AI Strategy

The Government of Botswana collaborates with Estonia to develop an Artificial Intelligence (AI) strategy, focusing on applications in smart agriculture and e-governance.

Mastercard & Equity Bank Enhance Money Transfers

Mastercard partners with Equity Bank to enable secure, efficient money transfers to 30 countries from Kenya, facilitating greater financial inclusion and improving cross-border payment services. This initiative capitalizes on the significant foreign currency inflows into Africa, aiming to streamline transactions and reduce costs for users.

Mono and Mastercard Team Up for Open Banking in Africa

Nigerian fintech Mono has partnered with Mastercard to launch account-to-account (A2A) payments and other open banking products via Mastercard Gateway. This marks the first A2A implementation in the EEMEA region, enhancing digital commerce across Africa. The collaboration supports financial inclusion and innovation, providing a secure, streamlined payment experience for businesses and consumers.

Financial Inclusion 💳

Kenya's Hustler Fund to Become Shariah Compliant

President William Ruto announced plans to make the Hustler Fund compliant with Islamic finance principles to enhance financial inclusion.

Diaspora Impact in Kenya💸

Diaspora Remittances Grow to Sh53.2bn in March

Remittances from Kenyans abroad have risen, with significant contributions coming from the United States.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 - 25, 513💙S𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply