- FINTAK Weekly Newsletter

- Posts

- East African Fintech Associations Unite for Investment Forum in Tanzania

East African Fintech Associations Unite for Investment Forum in Tanzania

A weekly digest of news, opinions and all things financial technology

This collaboration, formalized through a memorandum of understanding, will bring together the DRC Fintech Association, Association of Fintechs in Kenya, Tanzania Fintech Association (TAFINA), Fintech Association Of Kenya and FITSPA Uganda to co-host the East African Investment Forum -EAIF2024.

Taking place on September 12th-13th at the Serena Hotel in Dar es Salaam, EAIF2024 aims to promote innovation, showcase investment prospects, and drive the advancement, inclusivity, and sustainable growth of the financial technology industry in East Africa.

“By working together, we can create a more robust and inclusive financial landscape for all East Africans and attract investment opportunities," stated Ms. Zianah Muddu, Team Lead at FITSPA. "This MoU represents a significant step forward in fostering innovation, knowledge sharing, and cross-border partnerships within the region’s fintech space.”

Key areas of focus will include 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗛𝗮𝗿𝗺𝗼𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻, 𝗜𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗣𝗿𝗼𝗺𝗼𝘁𝗶𝗼𝗻, 𝗧𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆 𝗮𝗻𝗱 𝗜𝗻𝗻𝗼𝘃𝗮𝘁𝗶𝗼𝗻, and 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗜𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻.

Duncun Motanya, Chairperson of FINTAK, stated that this partnership unites efforts to create a robust, interconnected ecosystem capable of competing globally.

"Together, we will accelerate financial inclusion, drive economic growth, and position East Africa as a fintech powerhouse," he added.EAIF2024 will bring together industry leaders, policymakers, investors, and entrepreneurs to foster investment attraction, partnership development, and meaningful dialogue within the region's fintech sector.

🗞️Your Week in Summary...

📉 Pres. Ruto Cuts Govt Spending: What's Affected?

Kenya's new law reduces government spending by Ksh 145.7 billion.

💍 SA Fintech’s 'One Ring' to Rule Payments

VezoPay introduces a smart payment ring, aiming for seamless transactions.

⚖️ Google's Monopoly Ruled Unlawful

A federal judge rules Google has maintained an illegal monopoly in online search.

👩💻 Zandile Mkwanazi: Bridging Tech’s Gender Gap

GirlCode founder Zandile Mkwanazi empowers thousands of women with tech skills.

🚗 Mobius Motors Kenya Closes After 13 Years

Kenya's homegrown automaker shuts down due to financial struggles and tax disputes.

🤖 AI Bubble Bursts: What's Next?

Investors are growing skeptical about AI profitability as major stocks tumble.

And much more...

Flutterwave Receives License To Power Payments For Businesses In Ghana

Flutterwave has received the Enhanced Category Payment Service Providerlicense from the Bank of Ghana, allowing it to expand its payment solutions across Africa. This milestone enables businesses in Ghana to access various payment services, including collections, payouts, invoicing, and payment links, tailored to their specifIc needs.

"We have the payment infrastructure to help Ghanaian businesses seamlessly process payments and scale because that’s what we’ve always done. Since our inception, Flutterwave has helped over 1.5 million businesses including Uber, Air Peace, Bamboo, PiggyVest, and Netflix, to process payments worth over $32 billion."

The company aims to leverage Ghana's growing digital landscape, with projections indicating that the country's digital payments market will reach $7.46 billion in 2024. Flutterwave's solutions are designed to promote financial inclusion and support the growth of the digital economy in Ghana.

Mobius Motors Kenya Shuts Down After 13 Years

Kenya's only homegrown automaker Mobius Motors Kenya is shutting down its operations after a 13-year journey amid piling debts and a multi-million shilling tax dispute with the Kenya Revenue Authority (KRA). The company's shareholders resolved in a meeting on August 5, 2024 to place Mobius under voluntary liquidation.

Mobius, founded in 2011 by British businessman Joel Jackson, aimed to build affordable cars for the African market. The firm launched its first-generation Mobius II in Kenya in 2015. However, its exit comes amidst debts and a tax dispute with KRA, which hit Mobius with a Sh85.74 million tax claim in 2018 based on assessments covering 2014 to 2016.Mobius appealed the demand at the Tax Appeals tribunal but lost the case.

Video Game Developers Woo Investors With Pitches At Microsoft Camp

A group of video game developers is seeking investment opportunities following project pitches at a camp hosted by Microsoft over the weekend. Notable projects presented included ‘Tingish’ and ‘Finke Desert Race’ by Arkitech Studios, which won the Fak’ugesi Festival Awards in 2022, marking a milestone in African video gaming, animation, XR, digital art, and music.

The African video game industry is projected to reach $1 billion in revenue this year, up from $800 million in 2022. However, the Africa Games Developer Survey reveals that about 63% of local game developers have five years of experience or less, and only 19% have secured external funding for their projects.

Esteban Lora from Xbox Game Studios Publishinghighlighted the potential for growth in Africa’s gaming industry, emphasizing the benefits of collaboration between local developers and the global gaming community. The two-day hybrid event, held in Nairobi, Johannesburg, and Casablanca, brought together industry experts, aspiring developers, and gaming enthusiasts to encourage innovation and collaboration.

Irene Githinji from the Microsoft Africa Development Centre stressed the importance of skills development in the industry. She noted that the Xbox Game Camp provides a valuable opportunity to connect with developers and identify emerging talent, paving the way for initiatives that will support the industry's growth.

Starlink Kits Now Cheaper In Kenya After 34% Price Drop

Starlink reduced the price of its kits in Kenya by 34.07% until August 14. The price has dropped from the current Ksh 45,500 to KES 29,999, making the service more accessible to Kenyans.This price drop comes less than a year after Starlink launched in Kenya in July 2023. Hardware cost has been a significant barrier for many Kenyans seeking the service. At launch, the standard Starlink hardware price in Kenya was Ksh 89,000. Earlier this year, the company had a limited-time offer until June 10, 2024, reducing the price to KES 39,500.

To further grow in the Kenyan market, Starlink recently introduced an internet plan starting as low as KES 1,300 per month, offering subscribers a 50GB data package. The "Starlink Standard – 50GB" plan provides high-speed internet access at any fixed residential location in the country. A 100 mbps unlimited plan is priced at KES 6,500.

The price drop has had a positive effect on sales numbers. Additionally, Starlink began selling its kits through local retail store Naivas, months after partnering with e-commerce platform Jumia to make the kits more accessible to Kenyans.

Zandile Mkwanazi Hacks The Gender Divide In Tech

Zandile Mkwanazi is the founder and CEO of GirlCode ZA , a non-profit organization dedicated to empowering young women through technology. Established in 2014, GirlCode began as a small hackathon for 20 women and has since grown to impact over 80,000 girls by providing skills in coding, programming, and digital literacy.

Mkwanazi's journey into tech was somewhat serendipitous. Despite excelling in mathematics, she initially lacked direction until a chance internship in software development changed her path. Recognizing the gender disparity in tech roles, she initiated GirlCode to create economic opportunities for women and challenge societal norms that limit girls' participation in STEM fields.

Under her leadership, GirlCode has expanded its initiatives, including the GirlCoder Club, which teaches coding to girls from Grade 2 to Grade 11, and a 12-month skills development program for unemployed women. Collaborating with partners like Vuma, GirlCode aims to inspire young girls to pursue STEM careers through career days and hackathons.

Mkwanazi's vision is ambitious: to empower 10 million women and girls with tech skills by 2030, fostering diversity and representation in the tech industry. Her work has garnered recognition, making her a leading advocate for women in technology in South Africa.

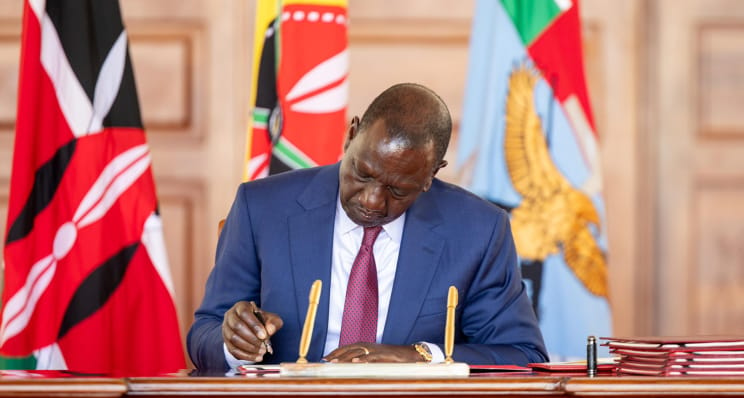

Pres. William Ruto Signs Supplementary Appropriations Bill to Reduce Government Expenditure

President William Samoei Ruto PHD signed the Supplementary Appropriations Bill into law on August 5, 2024, following its passage by the National Assembly on July 31, 2024.

This new law implements a reduction of Ksh 145.7 billion in government expenditure, with significant cuts affecting the Executive (Ksh139.8 billion), Parliament (Ksh3.7 billion), and the Judiciary (Ksh 2.1 billion). Despite these fiscal constraints, the law allocates essential funding, including Ksh 20 billion to support farmers, Ksh120.7 billion for education reforms, and Ksh 16.2 billion for health sector reforms aimed at promoting Universal Health Coverage.

Kenya Banks’ Assets Down 2.7% To $58.2 Billion

Kenyan banks experienced a 2.7% decline in assets in Q1 2024, shrinking to $58.2 billion (Ksh 7.5 trillion), primarily due to an 18.5% drop in foreign currency loans, which fell to $7.6 billion. The banks also reduced their holdings of government securities by $474.3 million

This contraction signals a reduced appetite for dollar-denominated loans as the Kenyan shilling strengthened, alongside tightening credit conditions amid a challenging macroeconomic environment. Net loans and advances accounted for 49.4% of total assets, down from 49.7% in Q4 2023.

Gross loans decreased by 2.8% to $31 billion, with notable reductions in sectors like manufacturing and tourism. Customer deposits, the primary funding source for banks, fell by $2.2 billion to $42.6 billion , highlighting reduced activity due to rising living costs.

10 startups selected for the 2024 Google for Startups Accelerator Africa Cohort'

PULA, an insurtech company based

Google for Startups Africa has selected 10 innovative startups for its 8th cohort, focusing on leveraging AI to tackle various challenges in healthcare, cargo mobility, energy solutions, and more. The selected startups come from Kenya, Nigeria, Rwanda, and South Africa, chosen from nearly 1,000 applications.The startups in this cohort include:

CDIAL.AI (Nigeria): Enhancing multilingual communication across Africa using artificial and collective intelligence.

Earthbond (Nigeria): Providing affordable and reliable energy solutions for homes and businesses, supported by carbon accounting.

Fixxr 👨🏾🔧 (South Africa): Offering convenient on-location vehicle maintenance and repair services for car owners and businesses.

Lifesten Health (Rwanda): Innovating health and wellness through advanced screening and incentive-based programs.

MyAIFactchecker (Nigeria): An AI-powered tool designed to combat misinformation and promote informed decision-making.

Nakili Kenya: A mobile app that modernizes management for salons, barbershops, and spas.

NextCounsel Limited (Nigeria): An AI tool that enhances lawyer productivity in contract management and compliance.

nobuk Africa (Kenya): Simplifying financial management for groups with a platform for fund collection and reporting.

Rana Energy (Techstars ‘23) (Nigeria): Delivering clean energy solutions to SMEs and communities through a data-driven model.

Triply.co (Kenya): Creating Africa’s travel operating system to connect travelers with booking experiences and management tools.

Federal Judge Rules Google Has Unlawfully Maintained Monopoly in Online Search

A federal judge has ruled that Google has unlawfully maintained its monopoly in the online search market, determining that the company engaged in practices that stifle competition and innovation. U.S. District Judge Amit Mehta stated that Google operates as a monopolist, having secured its dominant position by paying billions to companies like Apple and Samsung to ensure its search engine is the default option on their devices.

This ruling, which represents a significant victory for U.S. regulators, could lead to major changes in how Google operates, potentially including restrictions on its lucrative default agreements. The decision comes amid a broader scrutiny of Big Tech companies and their market behaviors, marking the first major antitrust ruling against a tech giant since the Microsoft case.

Google plans to appeal the ruling, asserting that its success is due to consumer preference rather than unfair practices.

Egypt’s Synapse Analytics Secures $2 Million To Expand Its AI Technologies Across GCC And Africa

Egyptian AI startup Synapse Analytics has secured a $2 million investment led by Silicon Badia and Hub 71, Abu Dhabi, to expand its AI-powered solutions across the Gulf Cooperation Council region and Africa. The startup aims to address financial inclusion and access by providing cutting-edge AI software for financial decisions, including credit scoring, cross-selling, dynamic pricing, and eKYC/eKYB processes.

Synapse Analytics offers a suite of solutions to help financial institutions leverage AI. Its flagship product, Konan, is a Machine Learning Operations platform that enables the integration and adoption of AI in areas such as credit risk assessment, pricing optimization, and product matching. The startup also provides Doxter, a document extraction and process automation platform that allows clients to process and store data from various documents.

Ahmed Abaza , Co-Founder and CEO of Synapse Analytics, emphasized the potential of AI in making financial services more inclusive, accessible, and personalized in the Middle East and Africa (MEA) region. He believes the MEA region, characterized by a young population, growing economies, and rapid digital finance adoption, can become a pioneer in the financial services world with the help of AI.

Galal Elbeshbishy , Synapse Co-Founder and COO, highlighted the importance of seamlessly integrating AI with existing data sources and systems. He stated that Synapse Analytics' solutions enable financial institutions to quickly launch AI-powered systems while maintaining rigorous risk management standards.

The South African Fintech Forging ‘One Ring To Rule Them All’ In Payments

South African fintech startup VezoPay is betting big on transforming payments with its innovative smart payment ring. While companies like McLEAR, Twinn, and TAPSTER have already entered this space, VezoPay, backed by notable investors, is staking its claim in the emerging payment ring market.

VezoPay's rings, available in various styles and price points starting from $112, offer a sleek, hands-free payment experience. One of the key selling points is that these rings do not require charging, which could appeal to tech-savvy and active consumers. "Our goal is to make payments as painless as possible," said VezoPay co-founder Jake Pinkus.

The company's recent partnership with Nedbank, one of South Africa's largest banks, marks a significant milestone and could open doors to other major financial institutions.

"We are in talks with other major banks and expect them to follow suit as the technology proves its efficacy," Pinkus added.

Egypt’s Edtech Educatly Raises $2.5 Million To Solidify Its Presence In Egypt, Nigeria, Kenya, And The UAE

Educatly , an Egyptian edtech startup, has successfully raised $2.5 million in a funding round led by TLcom Capital and Plus VC, with additional participation from Egypt Venture and the HBAN syndicate from Ireland. This investment aims to solidify Educatly's presence in key markets across the Middle East and Africa, including Egypt, Saudi Arabia, the UAE, Nigeria, Kenya, and Ireland.

Founded in 2020, Educatly provides comprehensive information on schools and universities worldwide, along with various programs and scholarships. The platform utilizes artificial intelligence and large language models to help universities engage with students effectively. Currently, it features over 1,100 universities across 90 countries.

The funding will enable Educatly to enhance its services and reach more students globally, aligning with the company's ambition to increase its user base from over 3 million to approximately 7 million by the end of 2024. The startup also operates research and development centers in Cairo and Dubai, investing $500,000 annually to develop a digital platform that meets global standards.

Airtel Kenya Launches GB kwa GB Campaign to Boost Smartphone Adoption

Airtel Kenya announced a new campaign on August 5, 2024, aimed at accelerating the digital revolution in the country. Dubbed "GB kwa GB" (Swahili for "GB for GB"), the campaign offered free data to both new and existing customers who upgraded to smartphones.

The initiative targeted two key customer segments: new smartphone users joining the Airtel network and existing customers transitioning from feature phones to smartphones, including those switching from 3G to 4G or 5G devices.

Under the campaign, users received 1GB of free data every week for six months. To enjoy the free data, customers needed to top up a minimum of Ksh 50 weekly, making the offer accessible and affordable. The free 1GB data was valid for three days, and the offer was open to all smartphone brands, allowing users freedom of choice.

Ashish Malhotra , Managing Director of Airtel Kenya, highlighted the campaign's importance, noting that it reflected the company's commitment to empowering more Kenyans to be part of the growing digital economy. He emphasized Airtel's dedication to bridging the digital divide by making it worthwhile for customers to acquire smartphones and experience the convenience of the digital age.

As of June 2024, Airtel Kenya had expanded its network significantly, adding 628 new sites across the country. Mr. Malhotra underscored the importance of network accessibility, stating that the telco's investment in cutting-edge network technology is only meaningful if it reaches the hands of every Kenyan.

Lagos State To Introduce Digital Rent Payment Platform, Aiming For ₦2.5 Billion Annual Revenue

Users will be able to access the feature through the 'Manage storage' menu once it's launched in future updates.

World Bank Commits $100 Million to Zambia’s Digital Transformation Initiative

The World Bank has announced a $100 million investment to support Zambia's digital transformation through the Digital Zambia Acceleration Project (DZAP). The announcement was made by Felix Mutati, Zambia’s Minister of Technology and Science, on July 19. This funding, provided by the World Bank’s International Development Association (IDA), aims to enhance internet accessibility, improve digital services, and strengthen the country's digital infrastructure.

Wengcai Zhang, the World Bank Managing Director, emphasized the initiative’s alignment with Zambia’s governmental goals, focusing on broadband, last-mile connectivity, and digital public infrastructure. The project also aims to develop digital skills and bridge the significant digital gap in Zambia, where only 53% of the population currently has internet access.

A Project Implementation Unit will be established within the Smart Zambia Institute to manage the DZAP. The World Bank has also expressed support for Zambia's bid to host the World Skills Africa Competition in Livingstone next year. The DZAP is expected to receive final endorsement from the World Bank Board in March 2025, with an initial $6 million advance to fund the project's early stages.

Kenya Airways Partners with Safaricom to Enhance Operational Efficiency and Customer Experience

The collaboration aims to improve connectivity, provide in-flight Wi-Fi, enhance infrastructure inspection and security surveillance, and advance loyalty programs. The two companies will focus on data science, software development, and aviation innovations, including applications in agriculture.

"Kenya Airways collaboration with Safaricom is a testament to the power of co-creation. By harnessing our combined expertise, we are not only addressing today's challenges but also laying the groundwork for sustainable growth, enhanced connectivity, and transformative innovations that will benefit our customers and communities for years to come," said Fredrick Kitunga, the Chief Information and Data Officer at Kenya Airways.

The partnership will also focus on creating and deploying Internet of Things ( solutions for various needs, including warehousing, baggage tracking, aircraft materials, and ULD to improve tracking, location accuracy, reconciliation, and inventory management.

"This Memorandum of Understanding solidifies our commitment to providing a transformative experience for our customers, connecting people in new and innovative ways. By leveraging our respective strengths, Kenya Airways in providing safe journeys and Safaricom in cutting-edge communications and technology, we ensure that our customers remain seamlessly connected throughout their travels," Cynthia Karuri-Kropac , the head of Business at Safaricom stated.

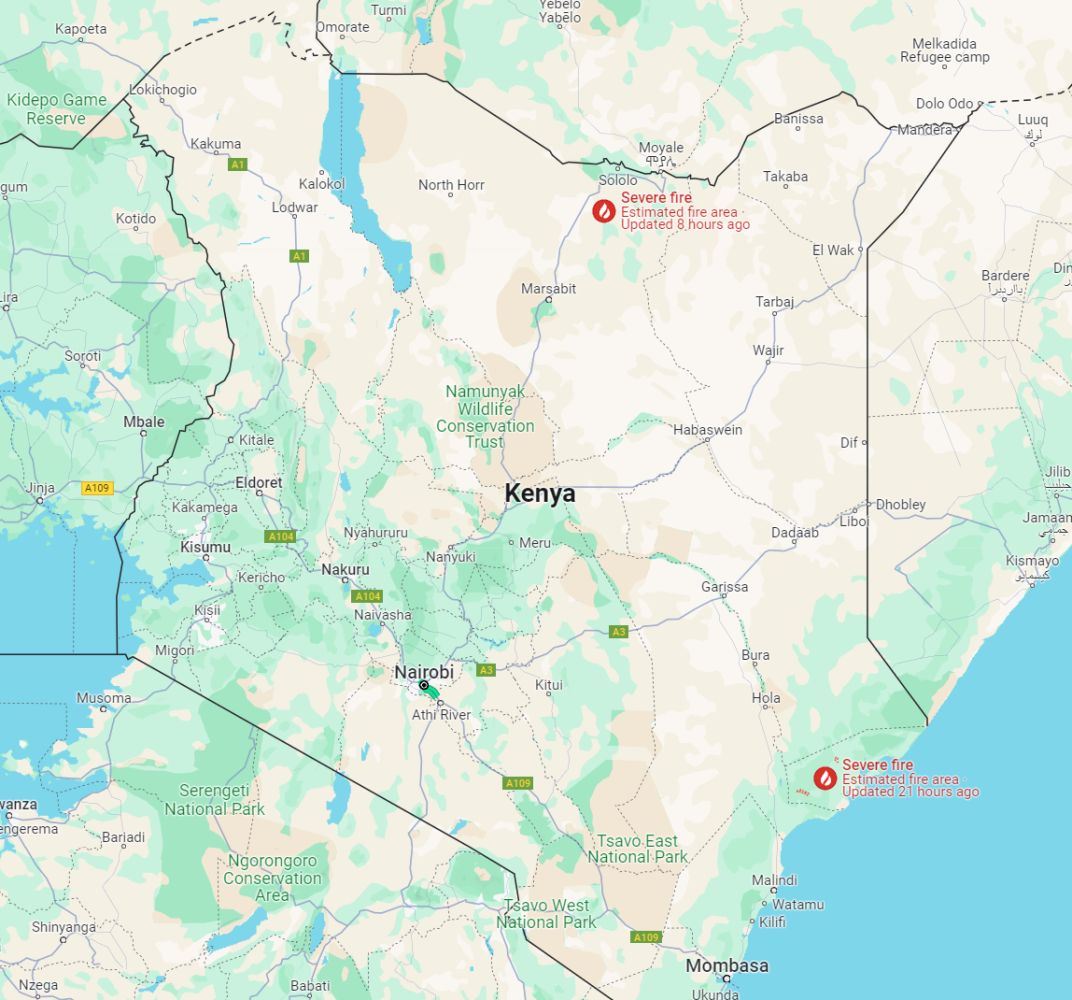

Wildfire Boundary Maps Expand To New Countries In Europe And Africa

Google has expanded its Wildfire Boundary Tracker to 17 new countries, including Kenya, to help communities prepare for and respond to the increasing threat of wildfires. The AI-powered tool provides accurate, up-to-date information on wildfire boundaries directly in Google Search and Maps.This expansion comes amid a global surge in wildfires, particularly affecting countries in Europe and Africa. The tracker analyzes satellite imagery and other data sources to deliver precise information on wildfire spread.

Yossi Matias , Vice President & Head of Google Research, emphasized the company's commitment to using technology for public safety during natural disasters. The tracker sends alerts to people in affected areas, offering safety tips and guidance, and supports multiple languages to cater to diverse populations.

In Kenya, wildfires have contributed to 0.60% of tree cover loss from 2001 to 2023, with 341 high-confidence fire alerts reported in 2024 alone. The initiative aims to complement existing emergency response efforts and provide additional protection for at-risk communities.

Ourpass Secures Microfinance Banking License Targeting Enterprise Clientele

OurPass Business Bank has obtained a Microfinance banking license from the Central Bank of Nigeria , five months after receiving initial approval. Set to commence operations in September 2024, the company aims to provide business accounts, lending services, and management tools tailored for enterprises.

CEO Samuel Eze stated that the integration process is nearly complete, with only one step remaining involving the Nigeria Interbank Settlement System (NIBSS). OurPass plans to enter the competitive Nigerian business banking sector, targeting large corporations such as Shoprite and SPAR, and offering credit facilities for inventory financing, asset financing, and invoice discounting.

Differentiating itself from digitally-focused competitors, OurPass intends to establish a physical presence in all 774 local government areas of Nigeria, focusing on business hubs and open markets. The startup is also set to unveil a banking-as-a-service offering and develop niche products for the creative industry by the end of the year.

NCC Mandates Telcos to Ensure Transparent Tariffs

The Nigerian Communications Commission has directed telecommunications operators to simplify their tariff plans, bundles, and promotional activities to enhance clarity and transparency for subscribers. Issued on July 29, 2024, the directive, titled “Guidance on the Simplification of Tariffs in the Nigerian Communications Sector,” mandates Mobile Network Operators to publish comprehensive tables outlining the features of their tariff plans and bundle offers.

These tables must include essential information such as add-ons, prices, opt-in and opt-out processes, renewal terms, and rollover policies. The guidelines aim to reduce the complexity of tariff structures, ensure transparency, protect consumer interests, and promote fair competition among operators.

Service providers are required to display all relevant tariff information, including plan names, prices, validity periods, and expected data speeds. Operators can maintain existing bonus-led tariff plans until December 31, 2024, during which they must educate subscribers about the new simplified plans.

Big Tech Traders Prepare for More Market Volatility as Selloff Intensifies

Investors have faced a dilemma in recent months: whether to pay high multiples for technology stocks or wait for a better entry point, risking missing out on significant gains. Those who opted to wait found an opportunity on Monday as the Nasdaq 100 Index fell by as much as 5.5%, extending a three-day slump. While some investors took advantage of the dip to buy shares of companies like Nvidia and Apple at discounted prices, many remained cautious, unsure if the selloff had ended.

Dan Cook, Chief Strategy Officer at Apex Trader Funding, expressed a common sentiment among investors, stating, “I’m waiting for a better opportunity to buy.”

Concerns over a potential US recession and heavy spending on artificial intelligence have made many hesitant to dive into the market.

The recent earnings reports from major tech companies have painted a mixed picture. While some, like Meta and Apple, showed positive trends, others, including Alphabet and Amazon, faced declines, raising concerns about growth prospects. Overall, 80% of S&P 500 tech companies exceeded earnings expectations, but fewer than 60% met revenue targets.

The Digital Key To Spotting New Markets

Leila Rwagasana, FinTech Lead at Rwanda Finance Limited, shares insights on how fintech is transforming financial services in Africa. She highlights that fintech is driving financial inclusion and economic growth, exemplified by M-Pesa in Kenya, which lifted 2% of households above the poverty line by 2021.Fintech operates without traditional banking infrastructure, expanding access significantly. It also supports SMEs by providing essential loans, enabling their growth, while digital-only banks offer lower-cost services that democratize access to finance.

The COVID-19 pandemic accelerated the adoption of digital banking, with banks increasingly collaborating with fintechs. Additionally, fintech promotes gender equality, as seen in Rwanda, where women's access to financial services rose from 73% to 90%.

Leila emphasizes that fintech is expected to grow 19% annually in Africa, reaching a valuation of $150 billion by 2025, driven by rising smartphone ownership and a young, tech-savvy population. Embracing fintech is key to achieving a more equitable and prosperous future.

Telkom Reports 3.9% Revenue Increase And Surpasses 21 Million Subscribers In Q1 2024

Telkom has reported its financial results for the quarter ending June 30, 2024, revealing a 3.9% increase in revenue, reaching R10.9 billion (approximately $587.2 million). The company also experienced a 14.6% growth in mobile subscribers, surpassing 21 million.

The revenue growth was largely driven by increased demand for Telkom’s next-generation network (NGN) services, with mobile service revenue rising by 9.5%, fixed data NGN revenue by 7.1%, and information technology revenue by 10.3%. Serame Taukobong, the Group CEO, expressed satisfaction with the performance, attributing it to a data-led strategy and strong value propositions.

Telkom's mobile division saw external mobile service revenue climb to R4.9 billion (around $268.99 million), contributing to a total external revenue increase of 5.3% to R5.9 billion ($308.9 million). The demand for data services remained robust, with mobile data traffic up by 25.8% and fixed data traffic by 33% compared to the previous year.

MTN Ghana Reports 31% Service Revenue Growth In First Half Of 2024

MTN Ghana has reported impressive financial results for the first half of 2024, showcasing a 31.2% year-on-year increase in service revenue, reaching GHS8.1 billion, up from GHS6.15 billion in the same period last year.

The company also saw its mobile subscriber base grow to 28.4 million, with an addition of 0.6 million new customers in the first quarter. Active data subscribers rose to 16.4 million, while the user base for Mobile Money (MoMo) services increased by 16.2%, totaling 16.5 million. Revenue from MoMo services surged by 44.8%, and digital revenue, including video streaming and gaming, jumped by 59.4%.

MTN Ghana made significant contributions to the state, paying GHS 3.9 billion in taxes, which accounted for 52% of its total revenue. The company invested GHS 2.8 billion to enhance network quality and capacity.

CEO Stephen Blewett announced ongoing discussions for a long-term agreement with Telecel to pursue a national roaming agenda and infrastructure sharing. Additionally, local ownership of Scancom PLC (MTN Ghana) reached 27.9%, meeting the 25% localization requirement for its 4G license.

HAVAÍC Announces First Close Of US$50m Fund 3

HAVAÍC announced the first close of its $50 million African Innovation Fund 3, securing $15 million in commitments as of July 2024. This fund, developed in partnership with cornerstone investors Universum Wealth and The SA SME Fund, aims to make 15 investments in early-stage, high-growth businesses originating from Africa, targeting those with regional and global growth potential.

The new fund is HAVAÍC’s largest to date, following its previous funds of $6 million in 2016 and $20 million in 2020, both of which are now fully deployed. The firm’s portfolio already serves over 20 million customers across 190 countries.

Ian Lessem, Managing Partner at HAVAÍC, emphasized the importance of their relationships with institutional investors, stating that this support allows them to assist more African tech entrepreneurs in scaling their businesses and generating diversified revenue. The initiative is expected to contribute to economic growth and job creation in Africa.

The SA SME Fund's CEO, Ketso Gordhan, highlighted that their commitment to HAVAÍC represents a significant investment in a leading venture capital firm focused on innovative solutions that address social challenges while achieving commercial returns.

Egypt’s Cartona Raises An $8.1M Series A Extension To Provide Retailers With Working Capital

Cartona , an Egypt-based B2B eCommerce platform, has successfully raised $8.1 million in a Series A extension, which includes $5.6 million in equity and $2.5 million in debt. This funding round was led by Algebra Ventures, with participation from Silicon Badia and the SANAD Fund for MSME, while Camel Ventures and GlobalCorp provided the debt component.

This latest funding comes a year after Cartona secured $12 million in its initial Series A round, bringing its total Series A funding to $20.1 million. The company plans to utilize the new equity capital to expand its operations in various sectors, including fast-moving consumer goods (FMCG) and the hotel, restaurant, and café (HORECA) industry, as well as to enter larger markets in the MENA region.

Cartona aims to address the working capital needs of local retailers with the $2.5 million in debt capital, which was raised in local currency. Founded in August 2020 by CEO Mahmoud Talaat and CTO Mahmoud Abdel-Fattah, Cartona connects buyers and sellers through a mobile app and currently serves over 188,000 retailers across 17 Egyptian cities.

SearchGPT Is Coming Soon; Five Ways It Will Be Different Than Google

Search Results: SearchGPT provides direct answer summaries with source links, while Google shows a list of web pages with snippets. SearchGPT aims to save time by delivering more concise responses.

Ads: SearchGPT likely won't have ads, as it will be available to ChatGPT Plus members who pay a subscription fee. Google, on the other hand, relies heavily on advertising revenue.

Context: SearchGPT retains context to answer follow-up questions, enabling a more conversational experience. Google's results are based on the current query alone.

Local Search and E-commerce: Google has a long-established advantage in local business search and shopping, areas where SearchGPT is still developing.

Technology: SearchGPT uses OpenAI's GPT-4 model, while Google relies on its own Gemini AI. This allows SearchGPT to understand language nuances and provide more accurate results.

While both tools have their strengths, SearchGPT aims to provide a more personalized, conversational search experience with direct answers, while Google offers comprehensive results and advanced features for detailed research and local needs.

Unlimit and Yuno Join Forces to Enhance Payments for Businesses Worldwide

Global fintech Unlimit has partnered with leading payment orchestration platform Yuno to enhance payment solutions for businesses worldwide. This collaboration aims to streamline online payments, reduce transaction costs, and improve the purchasing experience for customers globally. By combining Unlimit's extensive portfolio of over 1,000 payment methods with Yuno's advanced technology, the partnership seeks to empower businesses to facilitate safer and more efficient digital transactions.

The partnership comes at a time when the global digital payment market is projected to reach USD 361.3 billion by 2030, growing at a rate of 21.1% annually. Unlimit and Yuno are committed to overcoming payment challenges for merchants, making borderless payments a reality.

The AI Bubble Has Burst. Here's how Mashable Knows

Mashable highlights the bursting of the AI bubble as a result of shifting investor sentiment and growing skepticism about the profitability of AI technologies. The article points to a significant decline in the stock prices of major AI companies, particularly Nvidia, which has lost substantial market value amid concerns over delayed product launches and the sustainability of AI investments.

Additionally, there is a rising awareness that many AI applications may not be ready for widespread use, leading to doubts about their cost-effectiveness and reliability.

Reports from hedge funds and analysts emphasize that despite massive investments in AI infrastructure, companies have yet to demonstrate substantial revenue growth from these technologies, prompting fears that the initial excitement surrounding AI may be giving way to a more cautious outlook.

Wall Street Suffers Worst Day in Nearly Two Years Amid Recession Fears

Wall Street experienced its worst day in nearly two years, driven by fears of a U.S. recession following a disappointing jobs report. The S&P 500 dropped 3%, marking its largest decline since September 2022, while the Dow Jones fell 2.6%, losing over 1,000 points, and the Nasdaq Composite dropped 3.4%.

This downturn occurred just weeks after these indices reached record highs, with the S&P still up more than 9% for the year. The sell-off began in Asia, where Japan's Nikkei 225 plummeted 12.4%, and European markets also suffered significant losses. Concerns about the strength of the U.S. economy intensified after the Federal Reserve opted to maintain interest rates, leading to criticism that it was too slow to respond to economic headwinds.

Major tech stocks, particularly Apple and Nvidia, were heavily impacted, with Apple’s shares dropping 4.8% after Berkshire Hathaway reduced its stake in the company. The CBOE Volatility Index, known as Wall Street's fear gauge, surged to levels not seen since the early days of the COVID-19 pandemic, reflecting heightened market anxiety.

Weekly Global Economic Update 🌍

US Economy Remains Strong

The US economy grew by 2.8% in Q2, driven by robust consumer spending and business investment. However, potential slowdowns loom as consumer spending outpaces income growth, reducing savings. The Federal Reserve may cut interest rates in September to support economic stability.

China Cuts Interest Rates 📉

China's central bank reduced key interest rates by 10 basis points to stimulate its slowing economy. This move aims to boost credit amid weak domestic demand and deflationary pressures. Analysts call for additional fiscal measures to complement monetary easing.

Shipping Disruptions Impact Inflation 📦🚢

Houthi rebel attacks have surged shipping costs, affecting Europe-East Asia routes. This increase may lead to higher consumer prices, complicating inflation control for the ECB and BOE. US retailers are frontloading orders to mitigate shipping disruption risks, causing a spike in container arrivals.

Do you have an exciting fintech story, innovation, or insight you'd love to share with our vibrant community? This is a fantastic opportunity to showcase your achievements, share your expertise, or highlight how you're shaping the future of fintech in Kenya.

If you're interested, please don't hesitate to get in touch. Please email us at [email protected] with a brief outline of what you'd like to feature. We can't wait to hear from you and potentially share your story with our community!

𝐏𝐮𝐛𝐥𝐢𝐬𝐡𝐞𝐝 𝐰𝐞𝐞𝐤𝐥𝐲 | 35,223+💙S𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞𝐫𝐬

Reply