- FINTAK Weekly Newsletter

- Posts

- Fintech Association of Kenya Joins Alliance of Digital Finance and Fintech Associations

Fintech Association of Kenya Joins Alliance of Digital Finance and Fintech Associations

A weekly digest of news, opinions and all things financial technology

Fintech Association Of Kenya is now a member of the Alliance of Digital Finance and Fintech Associations . Speaking on the approval of the Association to join the Alliance, FINTAK Chairperson, Duncun Motanya said "This connects us to a powerful network of like-minded organizations worldwide. By joining the Alliance, we are now part of a global network, connecting with peer associations around the world to share knowledge and best practices and foster collaborations that transcend borders."

He added, "Our membership in the Alliance is a clear signal of our commitment to not just our local community but to the global ecosystem of digital finance professionals. It offers us a unique platform for exposure, collaboration, and the chance to play a pivotal role in shaping the future of finance. We are set to embark on a journey that will bring unparalleled opportunities for our members to engage in international partnerships, learn from global trends, and contribute to the vital mission of enhancing access to financial services through digital means."

Andrew Barden, a board member at FINTAK expressed gratitude to the Board and CEO of AllianceDFA, Sarah Corley , as well as Membership/Operations Manager Camilla Ferguson, for their outstanding leadership and strong commitment and efforts to promote inclusivity within digital finance, focusing on increasing diversity, accessibility, and sustainability. These initiatives, he noted, contribute to achieving greater financial resilience and fostering inclusive economic growth, which are critical pillars of the 2030 Sustainable Development Goals.

Zimbabwe's Online Payment Platforms Set to Resume Operations Amid Currency Transition

The Reserve Bank of Zimbabwe has disclosed plans for the revival of online payment platforms effective April 12, 2024, coinciding with the nation's transition to the Zimbabwe Gold (ZiG) as its primary currency. The decision follows a recent monetary policy statement introducing ZiG, which prompted a rush among banking institutions to convert Zimbabwe Dollar (ZW$) balances. This currency switch disrupted banking operations nationwide and posed challenges for online payment providers, necessitating adjustments to accommodate ZiG transactions. Despite assurances from Governor John Mushayavanhu regarding a 21-day transitional period for currency exchange, concerns linger about the accessibility of digital transactions until online platforms resume operations.

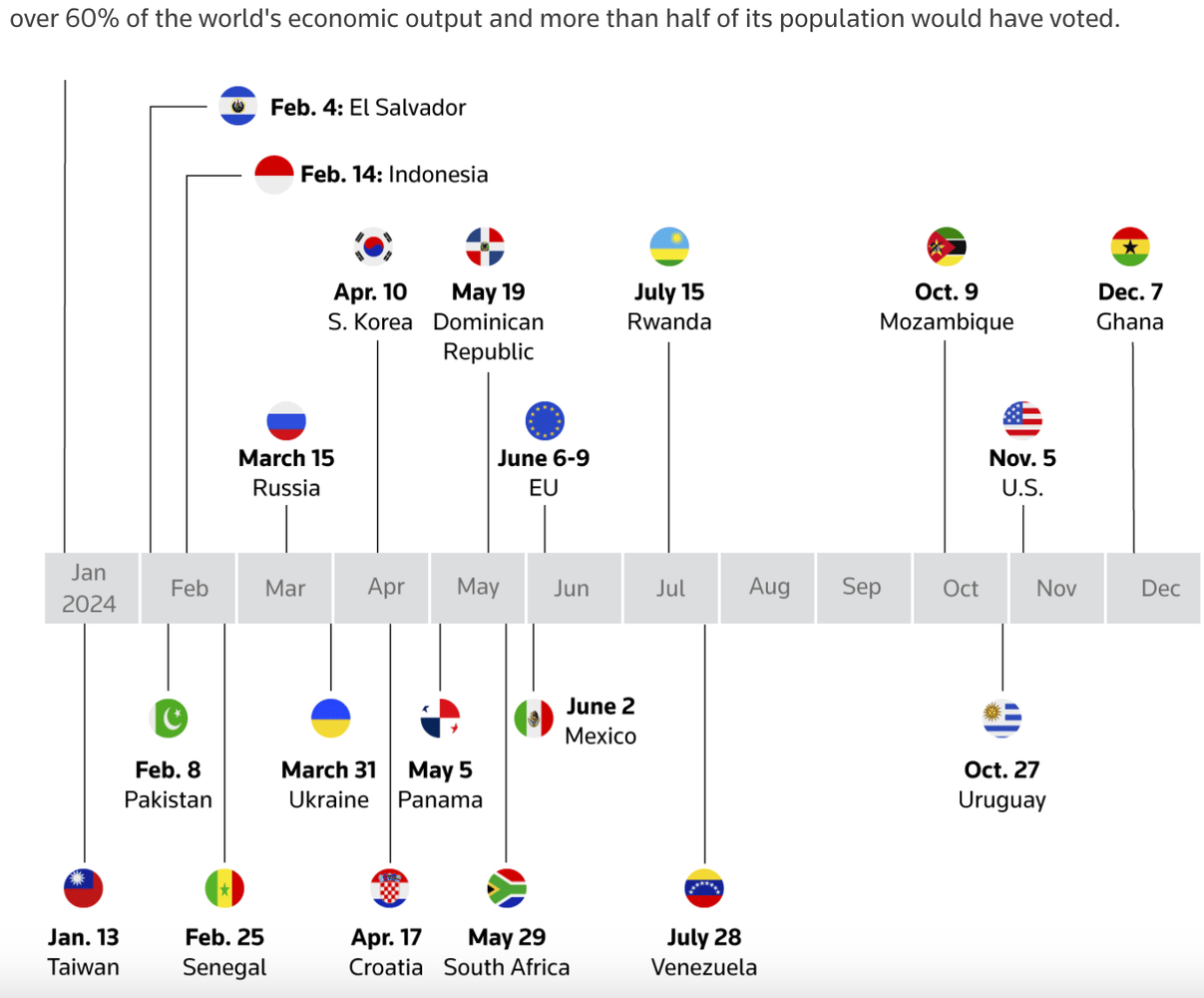

Global Markets Brace for Impact As 2024 Election Season Unfolds

In 2024, elections across the globe are set to bring significant changes to the global market landscape. As countries head to the polls, new leaders will reshape their economies based on their economic models. While past election outcomes have sometimes been overlooked, the upcoming United States presidential race in November is garnering unparalleled attention.

With India's Narendra Modi possibly securing his third term as prime minister, eyes are on the world's most populous nation. Taiwan, Portugal, Russia, and Turkey have already undergone their electoral processes, setting the stage for a year-end climax. These elections collectively represent over 60% of global economic output and more than half of the world's population.

Elections play a major role in shaping economic policies, as leaders implement strategies aligned with their visions. The outcome of the US presidential race, in particular, holds immense significance for global economies, as it will influence international trade and investments in emerging markets..

Data Center Expansion Could Drive Copper Demand Surge, Predicts Trafigura

Commodity trader TRAFIGURA TRADING LLC warns that the growing demand for copper, fueled by the expansion of artificial intelligence and data centers, could soar by up to one million metric tons by 2030. According to statements made at the Financial Times Global Commodities Summit in Lausanne, this surge may exacerbate supply deficits in the latter part of the decade.

Trafigura's chief economist, Saad Rahim , highlighted the unexpected surge in copper consumption linked to the proliferation of data centers and advancements in artificial intelligence (AI). Rahim cautioned that this additional demand, estimated at one million metric tons, could compound the existing four to five million ton deficit projected for 2030.

The global push for an energy transition, characterized by the adoption of electric vehicles and renewable energy technologies, is expected to drive copper consumption further. Rahim emphasized that these factors have not been adequately factored into current supply and demand forecasts, raising concerns about future market dynamics.

While global copper demand is anticipated to reach around 26 million tons this year, projections suggest a rising market deficit, with shortages expected to exceed 100,000 tons by 2025. China, a key player in both copper production and consumption, holds significant influence over global supplies of critical raw materials essential for the energy transition.

Geopolitical tensions surrounding the dominance of China in critical raw material production pose challenges for Western countries striving to achieve net zero emissions targets. Rare earths and graphite, crucial components for electric vehicle batteries, are among the materials where China is dominant, raising concerns about supply chain vulnerabilities.

Amidst these challenges, industry experts state the urgent need for strategic planning and diversification of supply chains to mitigate risks and ensure a smooth transition towards a greener future.

Panache Ventures, Kora move to secure investors funding

Panache Ventures , an early-stage venture capital fund, and Kora , a pan-African payment gateway, have formed a strategic partnership to address the funding challenges that African tech entrepreneurs face. This collaboration was announced during the Venture Capital 101 event in Lagos. The event featured industry leaders such as Prashant Matta of Panache Ventures and Dickson Nsofor of Kora, who highlighted the challenges and opportunities within Africa's tech ecosystem.

The partnership aims to equip tech founders across the continent with the necessary resources to secure venture capital funding and scale their innovative ventures. Panache Ventures and Kora are committed to fostering innovation and economic growth across Africa. Their focus is on mentorship, funding guidance, and strategic partnerships to catalyze the success of startups that will redefine Africa's technology landscape.

Panache Ventures Team

Cross-Border Payments Remain Costly across East Africa-IMF

International Monetary Fund reports that cross-border transactions between Tanzania and its East African neighbors incur transactional costs of over 30%. Bank intermediaries in East Africa impose substantial fees for currency conversion and wire services, contributing to the exorbitant transactional costs. Wholesale, Retail, and Remittances are identified as key factors driving up costs in cross-border transactions.

To bypass high bank fees, businesses are exploring low-cost payment options and cryptocurrencies. However, regulatory uncertainties surrounding digital currencies and Fintech solutions linger, highlighting the urgent need for innovative solutions to facilitate seamless cross-border trade in the region..

Report : Kenya Leads East Africa with US$ 600 Million Worth of Deal Activity in 2023

Kenya emerged as the leader in deal activity throughout East Africa in 2023, with a total of 96 deals valued at US$ 600.3 million, according to the 2023 DealMakers AFRICA Annual report. Tanzania followed with 12 deals worth US$ 285 million, and Uganda with 14 deals worth US$ 245 million. These figures highlight Kenya's pivotal role in driving regional economic growth through robust business transactions.

The report showed that East Africa recorded 144 transactions, surpassing West Africa (136 deals) and North Africa (107 deals) in terms of deal activity. Kenya and Nigeria led their respective regions, with Kenya securing the highest number of deals at 96. However, in terms of deal value, Southern Africa, particularly Zimbabwe, stood out with deals totaling US$5.8 billion, primarily driven by significant mining transactions.

Private equity transactions continued to surge, constituting 50% of the overall deal flow, reflecting a growing trend over the past few years. This underscores the increasing attractiveness of the region to investors seeking strategic opportunities.

Notable deals included the establishment of East Africa Device Assembly Kenya (EADAK), a joint venture aimed at setting up Kenya's first electronics device assembly plant, and mergers and acquisitions in sectors such as healthcare, cement, and renewable energy, which showcased the region's evolving business landscape.

Industry experts highlighted the significant role of international players in capitalizing on African opportunities, driven by faster growth prospects and favorable acquisition conditions compared to their home markets. The implementation of initiatives like the African Continental Free Trade Area (AfCFTA) is expected to further spur mergers and acquisitions, positioning Africa as a lucrative investment destination.

Read Report: https://tinyurl.com/3arnxfz7

Microsoft Report: AI Revolution to Inject $1.2 Trillion into Africa’s Economy by 2030

A recent report by Microsoft unveils the monumental impact Artificial Intelligence (AI) is set to make on Africa's economic landscape. Projections indicate that by 2030, AI could infuse a staggering $1.2 trillion into the continent's GDP, marking a significant 5.6% surge.

The transformative potential of AI extends across various sectors, promising enhanced efficiency, productivity, and innovation:

Agriculture: AI-powered tools will empower farmers with precise soil and weather insights, optimizing crop yields for greater food security and sustainability.

Healthcare: AI's capabilities in medical imaging analysis are revolutionizing disease detection, leading to earlier interventions and improved patient outcomes.

Finance: AI algorithms are poised to democratize financial services by evaluating creditworthiness and expanding access to banking for underserved populations.

Urban Development: Cities like eThekwini Municipality in South Africa are harnessing AI to become smarter, data-driven hubs, enhancing infrastructure management and citizen services.

Microsoft advocates for collaborative efforts among governments, businesses, and communities to maximize AI's potential for Africa's advancement. Together, they can shape effective regulations, foster a skilled workforce, and ensure the ethical deployment of AI technologies, paving the way for an inclusive and prosperous future.

The AI revolution is not a distant vision but a present reality in Africa. With responsible practices and strategic partnerships, the continent stands ready to unlock unparalleled economic and social opportunities, ushering in a new era of prosperity and progress.

Read Report: https://shorturl.at/fsTVY

South African Regulators Launch Antitrust Probe into Microsoft's Azure Cloud Services

South Africa's Competition Commission (CompCom) is preparing to file a formal complaint against Microsoft , alleging anti-competitive behavior in its Azure cloud computing services. The probe focuses on accusations of exorbitant fees imposed by Microsoft when businesses attempt to transition their cloud licenses to rival platforms.

This development mirrors similar antitrust investigations in Europe, where regulators scrutinize Microsoft's licensing practices for potential violations of fair competition. The pending complaint mirrors growing international concerns over the dominance of major tech companies in the global cloud market.

YouScribe Expands to Ghana, Revolutionizing Education Access and English-Language Resources

YouScribe , a leading digital library platform, has announced its entry into Ghana through a partnership with Digital Virgo and MTN Ghana , marking a milestone in educational accessibility and the availability of English-language resources in the country.

The launch of YouScribe in Ghana represents a strategic collaboration to leverage the nation's thriving digital subscription market and high smartphone penetration to democratize access to educational materials. With a vast repository of over a million audiobooks, ebooks, newspapers, and educational documents, YouScribe seeks to empower students, educators, and lifelong learners across Ghana.

Notably, the partnership with prominent Ghanaian publishers such as Adaex Edu and Subsaharan Publishers ensures that the platform offers culturally relevant and high-quality learning resources to its users.

Juan Pirlot de Corbion , Founder and CEO of YouScribe , emphasized the platform's commitment to promoting Ghanaian culture and bridging cultural divides through its multilingual digital library.

YouScribe's affordable daily subscription model, priced at approximately $0.056 (GH₵ 0.75), aligns with Ghana's efforts to enhance digital literacy and facilitate access to educational content. The platform's availability via mobile networks further facilitates inclusivity, bridging the digital divide and reaching a broader audience of learners.

Nedbank Joins Forces with African Greeneurs to Empower 20 Young Agripreneurs

Nedbank has pledged R6.5 million to support 20 young South Africans through its Enterprise and Supplier Development Programme (ESD). The initiative aims to empower participants to join the Agripreneur Development Programme, led by African Greeneurs, the agriculture and training arm of the Enterprising Africa Regional Network Pty Ltd ("EARN") .

The Agripreneur Development Programme, renowned for its comprehensive curriculum, seeks to equip young Africans with both technical and business acumen essential for building sustainable and profitable agribusinesses. Divided into two phases, the program offers immersive learning experiences to aspiring agripreneurs.

Kobang Maluleka , Managing Director at African Greeneurs , highlights the programme's commitment to fostering agricultural champions while addressing food security, employment, and economic growth imperatives. He emphasizes the meticulous candidate selection process and the program's unique exit strategy, which ensures graduates are equipped for success through land placement and access to vital support networks.

Nirmala Reddy (PhD) Nedbank's Senior Manager for Enterprise Development, expresses the bank's dedication to community development and entrepreneurship. She highlights the program's role in driving job creation, fostering sustainable agricultural practices, and contributing to overall societal development.

With Nedbank's support, the program leverages modern agricultural methods and technology to empower young agripreneurs, fueling economic growth and societal betterment

Ethiopian securities exchange raises targeted $11m capital

The Ethiopian Securities Exchange (ESX) (ESX) has met its initial capital raise goal of $11.07 million required to launch its operations, oversubscribed by more than double, with offers totaling $26.6 million from 48 investors. ESX is Ethiopia's first-ever stock exchange, with 25% government ownership and 75% allocated to private sector investors. Notable investors include FSD Africa , the Trade and Development Bank Group - TDB Group , and the Nigerian Exchange Group (NGX Group).

The launch aims to open up Ethiopia's economy to foreign investment and facilitate privatization of state-owned enterprises, with initial plans to list 50 companies, primarily from the financial services sector. ESX has made strides in publishing its draft Exchange Rulebook and finalizing its technology provider, paving the way for smoother market operations and new investment opportunities.

Innovative Agritech Solutions: Modernizing Agriculture in Africa

Africa's agricultural sector is currently undergoing a major transformation, thanks to the use of innovative agritech solutions that tackle long-standing challenges and drive modernization in the industry. These cutting-edge technologies rely on digital tools, data analytics, and precision farming techniques to optimize agricultural practices, boost productivity and address pressing issues such as limited access to resources, climate change, and food security.

The impact of agritech is vast and includes mobile applications that provide real-time information to farmers, such as Farmcrowdy in Nigeria and M-Shamba in Kenya. There are also precision farming technologies that use IoT sensors and drones to monitor crop growth. Startups like SunCulture and Illuminum Greenhouses in Kenya are pioneering vertical farming and hydroponic systems, conserving water and maximizing yields in urban areas.

Blockchain technology is enhancing supply chain transparency, while smart irrigation systems like those offered by FutureWater in Morocco and WaterBit in Kenya optimize water usage. Additionally, data analytics and predictive modeling from companies like Gro Intelligence in Kenya empower farmers with personalized insights, while robotics and automation technologies from startups like Hello Tractor in Nigeria streamline labor-intensive tasks.

These innovations not only increase productivity and sustainability but also empower farmers with vital resources and information, ultimately contributing to food security and economic development across Africa. As the continent embraces digital transformation and innovation, the agricultural sector stands poised for resilience, efficiency, and inclusivity in the face of evolving challenges.

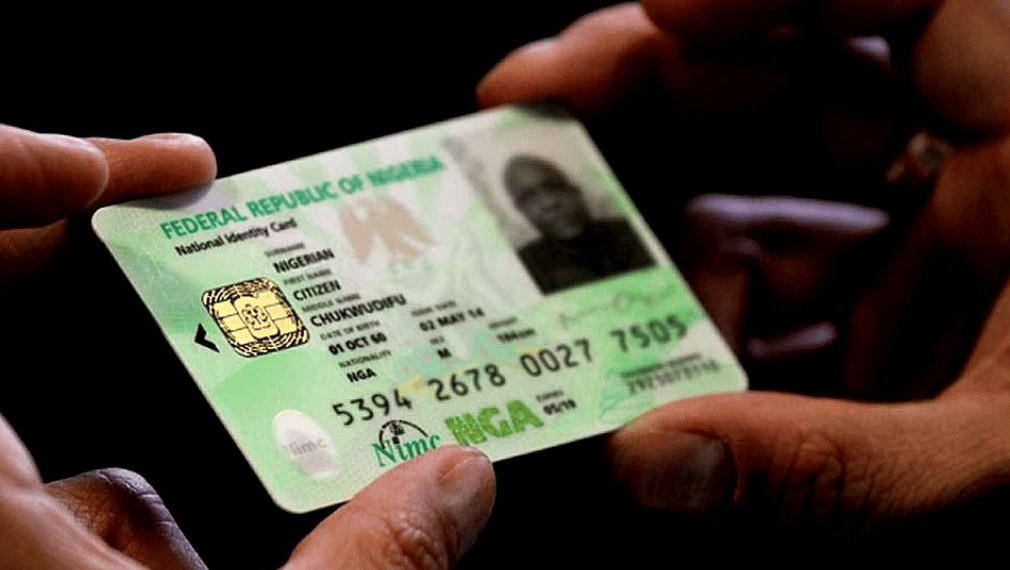

Nigeria Plans to Launch Payment-Integrated ID Cards to Boost Services

The Nigerian government is set to launch a payment-integrated ID card, led by the National Identity Management Commission (NIMC). This initiative aims to streamline identification processes and boost financial inclusion for citizens and legal residents. Partnering with the Central Bank of Nigeria (CBN) and the Nigeria Inter-Bank Settlement Systems PLC(NIBSS), the card will leverage the AfriGo domestic card scheme. Eligibility is based on registration with the National Identification Number (NIN), aligning with the NIMC Act.

The card will serve as Nigeria's primary identity card and can be linked to bank accounts for use as debit or prepaid cards. Despite concerns about the current NIN registration process, the NIMC assures citizens of various channels for obtaining the new card, including online platforms, commercial banks, and NIMC offices nationwide. Additionally, the government's formation of the Nigeria Digital Identification for Development Project Ecosystem Steering Committee underscores its commitment to enhancing service delivery and governance through secure digital identities, paving the way for a thriving digital economy.

Africa Data Centres Pioneers Solar Power Solution for Data Centers

Africa Data Centres , part of Cassava Technologies , has broken ground on an innovative solar farm in collaboration with DPA INDUSTRIES ~ DPA SA. This project marks a step towards powering data centers with clean energy and addressing South Africa's energy crisis.

Key Points:

Sustainable Power: The solar farm will initially supply Africa Data Centres' Cape Town facility, with plans to expand to Johannesburg centers.

Industry Leadership: The move positions Africa Data Centres as a sustainability leader in the data center industry.

Addressing Power Challenges: The project helps alleviate South Africa's power grid pressure.

Net-Zero Goal: This initiative supports Africa Data Centres' ambition to achieve net-zero emissions across all facilities.

Quotes emphasizing commitment and innovation:

Hardy Pemhiwa (Cassava Technologies): "This initiative positions Africa Data Centres as a trailblazer in the data center industry in responding to South Africa's energy crisis through sustainable technology solutions."

Tesh Durvasula (Africa Data Centres): "Today's announcement represents a significant stride in our initiative to sustainably energize South African data centers, advancing our objective of achieving carbon neutrality."

Nawfal EL FADIL (DPA SA): "We are thrilled and honored to contribute to Africa Data Centres' mission of achieving carbon neutrality. DPA SA brings a wealth of experience and a proven track record in delivering high-quality, sustainable energy solutions to this partnership."

Africa goes digital: Survey reveals overwhelming shift towards cashless transactions

A recent survey conducted by Regtech Africa and AGPAYTECH LTD. reveals a major shift towards digital payments in Africa, with 91% of respondents preferring digital transactions over traditional cash methods. The study, titled “African Digital Payment Systems and Consumers’ Experience in 2023,” surveyed 2,591 individuals across various regions, shedding light on key trends and challenges in the digital payment landscape.

Key Highlights:

Preference for Digital Payments: The survey indicates a seismic shift in Africa’s financial landscape, with 91% of respondents favouring digital transactions. Mobile banking emerges as a critical component, with 73.5% of participants utilizing banking apps for transactions.

Knowledge Gap on CBDCs: Despite the potential of Central Bank Digital Currencies (CBDCs) to revolutionize financial infrastructure, 69% of participants admitted to having no knowledge of CBDCs. This highlights the urgent need for widespread education initiatives.

Mixed Opinions on CBDCs: Opinions on CBDCs are divided, with only 19.8% expressing support for their issuance, while 47.9% opposed it, and 32.3% remained unsure. Comprehensive dialogue and education are necessary to foster informed decision-making.

Challenges Persist: Despite the growing preference for digital payments, 45.3% of consumers express dissatisfaction with digital payment systems. High transaction fees, security concerns, and perceived vulnerabilities are cited as key deterrents, highlighting the need for stronger safeguards and regulatory frameworks.

Future Trends: The research identifies a growing interest in innovative trends like “buy now, pay later,” “save now, buy later,” WhatsApp banking, CBDCs, and open banking. Financial institutions have a significant opportunity to capitalize on these evolving demands by prioritizing interoperability and user-centric design.

An Image showing small scale traders using digital payments

How fintech in low- and middle-income countries (LMICs) can inspire the digital healthcare revolution

The world is on the brink of a digital health revolution, inspired by the remarkable fintech innovations that have reshaped financial access, particularly in low- and middle-income countries (LMICs). Just as mobile money services like M-Pesa transformed financial transactions in Africa, digital health technologies are poised to revolutionize healthcare delivery in the Global South.

Fintech marvels like M-PESA Africa , Optasia , and Nubank have redefined access to financial services, breaking down barriers to traditional banking and finance. This disruptive potential of fintech serves as a blueprint for LMICs to lead the digital health revolution.

Mobile technologies, once tools for financial transactions, are now envisioned as conduits for health interventions and life-saving initiatives. Digital innovations like telemedicine and AI diagnostics have the potential to address universal healthcare challenges such as gaps in service delivery and health workforce shortages.

These digital tools promise scalable and quality care solutions by enabling remote care and bolstering workforce competencies through AI-assisted diagnostics and e-learning. Advanced data analytics and logistical innovations in medical supply chains further enhance healthcare delivery.

Startups like Nigeria's LifeBank and Kenya's Flare are pioneering technology to expedite blood donations, emergency response times, and medical deliveries, saving lives in critical situations. Platforms like India's eSanjeevani bridge the doctor-patient gap through telemedicine consultations.

What sets these innovations apart is their focus on crafting solutions tailored to local contexts, striving for inclusion to bring quality healthcare within reach of all, irrespective of geography or economic status. This shift towards proactive and preventive health strategies emphasizes community engagement and patient empowerment.

The success of these health tech initiatives demonstrates how LMICs are not only catching up but potentially leading digital health innovation. Technology emerges as the great equalizer in health, offering scalable, cost-effective, and user-centric solutions to work towards universal health coverage.

How fintech in low- and middle-income countries (LMICs) can inspire the digital healthcare revolution

How DHL harnessed genAI to unify 200 career sites into a single platform

DHL, a global logistics company, faced challenges with its decentralized approach to career sites, resulting in 200 disparate sites lacking brand consistency and failing to attract new hires effectively. In response, DHL undertook a project to consolidate these sites into a single genAI-powered platform, leveraging Phenom's HR tech solutions.

Notably, the new site saw significant improvements in candidate traffic, engagement, and speed of hires. It particularly excelled in attracting frontline workers like truck drivers, delivery personnel, and warehouse workers. The AI-powered platform facilitates personalized job recommendations, enhances recruiter efficiency, and enables real-time customization for different locations and languages.

DHL addressed several challenges, including visibility, brand consistency, and minimizing fraudulent activities associated with career sites. By integrating AI into their recruitment process, DHL optimized talent acquisition, improved employer branding, and enhanced candidate experience.

Meredith Wellard , VP of Group Talent Acquisition, Learning, and Growth at DHL, spearheaded the project, emphasizing the importance of learning before implementation and the collaborative effort involving HR, IT, legal, finance, compliance, and frontline employees. The company also utilized generative AI for internal applications like the Career Marketplace and content creation.

Google will struggle with Apple-generated AI query

Google faces a dilemma regarding the impact of artificial intelligence (AI) on its business, with both opportunities and threats on the horizon. While AI-based chatbots may improve search efficiency, Google's deep relationship with Apple poses a significant financial risk.

Despite Google's dominance in online search, recent market share declines indicate growing competition from AI-driven alternatives. Challenges such as sponsored links and the need for more direct search results have opened doors for competitors. However, Google's incumbency, access to data, and substantial investments in AI infrastructure provide a formidable defense. The uncertain economics of AI-powered searches, which are more costly and may require user fees, present additional challenges.

Furthermore, Google's recent ventures into AI have faced criticism, highlighting potential pitfalls. Amidst these pressures, Alphabet's stock performance reflects investor optimism and acknowledges AI competitors' rising influence. Apple's pivotal role in Google's search revenue, driven by iPhone users, poses a significant threat. Regulatory actions or Apple's potential development of its AI-based search tool could disrupt Google's revenue streams. Despite indications of cooperation, tensions between the two tech giants suggest a complex future for Google in the AI era.

Senegal Startup Develops KoriPass to Help Ease the Process of making Transactions across Africa

KORI TECH is a Senegalese startup founded in 2022 by CEO Nazib Ba and CTO Hamidou Ba. They have recently introduced an innovative e-wallet solution named KoriPass, which comes with physical payment accessories like bracelets, stickers, or keychains. This innovative initiative aims to revolutionize transactions across Africa, targeting sectors like small retail and transportation, which are plagued by cash transaction inefficiencies.

KoriPass leverages NFC technology to facilitate quick and contactless transactions, offering users the convenience of making micro-payments at their favorite merchants. Setting up KoriPass is simple, and even users without smartphones can link their preferred accessory to their KoriPass account and fund it either with cash or via the app. Merchants benefit from simplified payment acceptance, requiring only one KoriPass merchant account to cater to all mobile money providers in Senegal.

Early adoption of KoriPass has shown promising results, with growing merchant integration and positive feedback from users, particularly in sectors reliant on cash transactions. Kori Tech has received funding from Startupbootcamp AfriTech and La Délégation Générale à l’Entreprenariat Rapide (DER), and they are poised for expansion into new markets in West Africa, with a focus on francophone countries like Ivory Coast, Benin, and Togo.

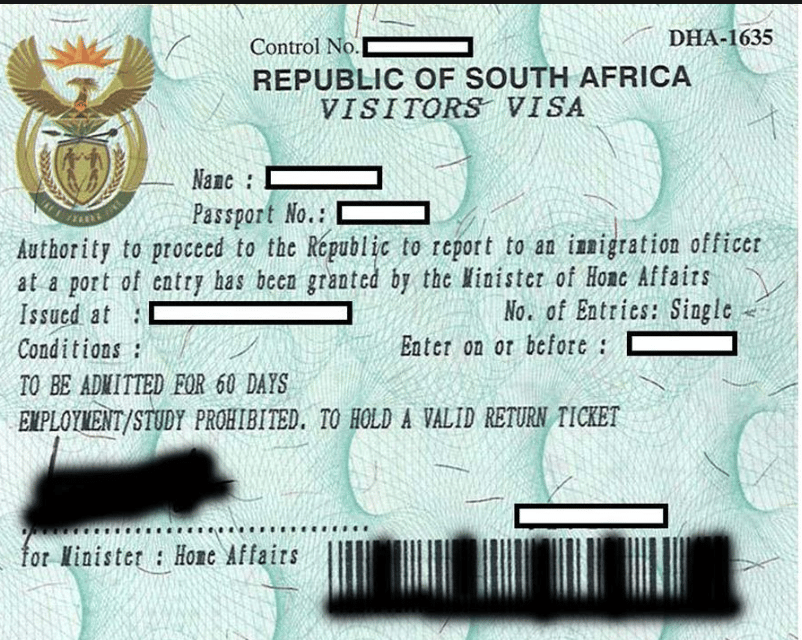

South Africa's Digital Nomad Visa: Paving the Way for Economic Boom or Social Divide?

South Africa has introduced its Digital Nomad Visa program, aiming to attract skilled remote workers to the country for up to three years. While proponents celebrate the potential for talent acquisition, economic growth, and tech hub development, skeptics raise concerns about soaring living costs, inequality, and tax transparency issues.

Key Highlights:

Pros:

Talent Acquisition: The program could stem brain drain, attracting skilled tech workers to foster innovation and bolster critical sectors.

Economic Boost: Digital nomads injecting foreign income may stimulate local economies and create job opportunities.

Tech Hub Potential: A surge in skilled professionals could elevate South Africa as a regional tech leader, attracting investments and nurturing local talent.

Cons:

Living Cost Surge: The influx of high-earning nomads might exacerbate housing crises, widening the gap between locals and newcomers.

Widening Inequality: Benefits may not trickle down evenly, deepening societal divides and leaving some sectors untouched by economic growth.

Tax Transparency Concerns: Unclear regulations on income thresholds and tax breaks raise questions about fairness and potential revenue leakage

X's (Formerly Twitter) Surprise Blue Check Surge Sparks User Confusion

X experiences a surge in verified accounts, courtesy of Elon Musk's initiative to provide complimentary Premium memberships to it's users with significant followings. Accounts with over 2,500 "verified subscriber followers" are receiving the coveted blue checkmark, even without subscribing to any paid tiers. Traditionally reserved for celebrities and public figures, Twitter's verified symbol became available through paid verification, leading to confusion among users who unexpectedly received it. While some users welcome the verification, others express surprise and uncertainty, emphasizing their lack of intention to pay for the privilege.

However, in a recent announcement, Musk disclosed that all platform accounts with over 2,500 verified subscriber followers would automatically receive Premium features at no cost. Moreover, accounts boasting more than 5,000 followers would be granted access to Premium+ features free of charge.

Musk's introduction of subscriptions on X is a strategic move to diversify revenue streams, particularly amidst challenges in advertising income following his contentious acquisition of Twitter in late 2022. Notably, several advertisers, including Disney and Apple, paused their online ad campaigns on X in November 2023 after Musk promoted a controversial conspiracy theory.

The duration of this offer's availability to users and whether they will have the option to opt-out of the service remain uncertain at present.

Amazon Web Services Initiates Mass Layoffs

Amazon Web Services (AWS) announces massive layoffs impacting hundreds of employees across sales, marketing, and technology divisions. This move follows a series of job cuts within Amazon.com, affecting various sectors including Prime Video, healthcare, and Alexa. The downsizing decision aims to streamline specific areas of the organization and aligns with broader industry trends, with over 57,000 workers affected by job cuts across 229 firms in 2024. The reduction in force at AWS, affecting a substantial portion of its sales and marketing division, coincides with a larger reorganization led by sales chief Matt Garman , reflecting efforts to optimize operations amidst a growth slowdown in the cloud business.

Uber and Waymo's Driverless Delivery: A Threat to Gig Workers

Uber and Waymo are expanding their partnership and are now offering autonomous food delivery in Phoenix. This move threatens delivery drivers and highlights the ongoing erosion of gig work in favor of automation.

Uber 's initial pitch for gig work focused on flexibility and independence. The company is one step closer to its goal: eliminating human workers. This strategy means no more drivers, no labor costs, and no battles over worker classification.

The rise of automation often disguises itself with a facade of poorly paid human workers. However, even those jobs are temporary, as AI systems are continually being refined. Companies like Uber relentlessly aim to drive their employee counts towards zero.

Switzerland Leads Rate Cut Cycle Among Major Central Banks

Switzerland has initiated a global trend of rate cuts among major central banks, signaling a renewed push for easing in both developed and emerging economies. The Swiss National Bank's decision to lower its key lending rate in March, the first such move among the world's top 10 most traded currencies since November 2020, contrasts with Japan's recent decision to end eight years of negative interest rates.

While the Swiss National Bank took the lead, seven other G10 central banks, including the US Federal Reserve Board and the European Central Bank , maintained their benchmark lending rates unchanged last month. Market sentiment suggests expectations for further rate cuts, particularly by the ECB and the Fed, starting as early as June.

In emerging economies, which often lead in both tightening and easing cycles, the pace of rate cuts has accelerated once again. Five of the 18 central banks in developing economies tracked by Reuters slashed interest rates in March, matching December's tally, reflecting intensified efforts to stimulate their economies.

Swiss National Bank

Ethiopia Granted Extension by Paris Club for IMF Bailout Talks

Ethiopia has been granted an extension until the end of June by its official international creditors to finalize discussions on International Monetary Fund (IMF) support. The previous deadline expired, and despite recent discussions between Ethiopia and the IMF, no agreement was reached. The Paris Club Secretariat , comprising developed creditor nations, initially indicated that Ethiopia's debt payment suspension through 2025 could be revoked if an IMF loan was not secured by March 31.

However, the deadline has now been extended to maintain momentum in reaching a staff-level agreement with the IMF. Ethiopia, facing financial challenges, defaulted on a $1 billion Eurobond coupon payment in December, joining the ranks of African nations that defaulted in recent years.

Microsoft, Quantinuum claim breakthrough in quantum computing

Microsoft and Quantinuum have announced a breakthrough in quantum computing, addressing the challenge of qubits' reliability (Qubits-fundamental units of information in quantum computing that can exist in multiple states simultaneously, allowing for parallel processing).

This advancement, achieved through a proprietary error-correction algorithm, has led to obtaining approximately four reliable qubits from 30 physical ones. The milestone, echoed by Microsoft's executive vice president, Jason Zander , as conducting over 14,000 experiments error-free, holds significant promise for the future of quantum computing. While the timeline to reach 100 reliable qubits remains unspecified, optimism surrounds the potential acceleration of this journey. With plans to integrate this technology into its cloud computing services, Microsoft's breakthrough heralds transformative possibilities in computational capabilities and scientific discovery.

Google Contemplates Charging for Premium Features on AI-Powered Search Engine

Google is exploring the possibility of introducing paid premium features to its generative AI-driven search engine, as the Financial Times reported, citing insider sources.

The tech giant is assessing various avenues, including integrating AI-driven search functionalities into its existing premium subscription services. According to the report, these services grant access to the new Gemini AI assistant within platforms like Gmail and Docs.

Alphabet Inc. , Google's parent company, witnessed a slight dip of approximately 1% in its shares during after-hours trading following the revelation.

Should Google proceed with this strategy, it would mark the first instance of placing any of its core products behind a paywall. This move underscores Google's ambition to establish a stronger foothold in the rapidly evolving AI landscape. Notably, the traditional Google search engine will remain freely accessible, with advertisements continuing to accompany search results even for subscribers, the report noted.

In response to inquiries, Google emailed, "We’re not working on or considering an ad-free search experience. As we’ve done many times before, we’ll continue to build new premium capabilities and services to enhance our subscription offerings across Google."

The tech giant, credited with pioneering the foundational technology for the current AI boom, is competing with prominent industry players such as OpenAI, creator of ChatGPT, and Microsoft, its primary supporter.

As Google weighs this potential shift in its business model, it reflects the broader landscape of technological innovation and monetization strategies within the AI sector.

African Tech Startup Funding Plummets in Q1 Amid Persistent "Funding Winter"

The daunting "funding winter" gripping African tech startups persists, with Q1 witnessing a staggering 52.3% decline in funding, dropping to US$310 million from last year's US$650 million.

According to the ninth edition of the African Tech Startups Funding Report, collaboration between Disrupt Africa, Flourish Ventures, AAIC Investment, and Atlantica Ventures, 2023 saw 406 startups amass a total of US$2.4 billion. However, this momentum took a hit, with a 35.9% decrease in funded ventures compared to 2022, signaling a sobering reset in the African tech ecosystem.

Despite hopes for a rebound in 2024, Q1's disappointing figures dashed expectations. The number of funded ventures slightly decreased from 87 to 82 compared to Q1 2023. While this decline rate is slowing, the persistently low funding levels overshadow 2024's prospects, potentially eclipsing last year's downward trend.

Read Report: https://shorturl.at/fBF17

African AI pioneer InstaDeep ready for future after €500m takeover

InstaDeep , founded by Karim Beguir and Zohra Slim , recently secured an acquisition by Biontech for €500 million, showcasing Africa's burgeoning presence in the global AI arena. Over a decade, InstaDeep transformed from a modest startup in Tunisia to a global leader with innovative AI solutions spanning industries like shipping, medical research, and circuit board programming.

InstaDeep's dedication to empowering local talent and delivering practical AI solutions propelled its meteoric rise despite initial challenges. BioNTech's acquisition highlights InstaDeep's alignment with global AI trends and underscores Africa's potential to advance AI innovation.

InstaDeep's CEO, Karim Beguir, emphasizes the importance of fostering talent and creating supportive ecosystems in Africa to unlock the full potential of AI innovation on the continent. With BioNTech's acquisition, InstaDeep anticipates further growth opportunities while maintaining its focus on African impact and operational independence.

InstaDeep Founder Karim Beguir

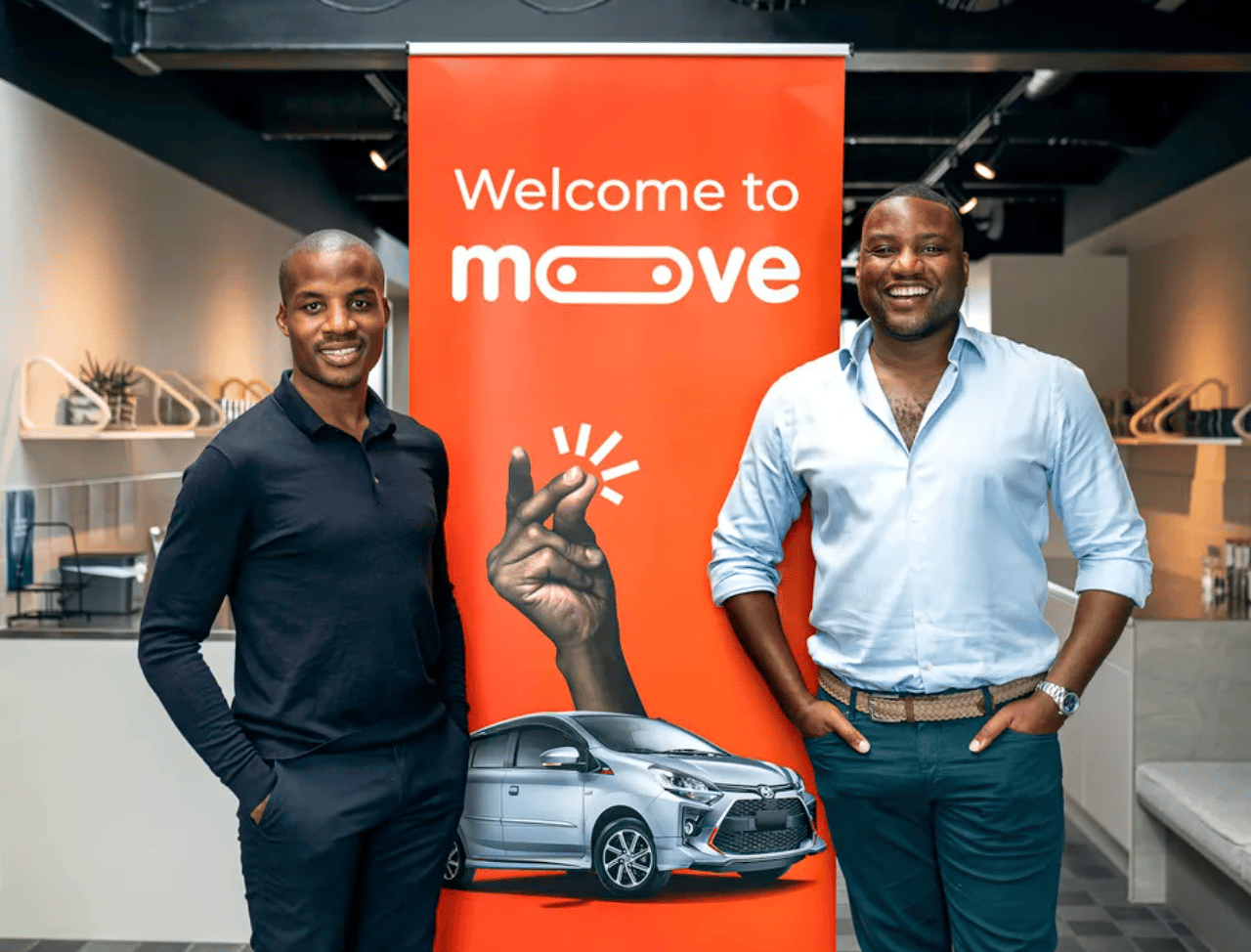

Moove leads African startups’ $466 million fundraising in Q1 2024

Moove , a Nigerian mobility startup, has led Africa's startup ecosystem by securing a substantial $110 million in the first quarter of 2024. This amount constitutes 24% of the total $466 million raised collectively by African startups during this period. Moove's impressive fundraising was primarily fueled by a $100 million Series B round led by Uber. Despite a 27% decrease compared to the previous quarter and only half the amount raised in Q1 2023, Moove's dominance showcases the resilience and potential of Africa's startup landscape.

Highlights:

Sectoral Shift: ClimateTech gains traction, signaling a shift towards sustainability-focused ventures.

Funding Landscape: Equity financing prevails at 71%, raising concerns over gender disparities in funding distribution.

Implications: Moove's success highlights Africa's startup vibrancy, urging inclusivity for sustainable growth and development.

Ladi Delano and Jide Odunsi Founders of Moove

The Week in a Flash: Fintech Highlights 🚀

Renewable Energy

🌍 Global Clean Electricity Rise: Tracking Key Markets' Progress 📈

The world is witnessing a surge in clean energy adoption, with Latin America and the Caribbean leading the charge at 69.3% clean electricity generation by 2023. Europe follows closely at 59%, while Oceania, North America, and Asia stand at 49%, 47%, and 30% respectively. Africa and the Middle East, though less frequently monitored, hover around 25% and 5-6%.

Digital Inclusion & Connectivity

🇮🇹 Italy Launches Digital Nomad Visa, Welcoming Foreign Freelancers! 🌍💼

Italy rolls out the Digital Nomad Visa, inviting third-country nationals, like Kenyans, to live and freelance in Italy for up to 12 months, extendable. ✨💻 Approved in March 2024, this visa caters to remote workers, offering a gateway to Italy without immediate permanent residency. Applicants need to meet specific criteria, including financial stability and health insurance. Apply now at the Italian consulate! 🛫🇰🇪

Artificial Intelligence

🍏💰 Apple Strikes Multi-Million Dollar Shutterstock Deal for A.I. Training Data Amid Fierce Tech Competition! 📸🤖

Tech giant Apple secures a substantial deal with Shutterstock, estimated at $25-50 million, to acquire millions of images for A.I. training. 🔍📊 This highlights the fierce competition among tech giants like Apple, Meta, Google, and Amazon for vast data repositories to power their A.I. initiatives. 🚀💻

AI and Technology Advancements

🔥🧠 Arm Unveils Ethos-U85 NPU & Corstone-320 IoT Platform to Revolutionize Edge A.I.! 💡🌐

Leading semiconductor company Arm integrates A.I. into its latest chips for IoT devices, redefining edge A.I. applications. 🚀💻 The Ethos-U85 NPU promises exceptional performance and efficiency, empowering developers to seamlessly integrate A.I. into various scenarios, from factory automation to smart home cameras. 🏭🏠

Market Dynamics and Corporate Strategies

💰🌍 IMF & Ivory Coast Seal $574M Deal! 🤝💸

The IMF clinches agreement with Ivory Coast, clearing the path for a $574 million disbursement! 💼🇨🇮 Under the Extended Fund Facility and Resilience and Sustainability Facility programs, Ivory Coast showcases satisfactory performance. 📈✨

🛒🌟 Grocery Giants Unite: Tesco, Woolworths, and Shoprite Launch $125 Million VC Fund 🚀

FOUNDER OF THE WEEK

In this week's spotlight, we feature Benjamin Njenga , the Co-founder of Apollo Agriculture . Benjamin's journey into agriculture is a testament to his passion and commitment to making a difference in the lives of farmers.

Growing up on a farm, Benjamin witnessed firsthand the challenges his mother, a smallholder farmer, faced. Determined to find solutions to help farmers like his mother, he pursued a degree in Agribusiness and Management at Egerton University.

Benjamin "Baba" Njenga

Benjamin's career took an unexpected turn when he joined Safaricom, where he gained invaluable insights into how technology could revolutionize agriculture. Combining his knowledge of farming with his experience in technology, he co-founded Apollo Agriculture with Eli Pollak and Earl St Sauver.

At Apollo Agriculture , Benjamin and his team provide farmers with financing, technical support, and access to quality inputs to improve their yields and profitability. Through their innovative approach, they have transformed the lives of over 200,000 farmers across Africa.

Benjamin's dedication to agriculture and his unwavering belief in its potential to drive economic growth and food security are truly inspiring. As Apollo Agriculture continues to expand its reach, Benjamin remains committed to making a positive impact in the agricultural sector.

Join us in celebrating Benjamin Njenga, a visionary leader who is shaping the future of farming in Africa.

𝑩𝒆 𝑭𝒆𝒂𝒕𝒖𝒓𝒆𝒅 𝒊𝒏 𝑶𝒖𝒓 𝑵𝒆𝒙𝒕 𝑵𝒆𝒘𝒔𝒍𝒆𝒕𝒕𝒆𝒓!

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 - 24,703💙𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply